Growth vs IDCW Mutual Funds in India: Which Payout Option Fits Your Goals?

When you invest in mutual funds in India, you’re not just choosing a fund - you’re choosing how your money grows over time. Two options dominate the conversation: Growth and IDCW (Income Distribution cum Capital Withdrawal). Both sound simple, but the difference between them can change your returns by thousands of rupees over just five years. So which one should you pick? It’s not about which is better. It’s about which fits your life.

What Growth Option Really Means

The Growth option is exactly what it sounds like: your money stays invested. Every dividend your fund earns - whether from stocks, bonds, or other assets - gets reinvested automatically. No cash hits your bank account. Instead, your units increase in number. This is the default setting for most long-term investors.

Think of it like planting a tree. You water it, care for it, and let it grow. You don’t cut off branches to use as firewood. Over time, that tree becomes tall, strong, and full of fruit. The same happens with Growth mutual funds. Compounding works silently in the background. A ₹1 lakh investment in a Growth fund returning 12% annually becomes ₹1.76 lakh in five years - and ₹3.11 lakh in ten. No action needed.

But here’s the catch: you won’t see any cash until you sell. If you need money for a wedding, medical bill, or a down payment, you’ll have to redeem units. That means you’re selling at market value, which could be higher or lower than what you paid. It’s flexible - but it requires discipline.

What IDCW Actually Does

IDCW - short for Income Distribution cum Capital Withdrawal - is the dividend option you’ve probably seen advertised as "regular income." But it’s not a true dividend like you get from a company. It’s a payout of your own money. The fund takes some of your capital and gives it to you as cash. Then it reduces your net asset value (NAV) by the same amount.

Imagine you own a ₹100 share. The fund declares an IDCW of ₹5. You get ₹5 in cash. But your share value drops to ₹95. Your total value? Still ₹100. You didn’t earn anything. You just got some cash back from your own investment.

This option is popular because it feels like free money. Especially for retirees or people on a fixed budget. But here’s the truth: if you’re relying on IDCW for monthly income, you’re slowly eating into your principal. A ₹50 lakh portfolio paying 4% annually in IDCW gives you ₹20,000 a month. Sounds great. But over ten years, you’ve taken out ₹24 lakh. That’s nearly half your capital gone - and your future returns shrink with it.

Why People Choose IDCW (And Why It’s Risky)

Many investors in India choose IDCW because they believe it’s "safe" or "guaranteed income." That’s a myth. Mutual funds don’t guarantee payouts. The fund house decides when and how much to distribute. In volatile markets, payouts can drop - or vanish. In 2020, during the pandemic, many IDCW funds slashed distributions by 30-50%. Investors who counted on that cash were caught off guard.

Another reason people pick IDCW: tax confusion. Some think dividend income is tax-free. It’s not. Since April 2020, dividends from mutual funds are taxed in your hands at your income tax slab rate. So if you’re in the 30% bracket, you lose ₹3 for every ₹10 you receive. Meanwhile, Growth funds only trigger tax when you sell - and even then, long-term gains (over one year for equity funds) are taxed at just 10% above ₹1 lakh.

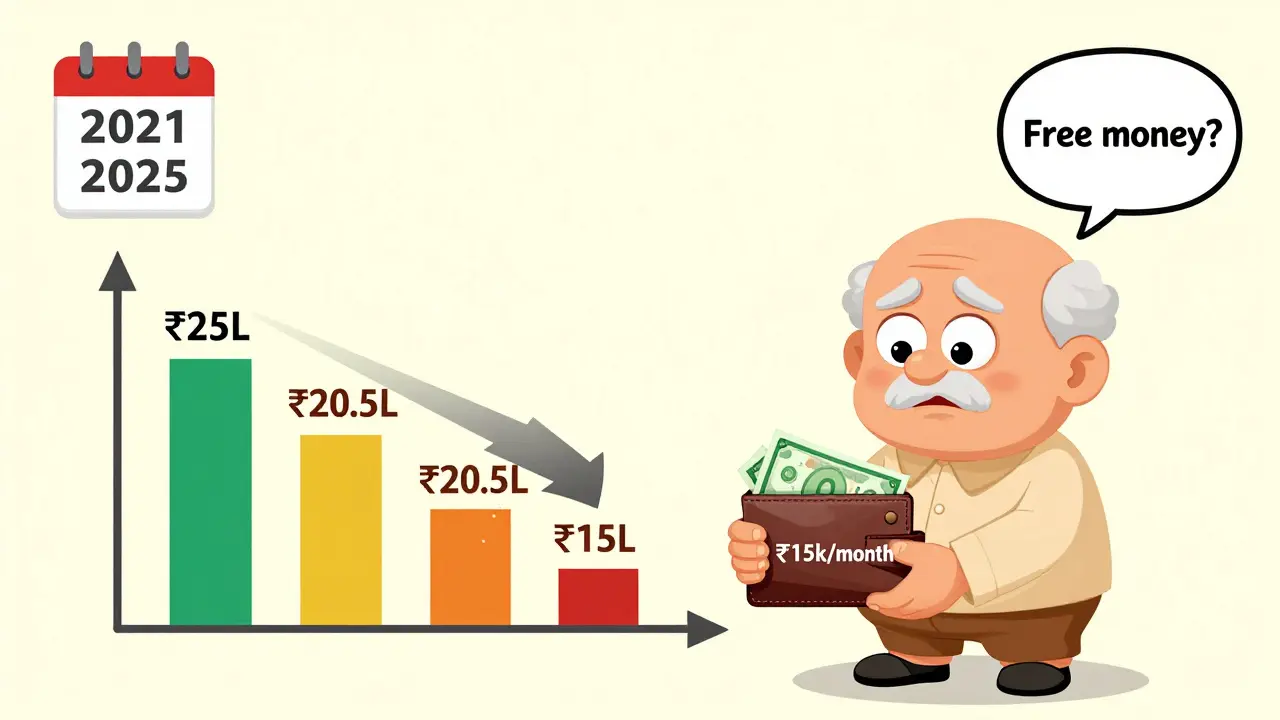

Here’s a real example: Ramesh, 62, invested ₹25 lakh in an IDCW equity fund in 2021. He took ₹15,000 every month. By 2025, he’d received ₹7.2 lakh. But his fund’s NAV had dropped 18% from the original. His remaining corpus? ₹20.5 lakh. He thought he was earning income. He was just spending his own savings faster than he realized.

Why Growth Is Better for Most People

For the vast majority of investors - especially those under 55 - Growth is the smarter choice. Why?

- Compounding works better: Reinvested returns grow faster. A 12% annual return compounds to 176% over five years. IDCW breaks that chain.

- Tax efficiency: No tax until you sell. Even then, you control when to trigger it.

- Market timing control: You decide when to cash out - not the fund house.

- Higher long-term returns: Studies by AMFI show Growth options outperform IDCW by 1.5-2.5% annually over 10 years in equity funds.

Take Priya, 38, who started investing ₹10,000/month in a Growth fund in 2020. By 2026, her corpus is ₹11.2 lakh. She hasn’t touched it. She plans to use it for her child’s education in 2030. She didn’t need cash now. She didn’t get distracted by monthly payouts. Her money worked harder.

When IDCW Might Make Sense

There are times when IDCW isn’t a bad idea.

- Retirees with no other income: If you’ve built a corpus and need steady cash, IDCW can help - but only if you’re not withdrawing more than 4% annually. Withdraw more, and you risk running out.

- Short-term goals (1-3 years): If you’re saving for a car or vacation in 2 years, IDCW lets you get some cash without selling.

- Psychological comfort: Some people feel safer seeing cash in their account. If that helps you stick to your plan, it’s worth considering - but monitor your corpus closely.

Important: Don’t use IDCW in equity funds for long-term goals. The volatility makes it unpredictable. Stick to debt funds if you want steady payouts - and even then, keep withdrawals below 5% per year.

The Hidden Cost of IDCW: The Erosion Trap

Here’s what most investors don’t realize: IDCW doesn’t just give you cash. It reduces your future earning power.

Let’s say you have ₹50 lakh in an IDCW fund returning 10% annually. You take ₹40,000/month - ₹4.8 lakh/year. That’s 9.6% of your corpus. You’re taking out nearly 10% every year. The fund’s return? 10%. Sounds fine. But here’s what happens:

- Year 1: You get ₹4.8 lakh. Your corpus drops to ₹45.2 lakh.

- Year 2: Your fund grows 10% on ₹45.2 lakh = ₹4.52 lakh. You take ₹4.8 lakh again. You’re now taking more than you earned. Your corpus shrinks to ₹40.92 lakh.

- By Year 5, your corpus is down to ₹28.6 lakh. You’re still getting ₹4.8 lakh/year - but now it’s 16.8% of your remaining money.

You didn’t lose money. You just spent it faster than it could grow. That’s the erosion trap. Growth avoids it entirely.

How to Decide: A Simple Framework

Ask yourself these three questions:

- Do you need cash every month? If yes, IDCW might help - but only if you’re withdrawing less than 4% of your total portfolio annually.

- Are you investing for retirement or a goal more than 5 years away? If yes, Growth is almost always better.

- Do you have other sources of income? If you have a pension, salary, or rental income, Growth lets your money compound undisturbed.

If you answered "yes" to the third question and "no" to the first, Growth is your clear choice. If you’re retired and rely on your fund for living expenses, IDCW can work - but monitor your corpus every year. Adjust withdrawals if your fund’s returns drop.

Pro Tip: Use Both - But Strategically

You don’t have to pick one. Many smart investors split their portfolio. Keep 70-80% in Growth for long-term growth. Put 20-30% in IDCW for short-term cash flow.

For example: You have ₹1 crore. Put ₹80 lakh in a Growth equity fund. Put ₹20 lakh in an IDCW debt fund. The equity part grows. The debt part gives you ₹15,000-20,000/month. You get the best of both worlds - without risking your core wealth.

Final Thought: It’s Not About Returns. It’s About Control.

Growth funds give you control. You decide when to sell. You decide when to take money. IDCW gives you convenience - but at the cost of your long-term power.

In India, where most people don’t have pensions or employer-sponsored retirement plans, your mutual fund is your safety net. Don’t let a monthly payout trick you into thinking you’re earning more. You’re not. You’re just spending your future.

Choose Growth unless you have a clear, documented need for cash. Then, and only then, consider IDCW - and keep it small, smart, and monitored.

Is IDCW the same as dividend mutual funds?

Yes, IDCW is the new name for what used to be called "dividend option." The fund house now calls it Income Distribution cum Capital Withdrawal because it’s not really a dividend - it’s a return of your own capital. The payout is not guaranteed and reduces your NAV. So while the name changed, the mechanics are the same.

Can I switch from IDCW to Growth later?

Yes, you can switch from IDCW to Growth at any time. But it’s treated as a redemption and fresh purchase. That means you’ll pay capital gains tax if you’ve held the fund for more than a year (10% on equity funds above ₹1 lakh). There’s no penalty, but you need to plan the tax impact. Always check with your fund house before switching.

Are IDCW funds better for retirees?

They can be - but only if used carefully. Retirees should never rely on IDCW as their only income. Use it as a supplement. Limit withdrawals to 4% of your total portfolio per year. Keep the majority of your money in Growth funds so your corpus keeps growing. Many retirees who used IDCW heavily ended up with half their money gone in 5-7 years.

Do IDCW funds have lower returns than Growth funds?

The fund’s underlying performance is the same. The difference is in what happens to your money. Growth reinvests everything. IDCW pays out cash and reduces your units. Over time, that means Growth builds more wealth. Studies from AMFI show Growth options outperform IDCW by 1.5-2.5% annually over 10 years in equity funds. That’s the power of compounding.

Is IDCW taxable?

Yes. Since April 2020, all mutual fund payouts - including IDCW - are added to your income and taxed at your slab rate. If you’re in the 30% tax bracket, you pay ₹30 on every ₹100 you receive. Growth funds only trigger tax when you sell - and long-term gains on equity funds are taxed at just 10% above ₹1 lakh. So Growth is often more tax-efficient.