Reverse Mortgage in India: Turn Your Home Into Retirement Income

Most retirees in India rely on savings, pensions, or help from their children. But what if your biggest asset - your home - could pay your monthly bills instead of just sitting empty? A reverse mortgage lets you do exactly that. It’s not a loan you repay. It’s money you get from your house while you keep living in it. And yes, it’s legal, regulated, and available right now in India.

How a Reverse Mortgage Works in India

Think of it like this: you own your home outright. No mortgage left. You’re 60 or older. Instead of selling your house to fund retirement, you borrow against its value. The bank gives you cash - as a lump sum, monthly payments, or a line of credit. You don’t make monthly repayments. The loan, plus interest, only gets paid back when you move out, sell the house, or pass away.

The Reserve Bank of India (RBI) approved reverse mortgages in 2007. Since then, public sector banks like SBI, HDFC, and PNB have offered them. The maximum loan amount is capped at ₹25 lakh (about $30,000 USD), and you can get up to 60% of your home’s assessed value. The property must be self-occupied, free of other loans, and located in a notified urban area.

Interest rates hover between 10% and 13% per year. That sounds high - until you realize you’re not paying it monthly. The interest compounds over time. So if you take ₹10 lakh today, you might owe ₹25 lakh in 10 years. But you still own your home. You still live in it. And you’re not forced to leave.

Who Qualifies for a Reverse Mortgage in India?

You must be at least 60 years old. If your spouse is younger, they can be added as a co-borrower - but only if they’re 58 or older. The house must be in your name, fully paid off, and meet the bank’s structural safety standards. You can’t have another loan secured against it.

There’s no income requirement. No credit score check. No employment proof. The only thing that matters is the value of your home and your age. That’s why it’s popular among retired teachers, government employees, and small business owners who own property but have limited cash flow.

One key rule: you must keep the property maintained. You can’t let it fall into disrepair. You must pay property taxes and insurance. If you don’t, the bank can call the loan due.

How Much Money Can You Get?

The amount depends on three things: your age, your home’s value, and the bank’s policy.

- Age 60-65: You can get up to 50% of the property’s value

- Age 66-70: Up to 55%

- Age 71-75: Up to 60%

- Age 76+: Up to 60% (same as above, but with higher interest risk)

Let’s say your house is worth ₹50 lakh. You’re 72. You could get ₹30 lakh (60%) as a reverse mortgage. That’s ₹2.5 lakh per year - or ₹20,800 per month - if you choose monthly payments. That’s enough to cover medical bills, groceries, or even help your grandkids with school fees.

Some banks let you choose between monthly payouts (like a pension), a lump sum (for big expenses like surgery), or a flexible credit line (use it when you need it). Monthly payments are the most popular - they mimic a steady income stream.

What Happens When You Pass Away?

This is the biggest worry for families. The loan doesn’t vanish when you die. The bank still gets paid. But here’s the catch: your heirs don’t lose the house automatically.

They have two choices:

- Pay off the loan - including interest - and keep the house

- Sell the house - the bank takes what’s owed, and your family gets the rest

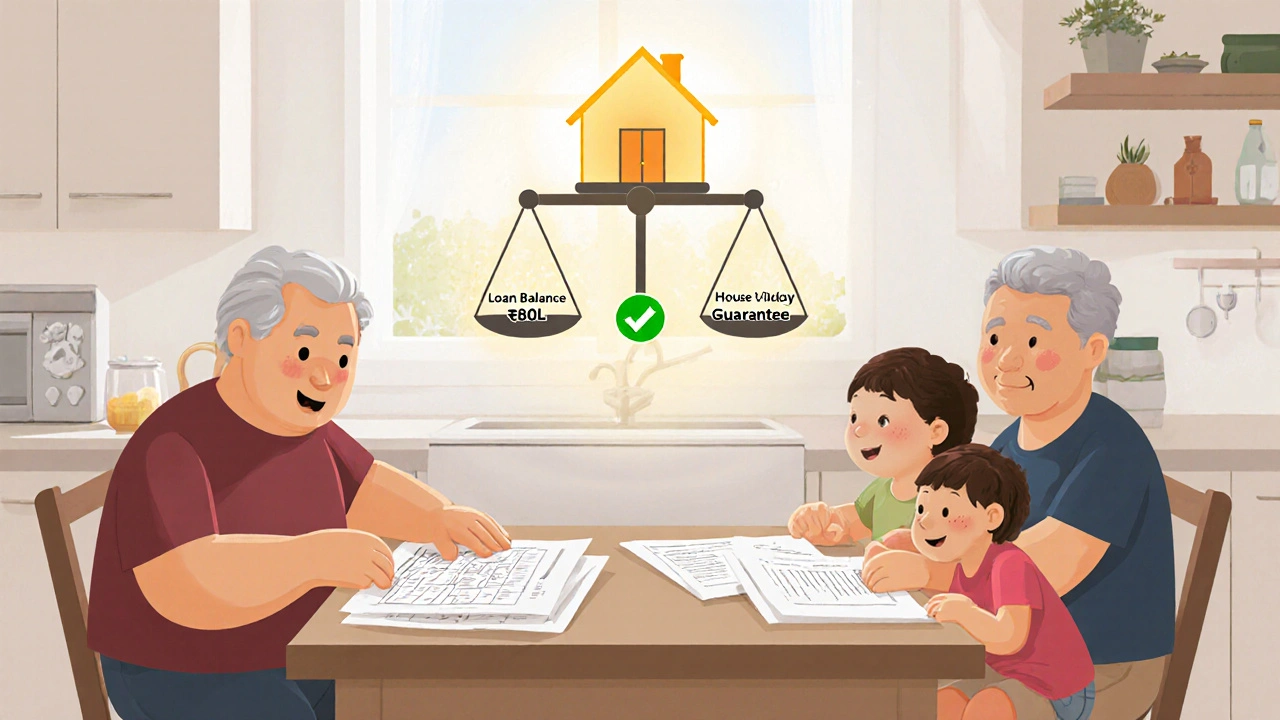

Let’s say you borrowed ₹30 lakh. After 12 years, with compounding interest, you owe ₹60 lakh. Your house sells for ₹80 lakh. Your family gets ₹20 lakh. If the house sells for only ₹50 lakh? The bank eats the loss. You and your family are protected. That’s called the “No Negative Equity Guarantee.” It’s mandatory under RBI rules.

No one can be forced to pay more than the home’s final sale value. Even if the loan balance grows beyond the property’s worth, your children won’t be on the hook.

Pros and Cons: Is It Right for You?

Here’s the real breakdown.

Pros

- Stay in your home - no need to move

- No monthly repayments - cash flow improves immediately

- Flexible payout options - monthly, lump sum, or line of credit

- Family protected - no debt passed on beyond the home’s value

- Simple eligibility - no income or credit checks

Cons

- High interest compounds fast - you could owe more than the house is worth

- Lower inheritance - your heirs get less or nothing if the house sells for less than the loan

- Property maintenance required - neglect can trigger default

- Not available in rural areas - only notified urban locations

- One-time processing fee - ₹10,000 to ₹25,000, depending on the bank

It’s not for everyone. If you plan to leave your home to your children and they’re okay with selling it later, it’s a good fit. If you’re hoping to leave a large inheritance, it’s not the best tool.

Alternatives to Reverse Mortgage

Before you sign anything, consider these options:

- Selling your home and downsizing - You get full cash value, move into a smaller apartment, and pocket the difference. Often more money than a reverse mortgage.

- Rental income - Rent out part of your house. Many seniors in Delhi and Bengaluru rent out rooms or guest wings. Easier to reverse if things change.

- Senior citizen savings schemes - RBI-backed schemes like SCSS offer 8.2% interest with quarterly payouts. But the max investment is ₹30 lakh per person, and you need to lock it for 5 years.

- Family support - Many Indian families still pool resources. A reverse mortgage can reduce the burden on children without cutting them out entirely.

Reverse mortgage isn’t the only way. But for those who love their home and don’t want to move, it’s the only way to unlock equity without leaving.

How to Apply

Here’s the step-by-step process:

- Check eligibility - Are you 60+? Is your home fully paid? Is it in a notified city?

- Get your property valued - Banks send an approved valuer. Expect to pay ₹5,000-₹10,000.

- Choose payout mode - Monthly, lump sum, or credit line?

- Submit documents - ID proof, property papers, age proof, bank statements.

- Attend counseling - Mandatory session with bank staff to explain risks.

- Sign agreement - Includes terms, interest rate, repayment conditions.

- Receive funds - Usually within 15-30 days after approval.

Most banks offer free counseling. Use it. Ask questions. Don’t sign anything you don’t understand.

Common Myths Debunked

- Myth: The bank takes your house. Truth: You keep ownership. The bank only gets paid when you leave.

- Myth: Your children lose everything. Truth: They can pay off the loan and keep the house. Or sell it and keep the surplus.

- Myth: It’s only for the poor. Truth: Middle-class retirees with property but low pensions use it most.

- Myth: Interest is too high. Truth: Compared to personal loans or credit cards, it’s cheaper - and you’re not paying monthly.

Final Thoughts

A reverse mortgage isn’t a magic fix. It’s a tool. One that turns your home from a static asset into a living income stream. For millions of Indian seniors who own property but struggle with rising medical costs and shrinking pensions, it’s a quiet revolution.

It doesn’t replace savings or family support. But it gives you control. You decide how to spend the money. You decide when to use it. And you stay where you’re most comfortable - in the home you built, surrounded by memories.

If you’re 60 or older, own your home, and need more monthly cash - talk to your bank. Ask for a reverse mortgage brochure. Sit down with your family. Run the numbers. You might be surprised how much your house can do for you - right now, while you’re still living in it.

Can I get a reverse mortgage if my home is in a rural area?

No. Reverse mortgages in India are only available in notified urban areas - cities and towns officially recognized by the government for urban development. Rural properties don’t qualify. If you live in a village or small town, consider renting out part of your home or downsizing to an urban area.

Can my spouse and I both be on the reverse mortgage?

Yes. If you’re 60 or older and your spouse is 58 or older, both names can be included. This protects the surviving spouse - if one passes away, the other can keep living in the home and continue receiving payments. If your spouse is younger than 58, they cannot be added as a co-borrower.

What happens if I want to move to a nursing home?

If you move out permanently - whether to a nursing home, to live with family, or elsewhere - the loan becomes due. The bank will ask you or your heirs to repay the full amount, plus interest. If the house is sold, the proceeds pay off the loan. Any leftover money goes to you or your estate.

Can I repay the reverse mortgage early?

Yes. You can repay the loan at any time without penalty. Many people do this after selling another property or receiving an inheritance. Once repaid, the lien on your home is removed, and you own it free and clear again.

Is the money I receive from a reverse mortgage taxable?

No. The money you receive from a reverse mortgage in India is not considered income under the Income Tax Act. It’s a loan advance, not earnings. You won’t pay tax on it. However, if you later sell the house and make a profit, capital gains tax may apply - but that’s separate from the reverse mortgage itself.