How to Calculate Real Estate ROI in India: Evaluating Property Investment Returns

Buying property in India isn’t just about having a place to live-it’s a financial move. But how do you know if a property is actually making you money? Many investors in cities like Bangalore, Pune, or Hyderabad think they’re earning good returns because rent is rising. But when you add up all the costs, their real profit might be close to zero. Real estate ROI in India isn’t about the rent you collect. It’s about what you keep after taxes, maintenance, vacancies, and time.

What Is Real Estate ROI and Why It Matters in India

ROI stands for Return on Investment. In real estate, it tells you how much profit you make compared to how much you spent. A simple way to think about it: if you put ₹50 lakh into a flat and earn ₹4 lakh a year in net profit, your ROI is 8%. That’s solid. But if you’re only counting rent and ignoring property tax, repairs, or the 6 months the unit sat empty, your ROI number is fake.

In India, property prices in Tier-1 cities have grown 5-7% yearly over the last decade, according to data from the National Housing Bank. But rental yields? They’ve stayed flat at 2-4% in most metros. That means your return isn’t coming from rent-it’s coming from price growth. And that’s risky. If prices stop rising, your ROI collapses.

Step-by-Step: How to Calculate Your Real Estate ROI

Forget the flashy online calculators. Here’s how to do it yourself, the right way.

- Calculate your total investment cost: This includes the purchase price, registration fees, stamp duty, legal charges, broker commission, and any renovation costs. Don’t skip these. In Delhi, stamp duty alone can be 6-8% of the property value. Add ₹2-3 lakh to your cost even if you didn’t pay it out of pocket.

- Estimate annual rental income: Look at similar properties in the same building or street. Use NoBroker, MagicBricks, or 99acres to find recent rentals. Don’t assume ₹30,000/month just because the listing says so. Ask a local agent for actual leased rates. Multiply by 12.

- Subtract all annual expenses: Property tax (varies by city-₹15,000-₹60,000/year), maintenance charges (₹1,000-₹3,000/month), insurance (₹5,000-₹15,000/year), repairs (budget ₹20,000-₹50,000/year), and vacancy loss (assume 1-2 months rent/year). If you use a property manager, add 8-10% of rent.

- Calculate net annual income: Rental income minus all expenses.

- Divide net income by total investment: Multiply by 100 to get a percentage. That’s your ROI.

Example: You buy a 2BHK in Navi Mumbai for ₹80 lakh. You spend ₹5 lakh on fees and renovations. Total investment: ₹85 lakh. You rent it for ₹28,000/month. Annual rent: ₹3.36 lakh. Expenses: property tax (₹30,000), maintenance (₹36,000), repairs (₹40,000), vacancy (₹56,000), property manager (₹30,000). Total expenses: ₹1.92 lakh. Net income: ₹1.44 lakh. ROI: (₹1.44 lakh / ₹85 lakh) × 100 = 1.7%.

That’s low. But if the property appreciates 6% a year, you gain ₹5.1 lakh in value. Now your total return is ₹6.54 lakh. That’s 7.7% total return. But remember-appreciation is not cash. You only realize it when you sell.

Where Real Estate ROI Is Actually Good in India (2025)

Not all cities are equal. Some places have high rent and low prices. Others have sky-high prices and barely any rent.

Best rental yields (2025 data):

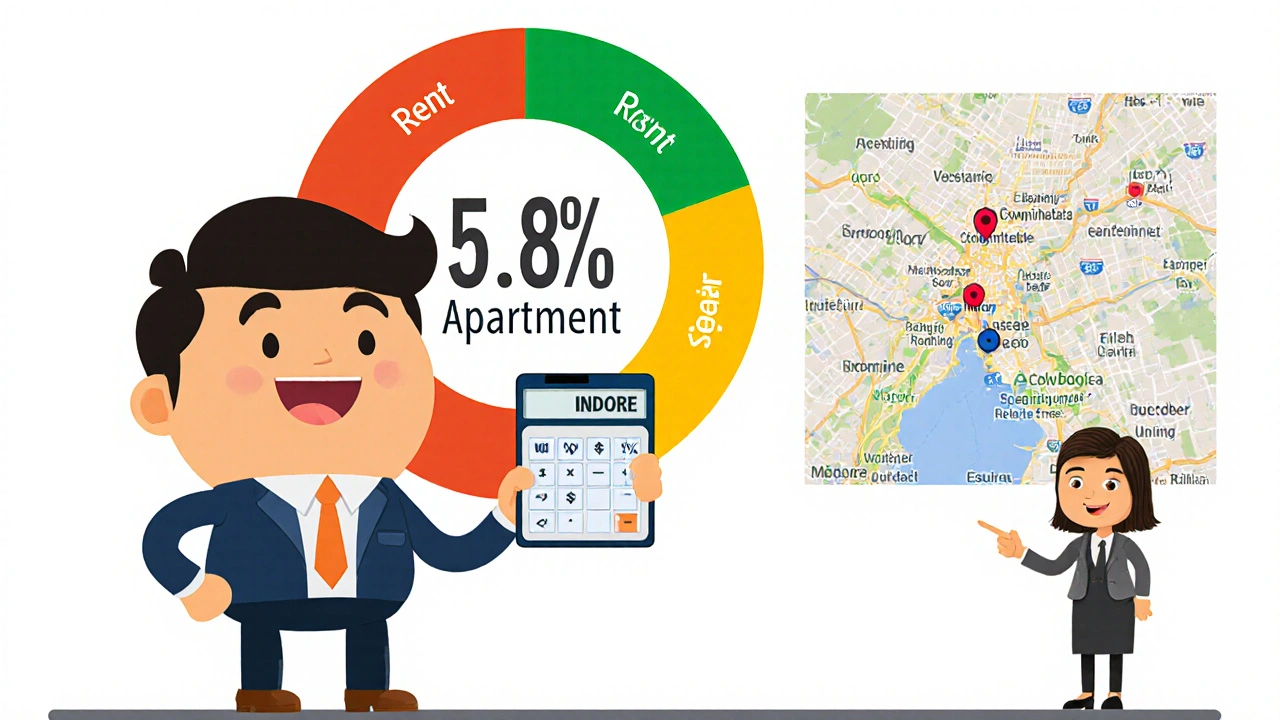

- Indore: 5.2-6.1% (low entry cost, growing IT workforce)

- Coimbatore: 4.8-5.7% (manufacturing hub, steady demand)

- Jaipur: 4.5-5.3% (tourism + student housing)

- Surat: 4.3-5.0% (diamond industry, high population density)

Worst rental yields:

- Mumbai: 1.8-2.5% (prices are insane, rent capped by law in many areas)

- Delhi: 2.2-3.0% (high taxes, low tenant turnover)

- Bangalore: 2.5-3.5% (high demand but even higher prices)

So if you’re chasing income, skip Mumbai. Go to Indore or Coimbatore. If you’re betting on appreciation, then Delhi or Bangalore might still work-but only if you hold for 7+ years.

The Hidden Costs That Kill ROI in India

Most investors miss these.

- Stamp duty and registration: Varies by state. Maharashtra charges 5% + 1% metro cess. Karnataka charges 5.65%. These aren’t optional. They’re part of your cost base.

- Capital gains tax: If you sell after 2 years, you pay 20% with indexation. That eats into your profit. If you sell before 2 years, it’s taxed as income-up to 30%.

- Legal disputes: 1 in 5 property deals in India face title issues. Always get a lawyer to check the chain of title. A ₹50,000 legal check can save you ₹50 lakh later.

- HOA and maintenance hikes: In gated communities, maintenance fees can double in 5 years. Factor that in.

- Utility arrears: Previous owners often leave unpaid water or electricity bills. You’ll inherit them. Ask for clearance certificates.

One investor in Pune bought a flat for ₹60 lakh. He didn’t check the title. Three years later, a distant relative claimed ownership. He spent ₹12 lakh in legal fees and lost the property. ROI? Negative.

Appreciation vs. Rental Yield: Which Should You Choose?

Two strategies. Both valid. But you must pick one.

Strategy A: Rental Income Focus - Buy in cities with high yields (Indore, Coimbatore, Surat). Hold for cash flow. Reinvest rent into more properties. You build a portfolio slowly but steadily. This works if you’re not in a rush. You’re trading slow growth for steady income.

Strategy B: Appreciation Focus - Buy in metro suburbs where infrastructure is coming. Think Noida Extension, Chennai’s Oragadam, or Hyderabad’s Gachibowli. These areas have low current yields (2-3%) but are on government development lists. If the metro rail or highway comes through, prices jump 30-50% in 3-5 years. But you need patience. And risk tolerance.

Don’t try to do both. If you buy in Mumbai for high appreciation, you’ll have negative cash flow. You’ll burn through savings. If you buy in Indore for appreciation, you’ll wait 10 years for a big jump-and you’ll miss out on the income.

Tools to Track Your ROI in Real Time

You don’t need fancy software. But you need to track.

- Use Google Sheets: Make a simple tracker with columns for purchase cost, rent, expenses, vacancy, and net income. Update it every quarter.

- Set calendar reminders: Property tax deadlines, maintenance checks, lease renewals.

- Check RERA portal: Every registered project has a completion timeline. If your builder is late, your rental income is delayed.

- Monitor local news: New metro lines, IT parks, or hospitals near your property? That’s your next price spike.

One investor in Ahmedabad started tracking his ROI in 2021. He noticed his maintenance costs were rising 12% yearly. He sold in 2024 and bought a similar property in Vadodara with lower fees. His ROI jumped from 2.1% to 4.8%.

When to Sell: Signs Your ROI Is Dying

Hold too long, and your ROI can turn negative.

- Your rent hasn’t increased in 3+ years, but expenses keep rising.

- Property tax has doubled since you bought.

- The building is aging-elevator broken, pipes leaking, no lift for elderly tenants.

- Neighborhood is declining: crime up, schools closing, shops shutting.

- You’re spending more on repairs than you earn in rent.

Don’t wait for the ‘perfect’ price. If your ROI drops below 3% and shows no sign of recovery, it’s time to exit. Reinvest elsewhere.

Final Rule: ROI Isn’t a Number. It’s a Habit.

The best real estate investors in India don’t chase hot markets. They track their numbers. Every quarter. Every year. They know their net cash flow before they sign a lease. They don’t assume. They verify.

Real estate ROI in India isn’t about luck. It’s about discipline. If you calculate it right, you’ll see which properties are winners-and which are money traps.

What is a good ROI for real estate in India?

A good ROI is 5% or higher from rental income alone. Most investors in Tier-1 cities get 2-3%, but that’s mostly from price appreciation. If you’re relying on rent, aim for 5-7% in cities like Indore, Coimbatore, or Surat. Anything below 3% is risky unless you’re betting on long-term appreciation.

Is property appreciation reliable in India?

It can be, but it’s not guaranteed. Over the last 10 years, Tier-1 cities saw 5-7% annual price growth. But that’s averaged out. Some areas rose 15% a year; others fell 5%. Government infrastructure projects (metro lines, highways, new airports) drive appreciation. Always check the RERA and Master Plan before buying. Don’t buy just because prices are rising.

Do I need to pay tax on rental income in India?

Yes. Rental income is taxed as ‘Income from House Property.’ You can deduct 30% of rent as standard maintenance expense, plus property tax paid. If you have a home loan, you can also deduct interest under Section 24. Net income after deductions is taxed at your slab rate. If your net rent is under ₹2.5 lakh/year, you pay no tax.

Can NRIs get good ROI in Indian real estate?

Yes, but with limits. NRIs can buy residential and commercial property (not farmland). They can rent it out and repatriate up to $1 million per year. But they must pay tax on rental income in India. The process is more complex than for locals-especially with TDS (10% withheld by tenant). ROI can be strong if they buy in high-yield cities and use a trusted property manager.

Should I buy a ready-to-move-in flat or under-construction property?

Ready-to-move-in flats give you immediate rent and ROI calculation. Under-construction properties are cheaper upfront but carry risk. Delays are common. You won’t earn rent until completion. If you buy under-construction, make sure the builder is RERA-registered and has a track record. Only 40% of under-construction projects in India deliver on time, according to RERA 2024 reports.