Section 80C for Homebuyers in India: How to Claim Principal, Stamp Duty, and Registration Fees

Buying a home in India isn’t just about finding the right location or negotiating the price. For most people, it’s also the biggest financial decision they’ll ever make - and one that comes with hidden tax benefits most buyers miss. If you’re purchasing your first home or upgrading, you could be leaving thousands of rupees on the table by not claiming Section 80C deductions properly. The good news? You can claim deductions not just on your home loan principal, but also on stamp duty and registration fees. Here’s exactly how to do it - and what most people get wrong.

What Section 80C Actually Covers for Homebuyers

Section 80C of the Income Tax Act lets you reduce your taxable income by up to ₹1.5 lakh per year. It’s not just for fixed deposits or life insurance. For homebuyers, it includes three key expenses: the principal repayment of your home loan, stamp duty paid at the time of purchase, and registration fees. These aren’t separate deductions - they all roll into the same ₹1.5 lakh limit.Let’s say you paid ₹80,000 in stamp duty and ₹20,000 in registration fees when you bought your flat. That’s ₹1 lakh already used up. Now, if your home loan principal repayment for the year is ₹50,000, you’ve hit your full limit. No more room for PPF, ELSS, or NSC contributions this year. But if you only paid ₹30,000 in principal, you still have ₹20,000 left to invest elsewhere under 80C.

What trips people up is thinking these are extra benefits. They’re not. They’re part of the same bucket. You can’t claim ₹1.5 lakh for principal + another ₹1.5 lakh for stamp duty. The total is capped at ₹1.5 lakh across all eligible 80C investments combined.

Eligibility: Who Can Claim These Deductions?

You can claim Section 80C deductions for home-related expenses only if you’re the owner of the property. That means:- You must be the first owner - no joint ownership with non-family members unless they’re co-applicants on the loan.

- The property must be in India. Overseas property purchases don’t qualify.

- The house can be under construction, but you can only claim stamp duty and registration fees once the agreement is signed and payments are made. Principal repayment claims start only after the loan disburses and repayments begin.

- It doesn’t matter if the property is self-occupied or rented out. You can still claim 80C on principal, stamp duty, and registration, even if you rent it later.

But here’s the catch: if you’re buying a property in your spouse’s name and you’re not a co-owner, you can’t claim any deduction - even if you’re paying the entire cost. The law ties the benefit to ownership, not payment.

Stamp Duty and Registration Fees: When and How to Claim

Many first-time buyers don’t realize they can claim stamp duty and registration fees in the year they’re paid - even if the house isn’t ready yet. These are one-time costs, so they’re claimed in full in the financial year you pay them, as long as the sale deed is registered.For example, if you signed the agreement and paid ₹95,000 in stamp duty and ₹15,000 in registration in April 2025, you can claim ₹1.1 lakh under Section 80C for FY 2024-25. You don’t need to wait for possession. You don’t need to start repaying the loan yet. The moment you pay these fees and the property is registered in your name, you’re eligible.

Keep these documents safe:

- Stamped and registered sale agreement

- Receipts for stamp duty payment (issued by the state government or authorized bank)

- Official receipt for registration fees (from the sub-registrar’s office)

Some states like Maharashtra and Karnataka have higher stamp duty rates - up to 5-6% of the property value. That means a ₹50 lakh property could mean ₹2.5-3 lakh in stamp duty. But you can still only claim up to ₹1.5 lakh under 80C. The rest is lost. That’s why it’s smart to time your purchase if you’re also planning other 80C investments.

Principal Repayment: The Bigger Piece of the Puzzle

Your home loan EMI has two parts: interest and principal. Only the principal portion qualifies for Section 80C. The interest part gets a separate deduction under Section 24(b), up to ₹2 lakh for self-occupied property.So how do you know how much of your EMI is principal? Your bank sends an annual statement breaking down the interest and principal paid each year. You can also use an amortization calculator to estimate it. For a ₹50 lakh loan at 8.5% over 20 years, the first year’s principal repayment is around ₹1.1 lakh. That’s already 73% of your 80C limit.

If you’re making prepayments, those count too - as long as they’re applied to the principal. A lump sum payment of ₹2 lakh toward your principal in January? That’s ₹2 lakh added to your 80C claim. But again, you’re still capped at ₹1.5 lakh total across all 80C investments.

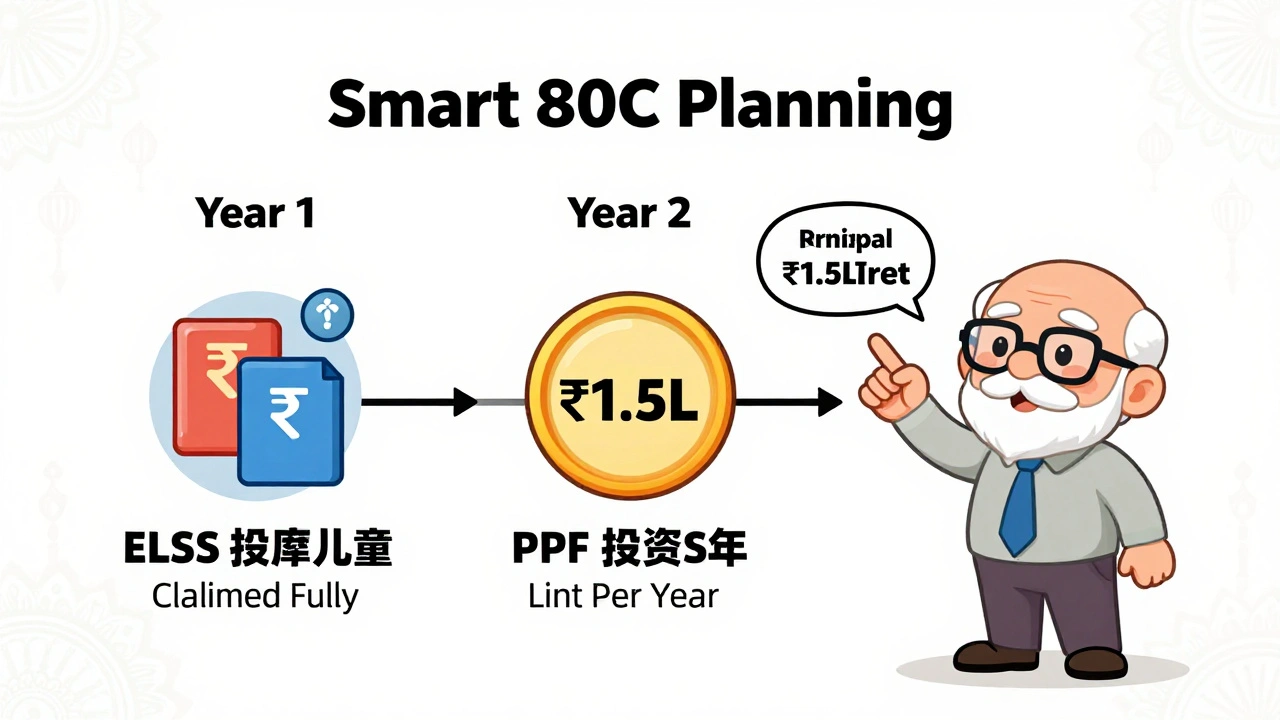

Pro tip: If you’re planning to invest in ELSS mutual funds or a PPF account, delay those payments until after you’ve claimed your stamp duty and registration fees. That way, you use up the lower-value, one-time expenses first, and save room for compounding investments.

Common Mistakes Homebuyers Make

Most people claim 80C deductions incorrectly. Here are the top three errors:- Claiming stamp duty and registration fees over multiple years - they’re one-time costs. Claim them only in the year you paid them.

- Thinking the entire EMI is deductible - only the principal portion counts for 80C. Interest goes under Section 24.

- Not keeping documents - without the official receipts and registered agreement, your claim can be rejected during scrutiny.

Another big mistake: assuming joint buyers get double the limit. If you and your spouse are co-owners and co-applicants on the loan, you can each claim up to ₹1.5 lakh - but only if you’re both paying from your own income and both are named on the property documents. If one person pays everything, only that person can claim it.

Real-Life Example: How Much Can You Save?

Let’s say you’re a salaried professional earning ₹12 lakh per year. You buy a ₹60 lakh flat in Pune in April 2025. You pay ₹3.2 lakh in stamp duty and ₹40,000 in registration. Your home loan principal repayment for the year is ₹1.3 lakh.You can claim:

- Stamp duty: ₹3.2 lakh → but capped at ₹1.5 lakh total

- Registration: ₹40,000

- Principal repayment: ₹1.3 lakh

But here’s the math: stamp duty + registration = ₹3.6 lakh. Principal = ₹1.3 lakh. Total eligible = ₹4.9 lakh. But your 80C limit is ₹1.5 lakh.

You can only claim ₹1.5 lakh. So you choose the most valuable combination: claim ₹1.5 lakh from stamp duty and registration (since those are one-time and can’t be claimed again), and skip the principal repayment for this year. Next year, when your principal repayment is ₹1.4 lakh, you can claim that and use other 80C options like PPF or ELSS for the remaining ₹10,000.

By optimizing when you claim what, you stretch your tax savings over multiple years. That’s how smart buyers play the system.

What If You’re Buying a Second Home?

Section 80C doesn’t care if it’s your first or second home. As long as you’re the owner and you’re paying the principal, stamp duty, or registration, you can claim it. But here’s the catch: if you’re claiming tax benefits on two homes, you’ll need to track each property’s expenses separately.For example, if you bought your first home in 2022 and claimed ₹1.5 lakh in 80C that year, and now you’re buying a second home in 2025, you can claim another ₹1.5 lakh for this new property’s stamp duty and principal - even if you’re still repaying the first loan. The limit resets per property.

But if you’re renting out your first home and living in the second, you can’t claim the interest deduction under Section 24 for both. Only one home can be treated as self-occupied. The other is deemed to be rented, and you’ll have to declare notional rent as income. That’s a separate issue - but 80C deductions still apply to both.

What Doesn’t Qualify?

Not everything related to buying a home counts. Here’s what’s excluded:- Interest paid on the home loan - that’s under Section 24, not 80C.

- Home renovation costs - unless you’re taking a home improvement loan, and even then, only the principal repayment of that loan qualifies.

- Brokerage fees, legal fees, or interior decoration costs.

- EMI payments made by your employer as a perk - those are taxable perquisites.

And don’t try to claim stamp duty on a plot of land alone. Section 80C applies only to residential or commercial property where construction has begun or is completed. Raw land purchases don’t qualify.

How to Claim: Step-by-Step

Follow these steps to ensure your claim goes through without a hitch:- Collect all receipts: stamped sale agreement, stamp duty payment receipt, registration fee receipt.

- Get your bank’s annual home loan statement showing principal repayment.

- Add up all your 80C investments: EPF, PPF, ELSS, insurance premiums, tuition fees, and now home expenses.

- Make sure the total doesn’t exceed ₹1.5 lakh. If it does, reduce other investments to stay under limit.

- Report these under ‘Deductions under Chapter VI-A’ in your ITR-1 or ITR-2 form.

- Keep all documents for at least six years - the income tax department can ask for them anytime.

There’s no separate form for stamp duty or registration claims. You just include them in your total 80C amount. But without proof, you’re risking a notice.

Next Steps for Smart Homebuyers

If you’re planning to buy a home in the next 12 months:- Calculate your expected stamp duty and registration fees before you finalize the deal. Use your state’s official calculator.

- Compare how much principal you’ll repay in the first year - use an EMI calculator.

- Plan your other 80C investments (PPF, ELSS, NSC) around these numbers.

- If you’re close to the ₹1.5 lakh limit, consider delaying other investments until after you’ve claimed your one-time home costs.

- Always pay stamp duty and registration through official channels. Never accept cash receipts without a government-issued challan.

Section 80C isn’t a loophole. It’s a designed incentive to encourage homeownership. But like any tool, it only works if you use it correctly. Most people don’t even know stamp duty qualifies. You do now. Don’t let your next home purchase cost you more in taxes than it should.

Can I claim stamp duty and registration fees if I bought the property in my parents’ name?

No. Only the legal owner of the property can claim Section 80C deductions. If the property is registered in your parents’ name, even if you paid for it, you cannot claim any tax benefit under 80C. The ownership must be in your name - or jointly with you as a co-owner.

Can I claim both Section 80C and Section 24 for the same home loan?

Yes. Section 80C covers the principal repayment of your home loan, while Section 24 covers the interest paid. These are two separate deductions. You can claim up to ₹1.5 lakh under 80C for principal, stamp duty, and registration, and up to ₹2 lakh under Section 24 for interest - for a self-occupied property.

Is there a time limit to claim stamp duty under Section 80C?

Yes. You can only claim stamp duty and registration fees in the financial year you paid them. You cannot carry forward or claim them in later years. If you paid ₹1 lakh in stamp duty in April 2025, you must claim it in FY 2024-25. Missing that window means losing the deduction permanently.

Can I claim Section 80C for a home purchased under a joint venture or partnership?

Only if you are a legal co-owner with a documented share in the property. If you’re part of a joint venture but not named as an owner in the sale deed, you cannot claim any 80C deduction. The tax benefit is tied to legal ownership, not financial contribution.

What if I paid stamp duty in cash? Can I still claim it?

No. Cash payments for stamp duty are not accepted under Indian tax law. You must pay through bank transfer, demand draft, or official e-stamping portal. Always get a government-issued receipt with a unique challan number. Without it, your claim will be rejected during scrutiny.