ASBA for IPOs in India: How the Application Supported by Blocked Amount Process Works

When you apply for an IPO in India, you don’t want your entire savings locked up for weeks just because you’re hoping to get shares. That’s where ASBA comes in - a simple system that lets you apply without freezing your money. It’s not magic. It’s banking rules made smart.

What Exactly Is ASBA?

ASBA stands for Application Supported by Blocked Amount. It’s a process introduced by SEBI in 2008 to make IPO applications safer and fairer. Before ASBA, investors had to transfer money upfront to their broker or bank. That cash sat idle until the IPO was allocated or rejected - sometimes taking 10-15 days. If you didn’t get shares, you waited even longer to get your money back.

With ASBA, your money never leaves your account. Instead, the bank blocks the exact amount you’re applying for. That means you still earn interest on it. You can still use the rest of your balance for daily expenses. And if the IPO doesn’t allocate you shares, the block is lifted automatically - no waiting, no paperwork.

How Does the Blocked Amount Work?

Here’s how it works step by step:

- You fill out an IPO application form - either online through your bank’s net banking portal or offline at a branch.

- You specify how many shares you want to apply for and the bid price (if it’s a book-built issue).

- The bank checks your account and blocks the total amount needed (shares × bid price).

- That blocked amount shows up in your account as ‘reserved’ or ‘blocked’ - you can’t spend it, but you still see it.

- When the IPO closes, the registrar processes applications and allocates shares.

- If you’re allotted shares, only the money for those shares is debited. The rest gets unblocked immediately.

- If you’re not allotted any shares, the entire blocked amount is released back to your account within 24-48 hours.

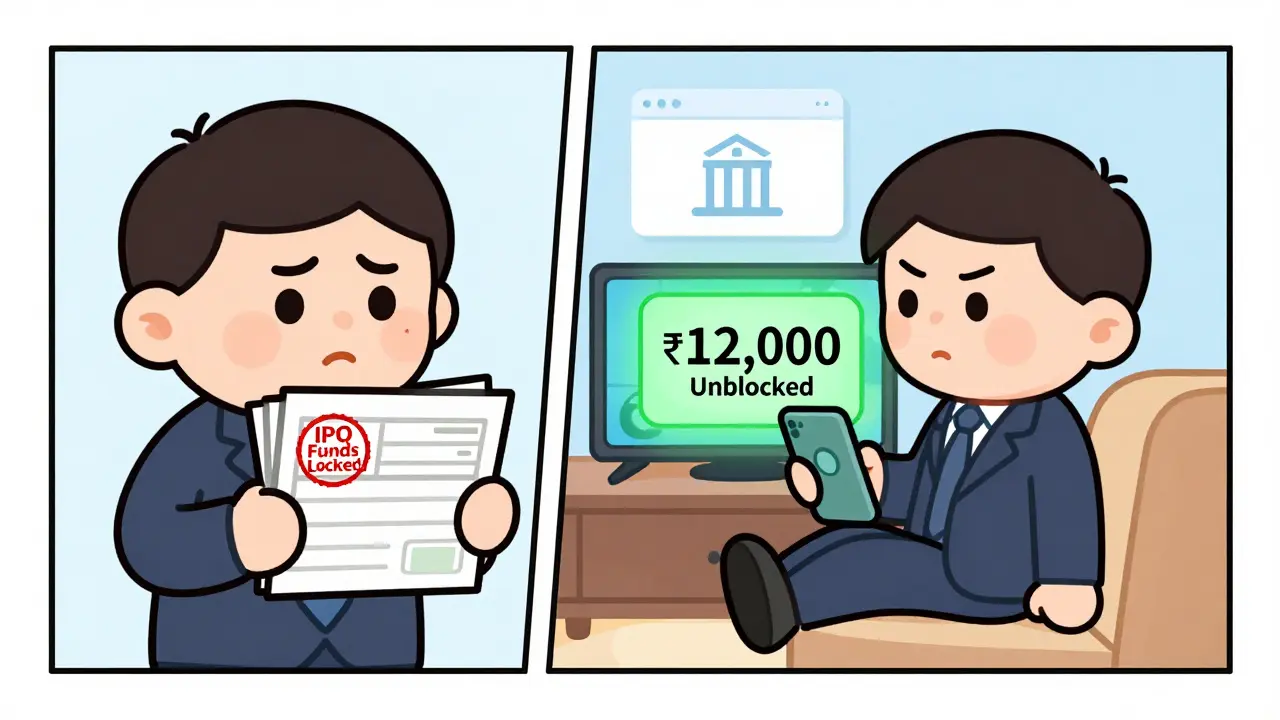

For example: You apply for 100 shares of Company X at ₹150 each. That’s ₹15,000. The bank blocks ₹15,000. You get 20 shares. Only ₹3,000 is debited. ₹12,000 is back in your account by the next business day.

Why ASBA Is Better Than the Old Way

Before ASBA, IPO applications used to cause chaos. Investors would send cheques or transfer money to brokers. Brokers pooled funds and submitted applications in bulk. If the IPO was oversubscribed - which it usually was - the money stayed locked for weeks. If there was a mistake in the application, you had to chase the broker for a refund.

ASBA fixed that. Now:

- There’s no risk of brokers misusing your funds.

- Your money stays in your own bank account, under your control.

- Refunds are faster - often within 2 days.

- There’s no need to reapply if you’re rejected.

- You can’t accidentally overpay - the system only blocks what you apply for.

SEBI’s own data shows that since ASBA became mandatory in 2016, over 98% of IPO applications in India now use this system. The number of complaints about delayed refunds dropped by 87% in the first year.

Who Can Use ASBA?

You don’t need a special account. If you have a savings account with any bank or financial institution that’s registered with SEBI as a Self-Certified Syndicate Bank (SCSB), you can use ASBA.

Most major banks in India support it: State Bank of India, HDFC Bank, ICICI Bank, Axis Bank, Kotak Mahindra Bank, and even regional banks like Bank of Baroda and Punjab National Bank. You can also use ASBA through stockbrokers who offer it as part of their trading platform - but only if they’re linked to an SCSB.

Non-resident Indians (NRIs) can use ASBA too - as long as their NRE or NRO account is with an SCSB bank. Retail investors, HNIs, and even institutional investors can apply through ASBA. It’s not limited to small-time investors.

How to Apply for an IPO Using ASBA

There are two ways: online and offline.

Online (Most Common)

Log in to your bank’s net banking portal. Look for the ‘IPO’ or ‘Investments’ section. You’ll see a list of active IPOs. Click on the one you want.

Enter:

- Number of shares you want

- Bid price (if applicable)

- Your Demat account number (this is critical - make sure it’s correct)

Click ‘Submit’. The bank instantly blocks the amount. You get a confirmation message and a unique application number. That’s it.

Offline (For Older Investors or Rural Areas)

Visit your bank branch. Ask for the ASBA form - it’s usually printed on blue paper. Fill it out with:

- Your name and PAN

- Demat account details

- Number of shares and bid price

- Bank account number

Submit it with a signed cheque or authorization. The bank will block the amount manually and give you a receipt. You’ll still get the same application number.

What Happens If You Apply Multiple Times?

One common mistake: applying more than once with the same PAN. SEBI strictly prohibits this. If you apply twice - say, once through SBI and once through HDFC - both applications will be rejected. Your money will be refunded, but you’ll be marked as a duplicate applicant.

This doesn’t just delay your refund. It can lead to your future IPO applications being flagged or even barred for a short period. Always apply only once, and always use the same Demat account.

ASBA vs. UPI for IPOs: Which Is Better?

Since 2023, SEBI allowed UPI as a payment method for IPO applications. Many investors now wonder: Should they use UPI instead of ASBA?

Here’s the truth:

| Feature | ASBA | UPI |

|---|---|---|

| Money Handling | Blocked in your bank account | Debited immediately |

| Interest Earned | Yes - money stays in account | No - money leaves account |

| Refund Speed | 1-2 days after allotment | Same day if rejected |

| Maximum Limit | No cap - works for large applications | ₹5 lakh per transaction |

| Best For | Investors wanting to keep funds liquid | Small investors who want instant confirmation |

ASBA is still the safer, more flexible option for most people. UPI is faster for small amounts and works well if you’re applying for under ₹5 lakh and want immediate confirmation. But if you’re applying for ₹10 lakh or more, UPI won’t work. And you’ll lose out on interest.

Common Mistakes to Avoid

Even with ASBA, people mess up. Here are the top errors:

- Entering the wrong Demat account number - your shares go to the wrong person.

- Applying multiple times with the same PAN - your application gets rejected.

- Not checking the bid price range - if you bid too low, you won’t get shares.

- Using a joint account without checking eligibility - some IPOs only allow single holders.

- Forgetting to link your Demat and bank accounts - the system won’t process your application.

Always double-check your Demat account number. It’s 16 digits and starts with IN. You can find it in your DP statement or on your broker’s app.

What If You Don’t Get Any Shares?

Most IPOs are oversubscribed. If you’re not allotted shares, your blocked amount is automatically released. No action needed. Check your bank statement after 48 hours. The balance should be back.

If it’s not - contact your bank’s customer service. Have your application number ready. Most banks resolve this within 24 hours. If they don’t, escalate to SEBI’s SCORES portal. It’s free, fast, and effective.

Can You Withdraw the Blocked Amount Early?

No. Once the block is placed, you can’t withdraw or transfer the amount. The bank holds it until the IPO process ends. This is by design - to prevent manipulation.

If you need cash urgently, you can’t access the blocked amount. Plan ahead. Only apply for IPOs with money you’re comfortable locking up for up to 10 days.

ASBA and Tax Implications

There are no direct tax implications for using ASBA. The blocked amount isn’t income. It’s just money you’re trying to invest. If you make a profit selling IPO shares later, capital gains tax applies - just like any other stock trade.

Short-term gains (if you sell within 1 year) are taxed at 15%. Long-term gains (over 1 year) are taxed at 10% above ₹1 lakh. ASBA doesn’t change this.

Final Thoughts

ASBA isn’t just a technical process. It’s a shift in how ordinary people interact with the stock market. It gives you control. It protects your money. It removes the middleman’s power to hold your cash.

For first-time investors, it’s the easiest way to enter the IPO market. For experienced ones, it’s the smartest way to avoid unnecessary risks. You don’t need to be a financial expert to use it. Just follow the steps. Double-check your Demat number. Apply once. Wait.

And remember - getting shares in an IPO isn’t guaranteed. But with ASBA, you’re guaranteed one thing: your money stays safe until the outcome is clear.

Is ASBA mandatory for IPO applications in India?

Yes, since 2016, SEBI made ASBA mandatory for all retail IPO applications in India. Banks and brokers cannot accept applications without using the blocked amount system. This rule applies to all public issues - whether it’s a small startup or a giant like Reliance.

Can I apply for an IPO without a Demat account?

No. You need a Demat account to receive shares if you’re allotted. Even if you apply through ASBA, the application form requires your Demat account number. Without it, your application will be rejected. Opening a Demat account is free and takes less than 24 hours through any broker.

How long does it take to get a refund if I don’t get IPO shares?

If you’re not allotted shares, the blocked amount is released within 24 to 48 hours after the IPO allotment is finalized. Most banks do it within one business day. If it takes longer, contact your bank and ask for the reason. You can also track the status on the registrar’s website using your application number.

Can I use ASBA for follow-on public offers (FPOs)?

Yes. ASBA works for both IPOs and FPOs. Any time a company offers new shares to the public - whether it’s their first time or their fifth - you can use ASBA to apply. The process is identical.

Do I need to pay any fees to use ASBA?

No. Banks and brokers are not allowed to charge any fee for using the ASBA facility. It’s a free service mandated by SEBI. If someone asks you for a processing fee, it’s a scam. Report it to SEBI’s SCORES portal immediately.