Estate Planning for Retirees in India: Wills, Nominees, and Succession

Retirement in India isn’t just about stopping work. It’s about making sure the life you built doesn’t vanish into legal chaos after you’re gone. Many retirees assume their family will naturally inherit everything - but without clear plans, that’s not how it works. Banks freeze accounts. Properties get stuck in court. Even simple things like a fixed deposit or a share in a family home can turn into years of fights. This isn’t about fear. It’s about control.

What Happens If You Don’t Plan?

Imagine you pass away suddenly. Your son finds your bank passbook but can’t withdraw a rupee because the bank needs a succession certificate. Your daughter lives abroad and doesn’t know about the land your father left you in Varanasi. Your wife, who never worked outside the home, suddenly has no access to your pension or insurance. These aren’t hypotheticals. They happen every day in India.

The law doesn’t care about your wishes unless they’re written down. Without a will, your estate is divided under the Indian Succession Act - and that’s where things get messy. For Hindus, Buddhists, Jains, and Sikhs, the Hindu Succession Act applies. For Muslims, it’s Sharia law. Christians and Parsis fall under the Indian Succession Act. Each has different rules. And none of them assume your spouse gets everything - even if you’ve been married for 50 years.

Wills: Your Only Real Control

A will is the single most important document in estate planning. It’s not just for the rich. If you own a house, a car, a bank account, or even a few gold coins, you need one. A will lets you say exactly who gets what. You can leave your scooter to your granddaughter, your pension savings to your caregiver, or your library to your local temple. No one else gets to decide.

There’s no minimum value. No stamp duty. No need for a lawyer - though one helps. You can write it by hand, sign it, and get two witnesses to sign too. That’s it. No registration is required, but if you register it at a sub-registrar’s office, it becomes much harder to challenge later. Registration costs around ₹1,000-₹2,000, depending on the state.

Common mistakes? Writing vague phrases like “my property to my children.” Which property? All of it? Just the house? What if one child dies before you? Use names, not relationships. Say “my daughter, Priya Sharma, residing at 123 Nehru Road, Delhi.” Be specific. Update it after major life events - marriage, divorce, birth of a grandchild. A will written in 2010 might not reflect your family today.

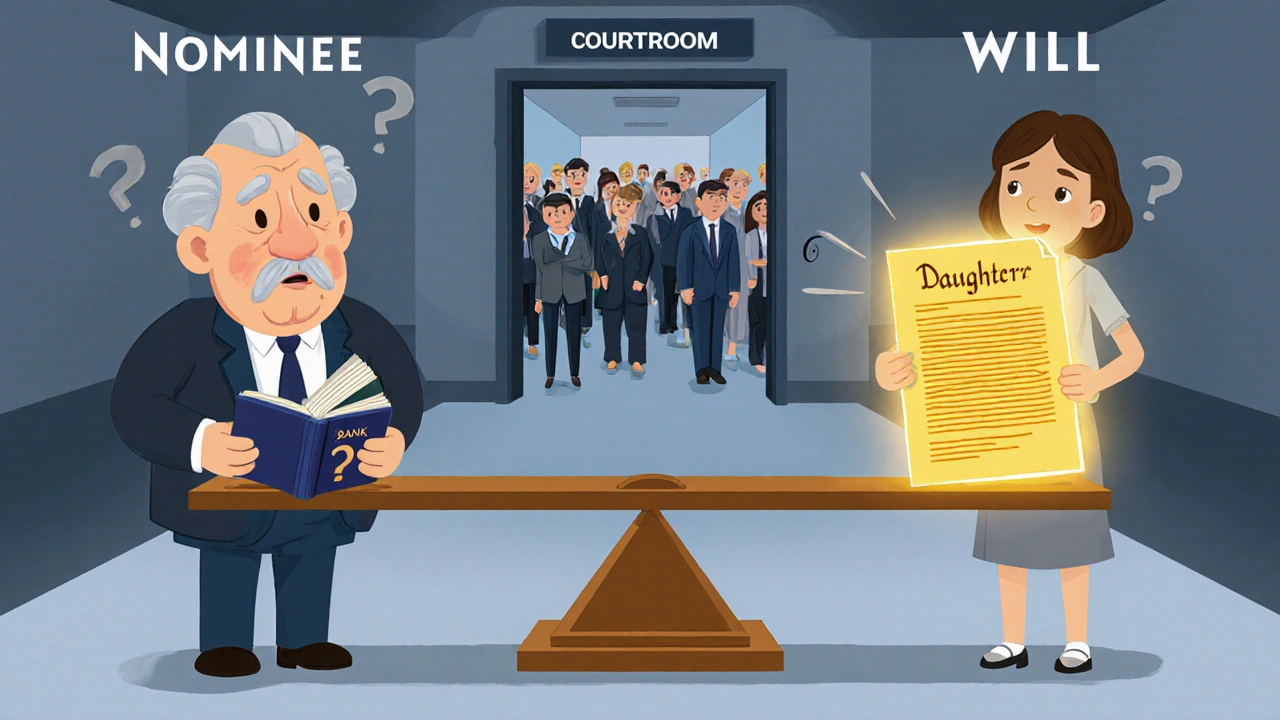

Nominees Are Not Heirs

This is the biggest myth in India. If you name your son as nominee on your bank account or insurance policy, he doesn’t automatically own it. He’s just a caretaker. The law says nominees hold assets in trust for the legal heirs. That means if you have a will that leaves everything to your daughter, your son must hand over the money - even if he’s the nominee.

Many retirees think naming a nominee is enough. It’s not. Nominees are useful for quick access to funds after death - banks release money to them faster than to legal heirs. But they can’t claim ownership. Courts have ruled this over and over. In 2023, the Delhi High Court confirmed that nominee rights are only procedural, not proprietary.

So what should you do? Always name a nominee - it makes things smoother. But never rely on it. Make sure your will matches your nominee choices. If your wife is your nominee on your EPF account, but your will says your daughter gets it, your wife will have to hand it over. That’s a recipe for family tension.

Succession Laws: Who Gets What When There’s No Will

If you die without a will, the law steps in. Here’s how it breaks down for the most common groups:

- Hindus, Sikhs, Jains, Buddhists: Your spouse and children inherit equally. If you have no children, your parents get a share. If your parents are gone, siblings come next. Your in-laws? They get nothing.

- Muslims: Shares are fixed by Sharia. A wife gets 1/8 if you have children, 1/4 if you don’t. Sons get twice the share of daughters. Parents get fixed portions too. No flexibility.

- Christians: Your spouse gets half. The rest goes to your children. If no children, your parents inherit. If no parents, then siblings.

- Parsis: Similar to Christians. Spouse gets half. Remaining divided among children. If no children, parents inherit.

Notice something? In most cases, your spouse doesn’t get everything. And your in-laws? They’re completely out unless you have no blood relatives. That’s why a will matters so much. Without it, you’re letting strangers - the law - decide who gets your life’s work.

Joint Ownership: A Trap for Retirees

Many retirees put their home or bank accounts in joint names with one child - thinking it’s a shortcut. But joint ownership can backfire. If you add your son as joint holder on your house, he becomes a co-owner. That means he can sell his share, mortgage it, or even kick you out legally if things turn sour. And if you later change your mind and remove him, you might need his signature - which he may refuse.

Joint accounts with spouse are safer. But even then, if your spouse dies first, the account doesn’t automatically go to your children. It goes to the surviving joint holder - you. Then, when you die, it becomes part of your estate. No shortcut there.

The only safe joint ownership is with your spouse, and even then, you still need a will. Joint ownership doesn’t replace estate planning. It just adds complexity.

What About Digital Assets?

Most retirees don’t think about this - but your email, social media, online savings, or cryptocurrency accounts are part of your estate. Banks now ask for passwords. Google and Facebook require legal proof to close accounts. If you don’t leave instructions, your family may never access your digital life.

Keep a secure, handwritten list of your digital accounts and passwords. Store it with your will. Tell your executor where to find it. Include login details for your EPF, PPF, mutual funds, and any apps where you have money. Even if it’s just ₹5,000 in Paytm, it matters. Without documentation, these assets vanish.

Who Should Be Your Executor?

Your executor is the person who carries out your will. They pay your debts, file taxes, and hand out your assets. It’s not a title - it’s work. Choose someone trustworthy, organized, and preferably younger than you. A child? Often yes. A friend? Sometimes better. Avoid naming someone who lives abroad unless they’re willing to travel back and forth for paperwork.

Don’t name your spouse as executor if they’re older or not financially literate. A 70-year-old widow trying to navigate probate court is not a recipe for peace. Pick someone who can handle the job - even if it’s your nephew who works in accounting.

Next Steps: What to Do Today

You don’t need to fix everything tomorrow. But you need to start.

- Make a list: Write down every asset - bank accounts, property, insurance, gold, vehicles, investments, digital accounts.

- Write a will: Use simple language. Name each asset and who gets it. Get two witnesses. Sign and date. Keep it in a safe place.

- Update nominees: Check your EPF, insurance, bank accounts. Make sure nominees match your will. If they don’t, change them.

- Tell your executor: Show them where the will is. Give them contact info for your lawyer or banker.

- Review every 3 years: Life changes. Your will should too.

Don’t wait for a health scare. Don’t wait until your children ask. Do it now. Your peace of mind - and your family’s - depends on it.

Can I write my own will in India without a lawyer?

Yes, you can. A handwritten will, signed by you and two witnesses, is legally valid under the Indian Succession Act. You don’t need a lawyer, stamp paper, or registration. But if your estate is complex - multiple properties, business interests, or blended families - a lawyer can help avoid future disputes. A simple will for a retiree with one house and a few savings can be done on plain paper.

What happens if my will is lost or destroyed?

If the original will is lost and no copy exists, the law assumes you destroyed it intentionally - and your estate is treated as if you died without a will. Always keep at least two copies: one with your executor, one in a safe deposit box. If you register your will at a sub-registrar’s office, a certified copy is stored there permanently.

Can I disinherit a child in my will?

Yes. Under Indian law, you can leave your property to anyone you choose - even a friend or charity - and exclude your children. But if you do, be clear in your will. Vague language like “I leave everything to my wife” can be challenged. Write explicitly: “I deliberately exclude my son, Rajesh Kumar, from inheriting any part of my estate.” This reduces the chance of a legal fight.

Do I need to register my will in India?

No, registration is not mandatory. But it’s highly recommended. A registered will is harder to forge or challenge in court. It’s stored safely at the sub-registrar’s office, and only the original can be used for probate. Registration costs ₹1,000-₹2,000 and takes less than an hour. It’s a small price to prevent years of legal battles.

What if I have property in multiple states?

You can include all your assets in one will, no matter where they are. But if you own land in different states, probate (court approval) may be needed in each state where property is located. To simplify, some people create separate wills for properties in different states - but they must be clearly linked and not contradict each other. Consult a lawyer if your assets span multiple states.