How to Plan Down Payment for a Home in India: Savings and Investment Strategy

Buying your first home in India isn’t just about picking a neighborhood or checking the number of bedrooms. The real hurdle? Saving enough for the down payment. Most lenders in India require 15% to 25% of the property value upfront. For a ₹50 lakh apartment, that’s ₹7.5 lakh to ₹12.5 lakh - more than most people earn in a year. If you’re starting from scratch, it feels impossible. But it’s not. With the right plan, you can build that money without going broke.

Know Exactly How Much You Need

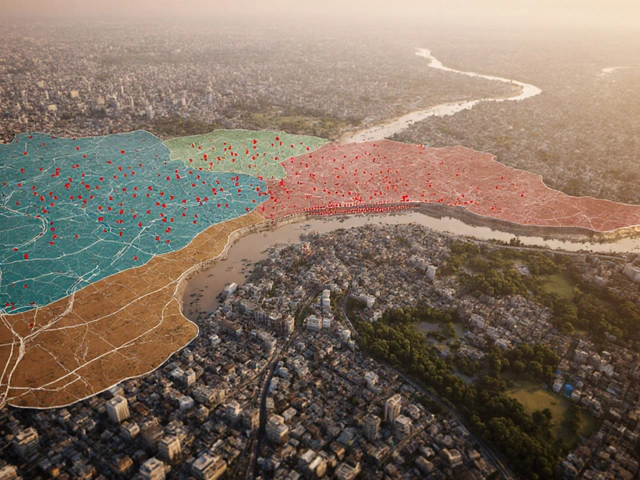

Start with the price of the home you want. Don’t guess. Look at listings in your target area - whether it’s Pune, Hyderabad, or a tier-2 city like Indore. Add 5% to 8% for registration fees, stamp duty, and legal costs. These aren’t optional. In Maharashtra, stamp duty alone can hit 5% of the property value. In Karnataka, it’s 5.65%. In Delhi, it’s 6%. You can’t skip these. So if you’re eyeing a ₹60 lakh flat, budget ₹63 lakh to ₹65 lakh total.

Now calculate the down payment. Most banks require 20% minimum for home loans. That’s ₹12 lakh for a ₹60 lakh home. Some lenders offer 85% loans for first-time buyers, but those come with higher interest rates or insurance costs. Stick to 20% if you can. It gives you breathing room later.

Set a Realistic Timeline

How long will it take? If you’re saving ₹25,000 a month, you’ll need 48 months to hit ₹12 lakh. That’s four years. If you’re saving ₹40,000 a month, it’s 30 months - two and a half years. Be honest. Track your spending for one month. Use a free app like Moneycontrol or even a Google Sheet. You’ll be shocked where your money goes.

Here’s a real example: A 28-year-old software engineer in Bengaluru earns ₹80,000 a month. He spends ₹35,000 on rent, ₹12,000 on food, ₹8,000 on transport, ₹5,000 on entertainment, and ₹3,000 on phone bills. That leaves ₹17,000. He can’t save ₹40,000 unless he cuts costs. So he moved to a shared apartment for ₹18,000, cooked at home, and cut subscriptions. Now he saves ₹32,000 a month. That’s ₹3.84 lakh a year. In three years, he’s at ₹11.5 lakh - close enough to start looking.

Use the Right Savings Tools

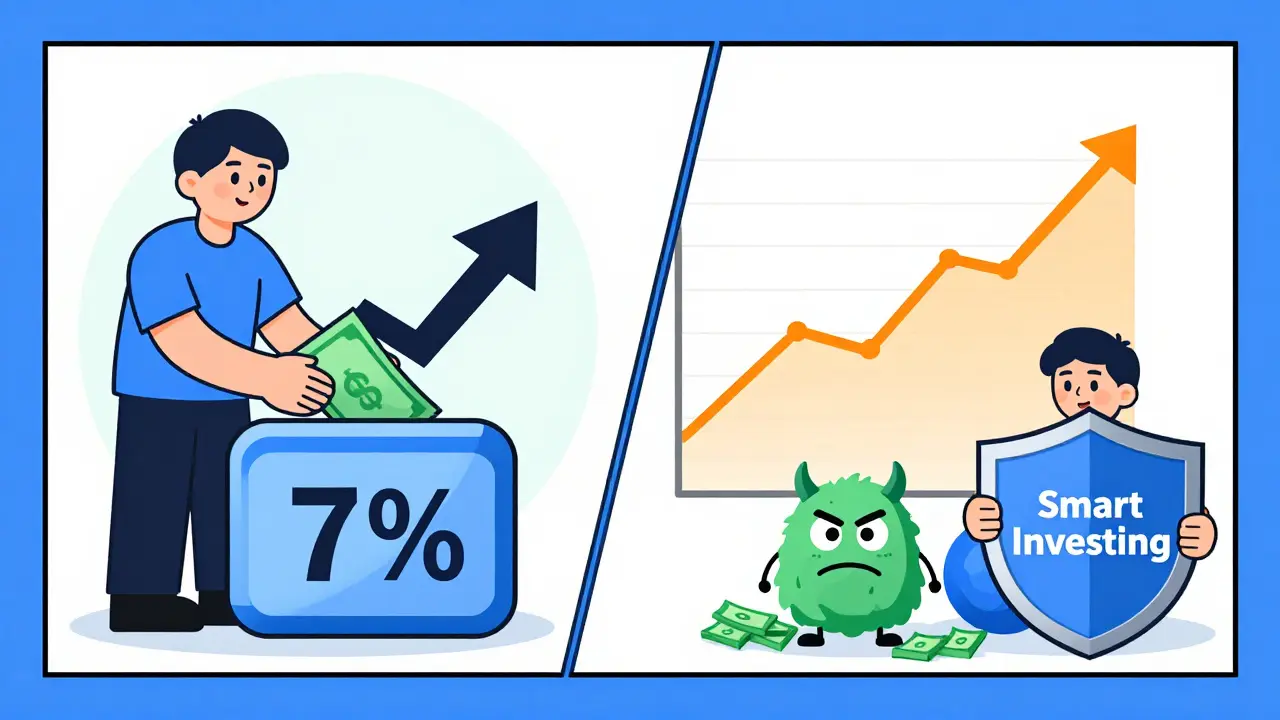

Don’t just keep your down payment money in a regular savings account. You’re losing money to inflation. India’s inflation rate is around 5.5% as of late 2025. If your savings account gives you 3.5%, you’re losing 2% a year in real value.

Instead, use:

- High-yield savings accounts - Banks like Kotak Mahindra and IDFC First offer 6% to 7% interest on savings accounts with no lock-in.

- Short-term debt mutual funds - These invest in government and corporate bonds. They’re low-risk and give 7% to 8% returns over 1-3 years. Examples: ICICI Prudential Short Term Fund or HDFC Short Term Debt Fund.

- Fixed deposits (FDs) - If you want zero risk, lock in a 3-year FD. Rates are around 7.25% for senior citizens and 6.75% for others. Use a ladder strategy: split your savings into three FDs maturing every year. That way, you have access to some money if you need it.

- Systematic Investment Plans (SIPs) in balanced advantage funds - These mix equity and debt. Over 2-4 years, they’ve returned 9%-11% annually on average. But only use this if you’re comfortable with small market swings. Don’t put your entire down payment here if you’re buying in under two years.

A 2024 study by SEBI found that investors who used short-term debt funds for home savings earned 2.3% more annually than those who kept cash in savings accounts. That’s ₹27,600 extra on a ₹12 lakh goal over three years.

Boost Your Savings With Side Income

Most people who save for homes in India don’t just rely on their salary. They add side income. Here’s what’s working in 2025:

- Freelancing - Graphic design, content writing, or accounting on platforms like Upwork or Fiverr. Many Indians earn ₹15,000-₹30,000 a month extra.

- Rental income - If you own a room or a small apartment, rent it out. In cities like Chennai or Ahmedabad, a single room can bring ₹8,000-₹12,000 a month.

- Selling unused items - Old electronics, furniture, or even clothes on OLX or Meesho. One woman in Jaipur sold five laptops and a bike over six months and added ₹4.2 lakh to her down payment.

- Part-time tutoring - Coaching school students in math or science. ₹500-₹800 per hour adds up fast.

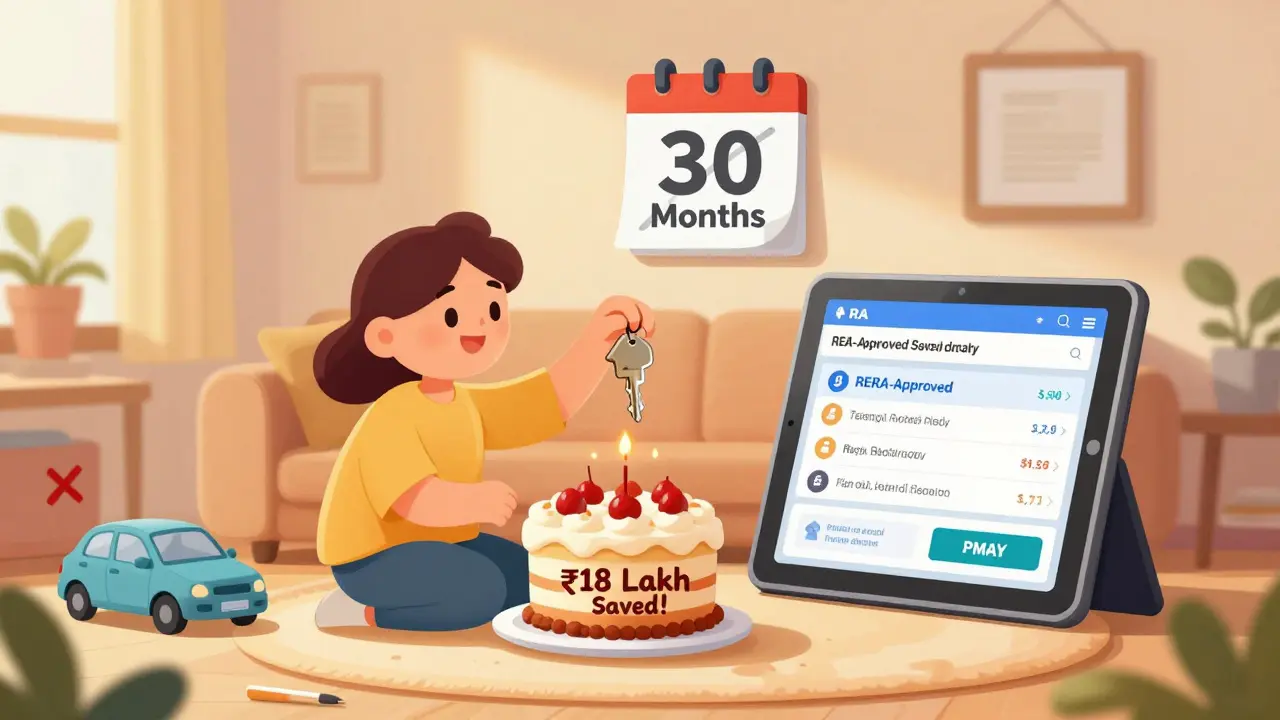

One couple in Noida saved ₹18 lakh in 30 months. He worked a 9-to-5 job. She taught online English to students in the U.S. during night hours. Together, they added ₹25,000 a month in extra income. That cut their saving timeline by 18 months.

Avoid These Three Costly Mistakes

People don’t fail because they don’t earn enough. They fail because they make these mistakes:

- Buying a car before the house - A ₹10 lakh car eats up your down payment. If you need transport, use public transit or a two-wheeler. Save the car for after you own your home.

- Using your EPF or PPF for the down payment - Yes, you can withdraw EPF, but you lose tax-free growth. PPF is meant for retirement. It’s a long-term tool. Don’t raid it.

- Waiting for the ‘perfect’ market - Prices won’t crash. They’ll keep rising. In 2024, home prices in India rose 7.3% on average. Waiting a year means you need 7% more money. Start now.

Use Government Schemes to Your Advantage

India has programs to help first-time buyers:

- Pradhan Mantri Awas Yojana (PMAY) - If your annual income is under ₹18 lakh, you can get interest subsidy of up to ₹2.67 lakh on a home loan. That reduces your EMI and lets you save more for the down payment.

- State-specific incentives - In Tamil Nadu, first-time buyers get 1% stamp duty rebate. In Gujarat, there’s a ₹1 lakh grant for women buyers. Check your state’s housing department website.

- Home loan pre-approval - Get pre-approved before you start looking. It tells you exactly how much you can borrow. That helps you set a realistic target for your down payment.

Track Progress and Adjust

Review your savings every three months. Did you earn more? Did your expenses drop? Did your target home price change? Adjust your plan. Maybe you can save ₹45,000 now instead of ₹35,000. Maybe you’ll aim for a smaller flat in a better location.

One man in Lucknow changed his goal from a 3BHK in Gomti Nagar to a 2BHK in Alambagh. The price dropped from ₹75 lakh to ₹58 lakh. His down payment goal went from ₹15 lakh to ₹11.6 lakh. He reached it six months earlier.

Don’t treat this like a chore. Treat it like a game. Every ₹10,000 saved is a milestone. Celebrate it. Buy yourself a coffee. Take a walk. Then get back to work.

When You’re Ready to Buy

Once you hit your target, don’t rush. Get the property inspected. Check the title deed. Make sure the builder has RERA registration. Don’t pay the full amount upfront. Pay in stages: 10% at booking, 30% at foundation, 40% at structure, 15% at possession, and 5% after final handover.

And remember - the down payment isn’t the end. You’ll still need money for furnishing, repairs, and moving. Keep 5% of your total budget aside. That’s your safety net.

How much down payment is required for a home loan in India?

Most banks in India require a down payment of 15% to 25% of the property’s value. For a home priced at ₹50 lakh, you’ll need ₹7.5 lakh to ₹12.5 lakh. First-time buyers may qualify for 85% loans, but those often come with higher interest rates or insurance costs. A 20% down payment is the sweet spot - it lowers your monthly EMI and gives you better loan terms.

Can I use my PF or PPF money for a home down payment?

You can withdraw from your EPF under certain conditions, like buying your first home, but it’s not recommended. You lose tax-free growth and future retirement security. PPF is designed for long-term savings over 15 years. Using it early defeats its purpose. Instead, use dedicated savings accounts, debt mutual funds, or FDs for your down payment.

What’s the best way to save for a home down payment in India?

The best approach combines safety and growth. Use a mix of high-yield savings accounts (6-7% interest), short-term debt mutual funds (7-8% returns), and fixed deposits (6.5-7.5%). For longer timelines (3+ years), balanced advantage funds can add 9-11% returns. Avoid keeping all your money in a regular savings account - inflation will eat into your savings.

How long does it take to save for a home down payment in India?

It depends on your income and savings rate. Saving ₹25,000 a month means it takes about four years to reach ₹12 lakh. At ₹40,000 a month, it takes 30 months. Many people shorten this timeline by adding side income - freelancing, tutoring, or renting out space. One couple in Noida saved ₹18 lakh in 30 months by combining salary and online teaching income.

Are there government schemes to help first-time homebuyers in India?

Yes. The Pradhan Mantri Awas Yojana (PMAY) offers interest subsidies up to ₹2.67 lakh for eligible first-time buyers with an annual income under ₹18 lakh. Some states also offer rebates - like 1% stamp duty reduction in Tamil Nadu or ₹1 lakh grants for women buyers in Gujarat. Always check your state’s housing department website before finalizing your purchase.

Final Thought: Start Today, Not Tomorrow

You don’t need a big salary to own a home. You need consistency. Save ₹5,000 a month for five years? That’s ₹3 lakh. Add ₹10,000 a month from side work? That’s another ₹6 lakh. You’re at ₹9 lakh. That’s half of a ₹12 lakh down payment. You don’t need to be rich. You just need to be steady.

Start now. Even if it’s small. Track it. Protect it. Grow it. The house you want isn’t out of reach. It’s just waiting for you to show up - one month, one rupee, one smart choice at a time.