ELSS Funds: Tax-Saving Mutual Funds with 3-Year Lock-In in India

When you think of ELSS funds, Equity Linked Savings Schemes are mutual funds that offer tax deductions under Section 80C of the Indian Income Tax Act. Also known as tax-saving mutual funds, they’re one of the few investment options that combine market-linked returns with immediate tax benefits. Unlike fixed deposits or PPF, ELSS funds put your money into stocks, giving you a real shot at higher growth over time.

The biggest thing that sets ELSS apart is its 3-year lock-in period, the shortest lock-in among all Section 80C instruments. This means you can’t withdraw your money for exactly three years from the date of each investment. Sounds strict? It’s actually smart. That lock-in forces you to stay invested through market ups and downs, which is exactly how most people build real wealth. Compare that to PPF’s 15 years or FDs with no lock-in but lower returns — ELSS gives you the sweet spot: growth potential without being stuck forever.

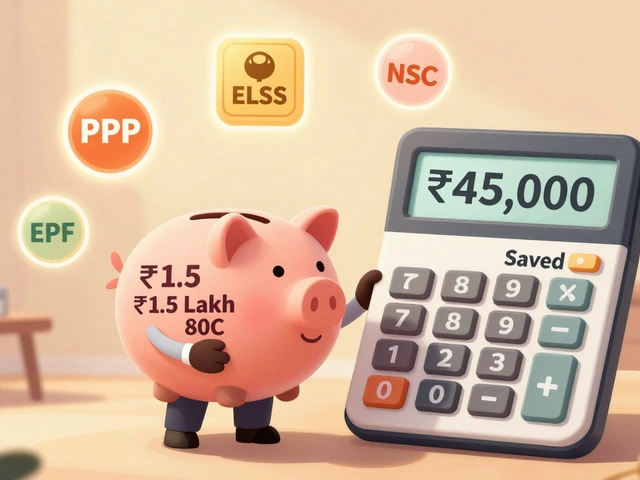

These funds are especially useful if you’re already saving through your employer’s EPF or NPS. Adding ELSS lets you stretch your ₹1.5 lakh Section 80C limit further, while putting more of it to work in the stock market. You don’t need to be a finance expert to start — many people begin with as little as ₹500 a month through SIPs. The key is consistency. Whether you’re saving for a house, your kid’s education, or just building long-term wealth, ELSS funds help you do it while cutting your tax bill.

What you’ll find in the posts below are clear, no-fluff guides on how ELSS compares to other 80C options, why the lock-in isn’t a drawback but a feature, how to pick the right fund, and how to time your investments so you don’t end up rushing at the last minute. No jargon. No hype. Just what works for real people in India trying to save tax and grow money at the same time.

ELSS funds in India offer tax savings under Section 80C with a 3-year lock-in and the potential for 12-15% annual returns. Learn how they compare to PPF, FDs, and NSC, and how to pick the right fund for long-term wealth building.

Continue Reading

Understand the four main types of mutual funds in India-Equity, Debt, Hybrid, and ELSS-and choose the right one for your goals, risk tolerance, and tax needs. Learn how to build a simple, effective portfolio.

Continue Reading

Learn how to choose the best ELSS funds for Section 80C tax savings by evaluating risk, long-term performance, and expense ratio. Avoid common mistakes and pick funds that truly grow your wealth.

Continue Reading