PPF Maturity in India and Post-Maturity Options: Extending Your Investment

When your Public Provident Fund (PPF) account hits 15 years, it doesn’t just close. It becomes a gateway-offering you real choices to keep growing your money, tax-free, for years to come. Many Indians assume PPF ends at maturity, but that’s a myth. The real power of PPF lies in what happens after maturity.

What Happens When Your PPF Account Matures?

Your PPF account matures exactly 15 years from the date it was opened. At that point, you can withdraw the full balance-principal plus interest-without any tax. That’s the default path. But here’s the catch: if you don’t withdraw, nothing automatic happens. The account doesn’t close. It doesn’t freeze. It just sits there, earning interest at the same rate as before, as long as you don’t touch it.

The government allows you to extend your PPF account in blocks of five years after the initial 15-year term. You’re not forced to withdraw. You’re not penalized for waiting. You simply need to fill out Form H and submit it to your bank or post office within one year of maturity. If you miss that window, the account still earns interest, but you can’t make new deposits until you formally extend it.

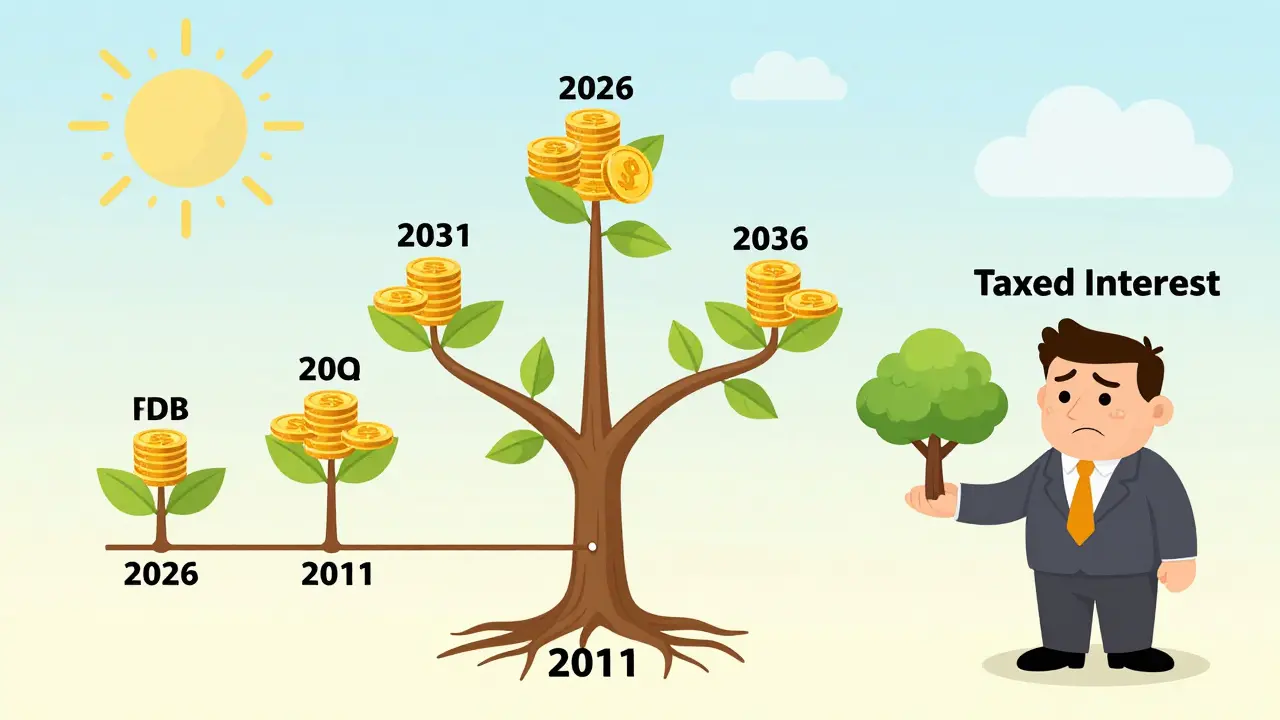

Let’s say you opened your PPF in 2011. By 2026, you’ve earned over ₹20 lakh (assuming ₹1.5 lakh yearly contributions and 7.1% annual interest). If you withdraw now, you get it all. If you extend, you keep compounding that growth, tax-free, for another five years.

How to Extend Your PPF Account

Extending your PPF is simple, but you must act. Here’s how:

- Visit your PPF account holder-either your bank branch or post office.

- Fill out Form H (available online or at the branch).

- Choose whether you want to extend with or without fresh contributions.

- Submit the form within one year of maturity.

- Keep your account active by making deposits if you chose to contribute.

You can extend up to two times-so a maximum of 25 years total. After that, you must withdraw everything. But even after two extensions, you can still leave the balance untouched and keep earning interest.

With or Without Contributions: Which Option Is Better?

When extending, you have two clear paths:

- With contributions: You can keep depositing up to ₹1.5 lakh per year. This is ideal if you’re still earning, want to maximize tax-free growth, or are using PPF as your main retirement bucket.

- Without contributions: You can’t add new money, but your existing balance keeps growing. This works if you want to preserve capital, avoid taxable income, or are waiting for a better investment opportunity.

Most people who extend without contributions do so because they’ve already maxed out other retirement tools-like EPF or NPS-and want to let their PPF grow quietly. It’s a low-risk, zero-tax strategy that outperforms many fixed deposits.

For example, if you have ₹18 lakh in your PPF at maturity and choose to extend without contributions at 7.1% interest, after five more years, you’ll have over ₹25.5 lakh. That’s a gain of ₹7.5 lakh, all tax-free. No TDS. No reporting. Just growth.

Why Extend Instead of Withdraw?

There are three strong reasons to extend your PPF instead of cashing out:

- Tax-free compounding: PPF interest is completely tax-free-both at accrual and withdrawal. No other savings instrument in India offers this combo. FDs? Taxable. Mutual funds? Capital gains tax. PPF? Zero.

- Guaranteed returns: PPF rates are set by the government and revised quarterly. Even in volatile markets, PPF delivers stable, predictable growth. In 2025, the rate was 7.1%. In 2020, it was 7.9%. It’s never dropped below 7% in the last decade.

- Protection from inflation: With rising living costs, locking in a guaranteed 7% return for 20+ years is a hedge against inflation. Most retirees don’t realize their fixed pensions lose value over time. PPF doesn’t.

Consider this: If you retire at 60 and extend your PPF for two five-year blocks, you could be drawing from it at 70, 75, or even 80. That’s not just savings-that’s long-term income security.

What You Can’t Do After Maturity

There are limits. Even if you extend, you can’t:

- Open a new PPF account after the original one matures (you can only extend the existing one).

- Transfer your PPF balance to someone else’s account.

- Take a loan against your PPF after maturity (loans are only allowed between the 3rd and 6th year).

- Withdraw partial amounts during the extension period (you can only withdraw the full balance after the extension ends).

These rules keep PPF simple and focused. It’s not a flexible savings tool-it’s a disciplined, long-term wealth builder.

Real-Life Example: How Mrs. Rao Used PPF After Maturity

Mrs. Rao, 62, from Jaipur, opened her PPF in 2008. She contributed ₹1.5 lakh every year. By 2023, her account had grown to ₹23.8 lakh. She didn’t need the money immediately, so she extended for five years without adding new deposits. In 2028, her balance will be over ₹33.5 lakh. She plans to use it as a steady income source during her late 70s, when medical costs rise. She didn’t invest in stocks. She didn’t buy property. She just let PPF do its job-quietly, reliably, tax-free.

PPF vs. Other Retirement Tools After 15 Years

Here’s how PPF stacks up against other common Indian retirement options after maturity:

| Instrument | Post-Maturity Extension? | Tax-Free Growth? | Contribution Allowed? | Interest Rate (2025) |

|---|---|---|---|---|

| PPF | Yes (up to two 5-year blocks) | Yes | Yes (if extended with contributions) | 7.1% |

| EPF | No | Only if withdrawn after 5 years of service | No | 8.25% |

| NPS | No | Partially taxable (40% tax-free, 60% taxable) | No | Varies (market-linked) |

| Fixed Deposit | No | No | No | 6.5-7.5% |

| Sukanya Samriddhi Yojana (SSY) | Yes (until daughter turns 21) | Yes | No | 8.2% |

PPF stands out because it’s the only instrument that lets you keep growing money tax-free, with optional contributions, after the initial term. EPF and NPS lock you in. FDs tax you. SSY is only for daughters. PPF is open to anyone-and it lasts.

Common Mistakes to Avoid

- Missing the one-year window: If you don’t extend within a year of maturity, you can’t make new deposits. You can still earn interest, but you lose the chance to grow further.

- Assuming automatic withdrawal: Banks don’t auto-withdraw. You must initiate the process.

- Not checking interest rates: Rates change quarterly. Always confirm the current rate before extending.

- Ignoring inflation: If you withdraw too early, you might not keep up with rising costs. Extending helps preserve real value.

When Should You Withdraw Instead of Extend?

There are times when cashing out makes sense:

- You need the money for medical emergencies or home repairs.

- You’ve already maxed out other tax-saving options and need liquidity.

- You’re planning to move abroad and can’t maintain a PPF account.

- You have a higher-return investment opportunity with low risk (rare, but possible).

But if you’re healthy, not in debt, and still have time before major expenses, extending PPF is almost always the smarter move.

Final Thought: PPF Is a Lifetime Tool

PPF isn’t just a 15-year savings plan. It’s designed to be a lifelong wealth engine. People treat it like a short-term deposit, but it’s built for multi-decade growth. If you’ve been contributing for 15 years, you’ve already shown discipline. Don’t stop now. Extend it. Let your money keep working. You’ve earned it.

Can I extend my PPF account after 20 years?

Yes. After the initial 15-year term, you can extend your PPF account in blocks of five years. You’re allowed up to two extensions, meaning your account can remain active for a total of 25 years. After that, you must withdraw the entire balance.

Can I continue contributing to my PPF after maturity?

Yes, but only if you formally extend your account and choose the option to make fresh contributions. You can deposit up to ₹1.5 lakh per year during each five-year extension period.

What happens if I don’t extend my PPF after maturity?

If you don’t extend, your account will continue to earn interest at the prevailing rate on the existing balance. However, you won’t be allowed to make any new deposits. You can still withdraw the full amount at any time, but no further growth will occur unless you extend.

Is PPF better than FD after retirement?

For most retirees, yes. PPF offers tax-free interest, guaranteed returns, and the option to extend with or without contributions. FDs are taxable on interest income and don’t allow extensions. Even if FD rates are slightly higher, the tax advantage of PPF usually makes it more valuable over time.

Can I have multiple PPF accounts?

No. One person can hold only one PPF account. If you try to open a second, it will be closed, and any deposits made will be returned without interest. But you can extend your existing account multiple times to keep growing your savings.