Affordable Housing Projects in India: Eligibility, PMAY Subsidies, and Return on Investment

Why affordable housing in India is a smart move right now

If you're looking to invest in real estate without breaking the bank, affordable housing in India is one of the few areas where the math actually works. Between government subsidies, rising urban demand, and low entry prices, you can buy a property today for under ₹30 lakh in cities like Pune, Ahmedabad, or Surat - and still make money over time. Unlike luxury apartments that sit empty for months, these units are in high demand from first-time buyers, young families, and migrant workers. The government isn't just encouraging this market - it's paying you to be part of it.

What exactly is PMAY and how does the subsidy work?

The Pradhan Mantri Awas Yojana (PMAY) is India’s largest housing scheme, launched in 2015 to give every family a pucca house by 2024. But even in 2026, the subsidy is still active and more valuable than ever. If you’re buying an affordable home under PMAY, you get direct interest subsidy on your home loan - up to ₹2.67 lakh for homes under ₹12 lakh in urban areas, and up to ₹2.35 lakh in rural areas. That’s not a tax break. That’s cash in your pocket.

For example, if you take a ₹10 lakh loan at 8.5% interest over 20 years, your total interest payment would be around ₹11.2 lakh. With PMAY subsidy, you get ₹2.67 lakh knocked off that amount. Your monthly EMI drops by ₹1,800 to ₹2,200. That’s like getting a raise without changing jobs.

The subsidy is paid directly to your lender, not to you. But the effect is the same: lower EMIs, faster loan payoff, and more cash flow. You don’t need to file extra paperwork every year. Once you qualify and your project is PMAY-approved, the subsidy kicks in automatically.

Who qualifies for PMAY subsidies?

Not everyone can get this subsidy - but the rules are simpler than you think. Here’s who qualifies in 2026:

- You or your spouse must not own a pucca house anywhere in India.

- Your annual household income must be under ₹18 lakh (for EWS/LIG category) or ₹12 lakh (for MIG-I) or ₹18 lakh (for MIG-II).

- The home must be under 60 sq.m. in urban areas or 100 sq.m. in rural areas.

- The project must be registered under PMAY and approved by the local housing authority.

Even if you’re self-employed, have a side income, or work in the informal sector, you can still qualify as long as you can prove your income with bank statements, Aadhaar-linked income records, or a certificate from your local panchayat or municipality.

One common mistake? People think they need to be first-time buyers. That’s not true. If you own land but no house, you’re still eligible. If you sold your old house two years ago, you’re still eligible. The rule is simple: you can’t own a pucca house at the time of applying.

Where are the best affordable housing projects in 2026?

Not all affordable housing projects are equal. Some are in remote suburbs with no transport, schools, or hospitals. Others are in growing corridors with real infrastructure. Here are the top 5 locations for ROI in 2026:

- Pune Peripheral Corridors - Areas like Hinjewadi Phase 3, Kharadi Extension, and Chakan have seen 18% annual price growth since 2022. Projects here are fully PMAY-approved and close to IT parks.

- Ahmedabad’s East Corridor - Near the upcoming Metro Line 3, prices have jumped 22% since 2023. Projects by Tata Housing and Godrej Properties offer 1BHK units under ₹22 lakh with PMAY subsidy.

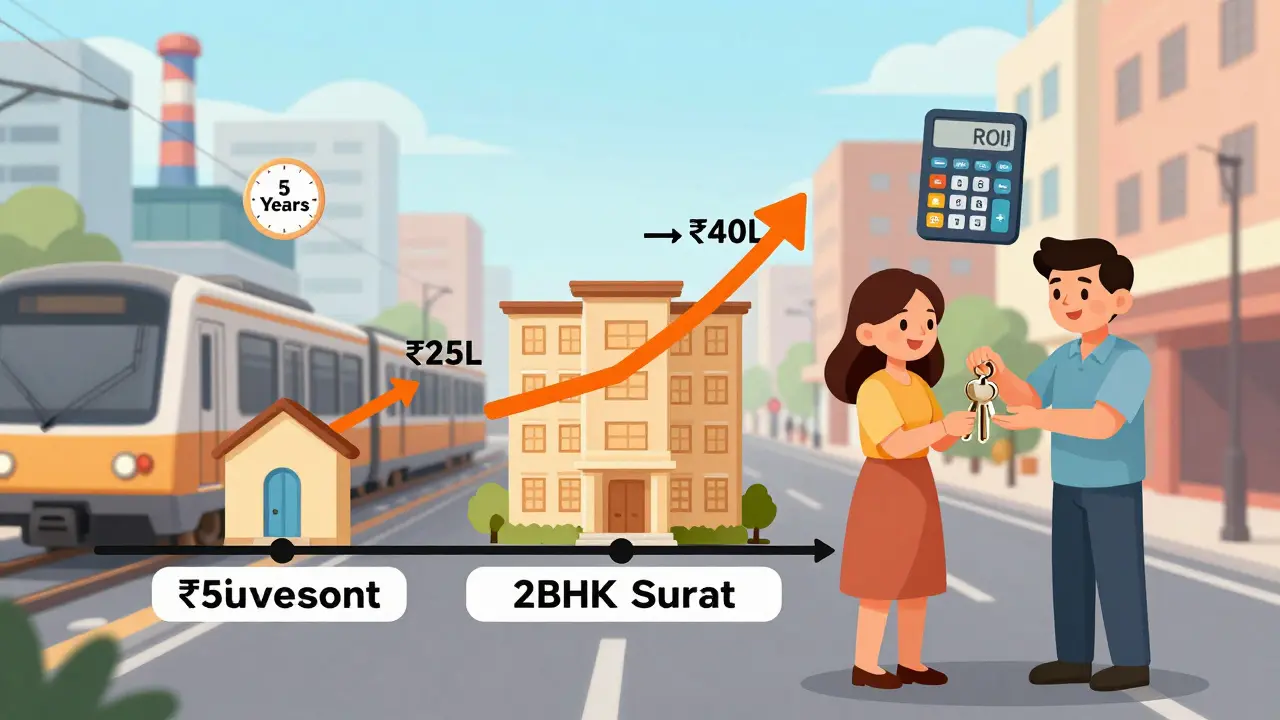

- Surat South - Surat’s diamond and textile industries drive demand. New projects near the Ring Road offer 2BHK flats for ₹25-28 lakh with guaranteed rental yields of 6-8%.

- Indore’s Vijay Nagar Extension - Affordable, well-connected, and close to the new airport. Rental demand from students and young professionals is steady.

- Navi Mumbai’s Taloja - Just 20 minutes from the airport, with metro connectivity. Prices are still under ₹30 lakh for 2BHK, but rental demand is rising fast.

Always check if the project has RERA registration and PMAY approval. A project might look cheap, but if it’s not on the official PMAY portal, you won’t get the subsidy. You can verify this at pmaymis.gov.in - just search by project name or location.

How to calculate your real ROI

ROI isn’t just about price appreciation. It’s about cash flow, subsidy savings, and rental income. Here’s how to calculate it properly:

Take a ₹25 lakh home in Surat with PMAY subsidy:

- Down payment: ₹5 lakh (20%)

- Loan: ₹20 lakh at 8.5% for 20 years → ₹17,200/month EMI

- PMAY subsidy: ₹2.67 lakh → reduces effective interest → new EMI: ₹14,800/month

- Rental income: ₹12,000/month (average for 2BHK in Surat)

- Net cash flow: ₹12,000 - ₹14,800 = -₹2,800/month (negative cash flow)

At first glance, this looks bad. But here’s the trick: the ₹2.67 lakh subsidy is a one-time gain. Spread over 20 years, it’s worth ₹1,113 per year - or ₹93/month. That’s not enough to cover the shortfall.

But wait - what if you rent it out for ₹15,000/month? That’s possible in high-demand areas. Now your net cash flow is +₹200/month. And if the property appreciates at 10% a year (which it has in Surat since 2022), in 5 years you’re sitting on a ₹40 lakh asset. Your initial ₹5 lakh investment is now worth over ₹40 lakh. That’s 8x return.

That’s the real ROI: low entry, subsidy help, and strong appreciation. You’re not buying for rent. You’re buying for future sale. The subsidy makes the math possible.

What can go wrong? Common pitfalls to avoid

Not every affordable housing deal is a winner. Here are the top three mistakes investors make:

- Buying in unapproved projects - If the project isn’t on the PMAY portal, you won’t get the subsidy. Always verify on pmaymis.gov.in.

- Ignoring location connectivity - A ₹20 lakh flat with no bus route, school, or hospital won’t appreciate. Look for projects within 5 km of metro, highways, or industrial zones.

- Overestimating rental income - Just because a listing says ₹15,000/month doesn’t mean it’s rented. In many cities, vacancy rates are 20-30%. Assume 70% occupancy when calculating returns.

Also, avoid projects that promise “guaranteed rental income.” Those are usually developer tricks. Real rental income comes from demand, not promises.

What’s next? How to get started in 2026

If you’re ready to move forward, here’s your 5-step plan:

- Check your eligibility on pmaymis.gov.in - use the income calculator tool.

- Shortlist 3-5 PMAY-approved projects in growing cities (Pune, Surat, Indore, Ahmedabad, Navi Mumbai).

- Visit the site. Talk to residents. Ask about water, power, and security.

- Get pre-approved for a home loan. Banks like HDFC, SBI, and ICICI offer faster processing for PMAY projects.

- Sign the agreement only after verifying RERA registration and PMAY status.

You don’t need a big budget. You don’t need to be an expert. You just need to avoid the traps and pick the right location. In 2026, affordable housing in India isn’t charity. It’s the most reliable real estate play left.

Frequently Asked Questions

Can NRIs get PMAY subsidies for affordable housing in India?

No. PMAY subsidies are only for Indian citizens who are first-time homebuyers and meet income criteria. NRIs can buy property, but they’re not eligible for the interest subsidy under PMAY. They can still get home loans, but without government support.

Is it better to buy a ready-to-move-in flat or under-construction under PMAY?

Under-construction is usually better for ROI. Prices are lower, and you get the full subsidy benefit upfront. Ready flats often cost 15-20% more because the developer already factored in the subsidy. If you buy ready, you might miss out on the best pricing window. But if you need to move in fast, choose a project that’s 80% complete with clear possession dates.

Can I use PMAY subsidy for a plot and self-build?

Yes - but only under the PMAY-Gramin (rural) component. For urban areas, the subsidy is only for constructed homes bought from approved developers. You can’t use it to build on your own land in cities. The government wants to ensure quality, safety, and scalability - so self-builds are excluded in urban PMAY.

What happens if I sell my PMAY house before 5 years?

You must repay the subsidy amount if you sell within 5 years of possession. The rule exists to prevent speculative flipping. After 5 years, you can sell freely without repayment. Most investors wait 5-7 years to sell - by then, appreciation far exceeds the subsidy amount.

Do I need to be an Indian citizen to buy affordable housing in India?

You don’t need to be an Indian citizen to buy property - foreigners and NRIs can purchase residential units. But only Indian citizens who meet income and ownership criteria can get the PMAY subsidy. So if you’re not a citizen, you can still invest, but you won’t get the government’s financial help.