How to Choose the Right Mutual Fund Scheme in India for Your Financial Goals

Choosing the right mutual fund scheme in India isn’t about picking the one with the highest past returns. It’s about matching your money to your life goals - whether you’re saving for a house, your child’s education, or retirement. Too many investors jump into funds because they saw a 20% return last year, only to lose money when the market shifted. The truth? Your fund should work for your plan, not the other way around.

Start with Your Financial Goal

Before you look at a single fund performance chart, ask yourself: What are you saving for, and when do you need the money? This is the foundation of every smart mutual fund choice.

If you’re saving for your child’s college in 12 years, you have time to ride out market ups and downs. A large-cap or multi-cap fund could be ideal. But if you need money for a down payment in two years, you can’t afford to risk a 15% drop. That’s where debt funds or balanced advantage funds make more sense.

Here’s a simple breakdown:

- Short-term goals (under 3 years): Liquid funds, ultra-short duration funds, or low-risk debt funds.

- Medium-term goals (3-7 years): Hybrid funds, balanced advantage funds, or corporate bond funds.

- Long-term goals (7+ years): Equity mutual funds - large-cap, mid-cap, small-cap, or index funds.

Don’t confuse a fund’s name with its risk. A fund called "Growth Plus" might be heavily invested in small caps - high risk. A fund named "Income Secure" might still hold corporate bonds with credit risk. Always check the portfolio, not the label.

Understand the Fund Type

India’s mutual fund market offers over 2,500 schemes. That’s overwhelming - unless you know the categories.

Equity funds are the most common, but they’re not all the same:

- Large-cap funds: Invest in top 100 companies by market value. Slower growth, lower volatility. Good for steady long-term wealth.

- Mid-cap and small-cap funds: Higher growth potential, but much more volatile. Only for investors with a 7+ year horizon and high risk tolerance.

- Multi-cap funds: Spread across large, mid, and small caps. Offers diversification in one fund.

- Index funds: Track the Nifty 50 or Sensex. Low fees, no active manager trying to beat the market. Great for passive investors.

- Thematic or sectoral funds: Focus on tech, pharma, or infrastructure. High risk. Only add a small portion (5-10%) to your portfolio if you understand the sector.

Debt funds aren’t just "safe" - they vary too:

- Overnight funds: Invest in securities maturing the next day. Near-zero risk.

- Short-duration funds: Hold bonds for 1-3 years. Good for goals in 2-4 years.

- Corporate bond funds: Invest in bonds issued by companies. Higher yield than government bonds, but credit risk exists.

- Dynamic bond funds: Fund manager adjusts duration based on interest rate outlook. Useful if you expect rate cuts or hikes.

Hybrid funds mix equity and debt. Balanced advantage funds automatically shift between stocks and bonds based on market valuations - a smart, hands-off option for many.

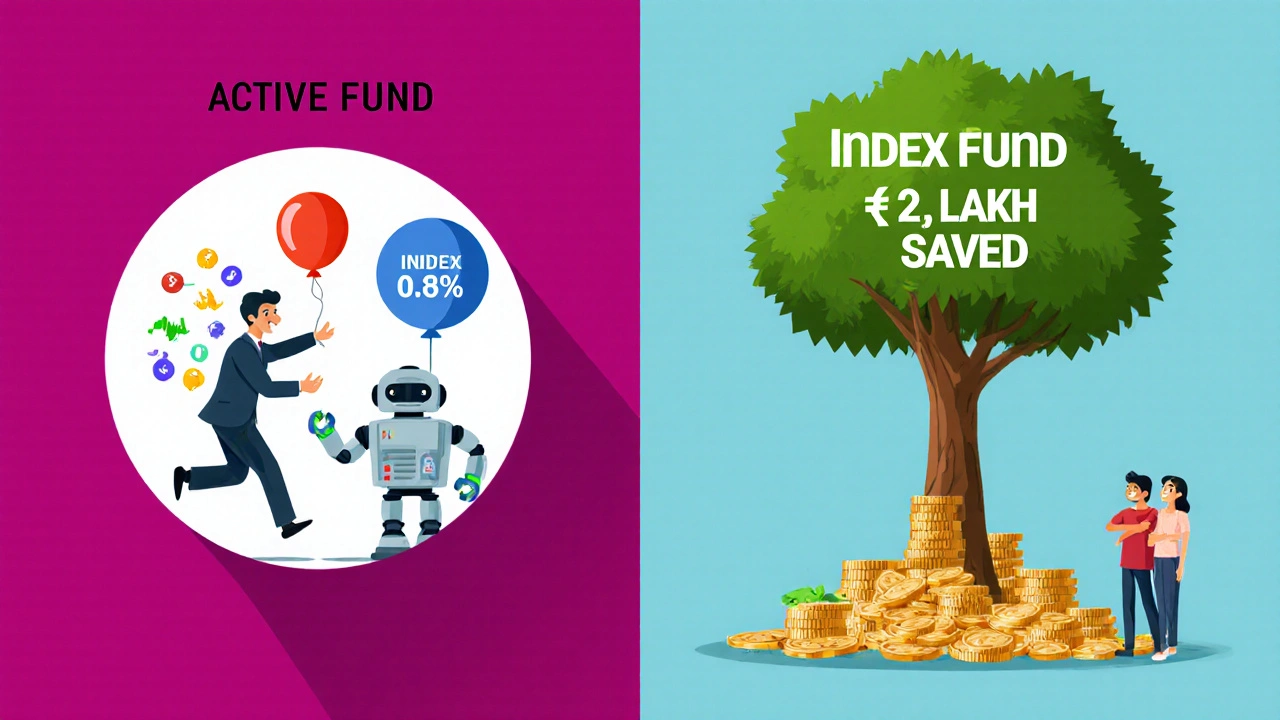

Check the Expense Ratio

It sounds boring, but a 1% difference in expense ratio can cost you over ₹2 lakh in 20 years on a ₹10 lakh investment.

Active funds charge more because a fund manager picks stocks. Passive funds like index funds charge less - often 0.1% to 0.5%. For example, a large-cap active fund might charge 1.8%, while its index counterpart charges 0.3%. That’s a 1.5% gap. Over 15 years, that gap turns into tens of thousands in lost returns.

Don’t just compare the headline number. Look at the total expense ratio (TER), which includes all fees. You can find this on the fund house’s website or on platforms like Value Research or Morningstar India.

Remember: A cheaper fund isn’t always better - but an expensive fund without consistent outperformance is a waste.

Look at Consistency, Not Just Top Returns

Many investors chase funds that ranked #1 last year. But the fund that topped the charts in 2023 might be in the bottom half in 2025.

Instead, look at 3-year, 5-year, and 7-year returns. A fund that consistently ranks in the top 25% over multiple cycles is more reliable than one that had a one-time spike.

For example, if you’re comparing two large-cap funds:

- Fund A: 12% return last year, 7% over 5 years

- Fund B: 9% last year, 11% over 5 years

Fund B is the better choice. It delivered steadier results. That’s what matters for long-term wealth.

Use tools like Value Research’s star ratings or Morningstar’s quant ratings. They analyze risk-adjusted returns, not just raw numbers. A 4-star rating means the fund has done well relative to peers over time, not just recently.

Match the Fund Manager’s Style to Your Risk

The fund manager’s philosophy matters. Some managers chase high-growth stocks. Others focus on stable, dividend-paying companies. Some rotate sectors aggressively. Others stick to a strict formula.

If you’re risk-averse, avoid funds with managers who frequently change their top 10 holdings. That’s a sign of high turnover - which increases transaction costs and tax liability.

Check the fund’s fact sheet. Look for:

- Portfolio turnover ratio (below 50% is ideal for long-term investors)

- Number of stocks held (too few = concentrated risk; too many = diluted returns)

- Top 5 holdings (are they familiar, stable companies? Or speculative bets?)

Also, check how long the current fund manager has been in charge. If they’ve been there less than 2 years, their track record might not reflect the fund’s true performance.

Use SIPs, Not Lump Sums

Most people in India think they need a big chunk of money to start investing. That’s not true.

Systematic Investment Plans (SIPs) let you invest as little as ₹500 a month. More importantly, they remove emotion from investing.

When the market drops, your SIP buys more units. When it rises, you buy fewer. Over time, this averages out your cost - a strategy called rupee-cost averaging.

Studies by SEBI show that SIP investors in equity funds have outperformed lump-sum investors over 5-10 year periods, even when timing the market perfectly.

Set up SIPs on payday. Make it automatic. Don’t stop during market crashes. That’s when you need to invest more, not less.

Review, But Don’t Overreact

Check your mutual fund portfolio once every 6-12 months. Not daily. Not monthly.

Red flags to watch for:

- Consistent underperformance for 2+ years compared to its category

- Fund manager change

- Significant shift in portfolio strategy (e.g., large-cap fund suddenly holding small caps)

- Expense ratio increased by more than 0.3%

If none of these happen, leave it alone. Churning your portfolio based on short-term noise destroys returns.

Rebalance only if your goals or timeline change. For example, if you’re 5 years from retirement, shift 20-30% of your equity exposure to debt funds - even if the market is doing well.

Tax Efficiency Matters

Not all mutual funds are taxed the same.

Equity funds (where at least 65% is in Indian stocks):

- Short-term capital gains (held less than 1 year): 15%

- Long-term capital gains (held more than 1 year): 10% on gains above ₹1 lakh per year

Debt funds:

- Short-term (under 3 years): Taxed at your income tax slab rate

- Long-term (over 3 years): 20% with indexation benefit

Indexation adjusts your purchase price for inflation. That means you pay tax only on real gains, not the inflation part. This makes debt funds more tax-efficient than fixed deposits over 3+ years.

Always consider tax when choosing between funds. A fund with slightly lower returns but better tax treatment can give you more money in hand.

Use Direct Plans, Not Regular Plans

There are two types of mutual fund plans: Direct and Regular.

Regular plans pay commissions to advisors or distributors. That money comes out of your returns - typically 0.5% to 1.5% extra in expense ratio.

Direct plans have no commissions. Same fund, same portfolio, same manager - just lower fees.

Over 15 years, switching from a Regular to a Direct plan can add ₹3-5 lakh to your corpus on a ₹10 lakh investment. It’s free money.

You can buy Direct plans through fund house websites (like SBI Mutual Fund, ICICI Prudential) or platforms like Groww, Zerodha Coin, or Paytm Money. No advisor needed.

Final Checklist Before You Invest

Before hitting "Invest," run through this:

- Is my goal clearly defined? (Amount needed, deadline)

- Does the fund type match my timeline? (Equity for long-term, debt for short-term)

- Is the expense ratio below 1.5% for active funds? Below 0.5% for index funds?

- Has the fund performed consistently over 5+ years?

- Is the fund manager still in place? Have they held the fund for 3+ years?

- Am I investing through a Direct plan?

- Have I set up a SIP for automatic, disciplined investing?

If you answered yes to all, you’re ready. Don’t wait for the "perfect" moment. Start now. Even ₹1,000 a month, invested wisely, can grow into a life-changing sum over time.

How do I know if a mutual fund is right for my risk profile?

Your risk profile depends on your goal’s time horizon and how much loss you can stomach. If you need the money in 2 years, you shouldn’t invest in small-cap funds - even if they’re rising. Use tools like SEBI’s investor risk profiling questionnaire or ask for a free assessment on platforms like Kuvera or ET Money. Conservative investors should lean toward debt and hybrid funds. Aggressive investors with 7+ years can focus on equity.

Can I invest in multiple mutual funds at once?

Yes, and you should - but only if they serve different goals. Don’t hold five large-cap funds just because they’re all "top performers." That’s duplication. Instead, build a portfolio: one large-cap fund for stability, one mid-cap for growth, one debt fund for safety. Keep it simple. 3-5 funds are enough for most people.

What’s the difference between a mutual fund and a SIP?

A mutual fund is the investment product - the pool of stocks or bonds. A SIP is just a way to invest in it - monthly, automatic payments. You can invest in the same mutual fund via SIP or as a lump sum. SIPs reduce timing risk and make investing easier. Most people benefit from SIPs.

Should I switch funds if the market crashes?

No. Market crashes are normal. The best time to invest is often when everyone’s scared. If your fund’s fundamentals haven’t changed - the manager is still there, the portfolio hasn’t shifted, the expense ratio is stable - stay put. Selling during a crash locks in losses. Buying more via SIP during a crash builds wealth faster.

Are index funds better than active funds in India?

For most investors, yes. Over the past 10 years, over 70% of active large-cap funds in India have failed to beat the Nifty 50 index. Index funds have lower fees and deliver market returns. If you don’t want to pick winners or time the market, index funds are the smart default. But if you want exposure to mid-caps or small-caps - where active managers sometimes outperform - you can mix in one or two active funds.