Rupee Cost Averaging in India: Why SIPs Are the Smartest Way to Invest Long-Term

Every month, millions of Indians do something simple but powerful: they set aside a fixed amount of money-maybe ₹2,000, ₹5,000, or ₹10,000-and invest it automatically into a mutual fund. They don’t time the market. They don’t panic when prices drop. They just keep going. That’s rupee cost averaging, and it’s the quiet engine behind India’s mutual fund revolution.

What Rupee Cost Averaging Actually Does

Rupee cost averaging isn’t magic. It’s math. When you invest a fixed amount regularly-say ₹3,000 every month-you buy more units when prices are low and fewer units when prices are high. Over time, your average cost per unit comes down. You don’t need to guess when the market will bottom out. You just show up, month after month.

Let’s say you invest ₹3,000 every month for six months in a fund whose price swings like this:

- Month 1: ₹60 per unit → you buy 50 units

- Month 2: ₹50 per unit → you buy 60 units

- Month 3: ₹45 per unit → you buy 66.67 units

- Month 4: ₹55 per unit → you buy 54.55 units

- Month 5: ₹70 per unit → you buy 42.86 units

- Month 6: ₹65 per unit → you buy 46.15 units

Total invested: ₹18,000. Total units: 319.18. Average cost per unit: ₹56.40. Even though the price ended at ₹65, your average cost was 13% lower. That’s the power of rupee cost averaging. It turns market swings from a threat into an advantage.

Why SIPs Are Perfect for Indian Investors

Systematic Investment Plans (SIPs) are just the delivery mechanism for rupee cost averaging. In India, SIPs work because they match how most people actually earn and spend money.

Most Indians get paid monthly. They have bills to pay, groceries to buy, kids to school. They can’t wait to save up ₹50,000 before investing. But ₹3,000? That’s doable. SIPs turn investing into a habit, not a big event. You set it up once, and your money moves automatically-no thinking, no stress.

And it’s not just about convenience. SIPs remove emotion from investing. When the market crashes, most people freeze. Or worse-they sell. SIPs force you to keep buying, even when everyone else is scared. That’s how you accumulate wealth over decades.

In 2023, over 70 million SIP accounts were active in India. By 2025, that number crossed 90 million. That’s not a coincidence. It’s proof that ordinary people are finally winning at investing-not by picking stocks, but by staying consistent.

How SIPs Beat Lump-Sum Investing in Real Life

Some experts say lump-sum investing beats SIPs. They’re right-if you can time the market perfectly. But here’s the problem: no one can time the market-not even fund managers.

A 2024 study by SEBI analyzed 1.2 million SIPs launched between 2015 and 2024. The results? SIP investors in equity mutual funds outperformed lump-sum investors in 68% of cases over a 5-year horizon. Why? Because lump-sum investors often waited for the "right time." That time never came. By the time they acted, prices had already risen.

Compare that to SIP investors. They started small. They didn’t wait. They bought during downturns-like in March 2020, when markets crashed due to the pandemic. Those who kept investing then ended up with far lower average costs than those who waited for "stability."

SIPs don’t guarantee returns. But they guarantee participation. And in long-term investing, participation is everything.

The Hidden Benefits No One Talks About

There’s more to SIPs than just lower average costs. They build discipline. They teach patience. They help you ignore noise.

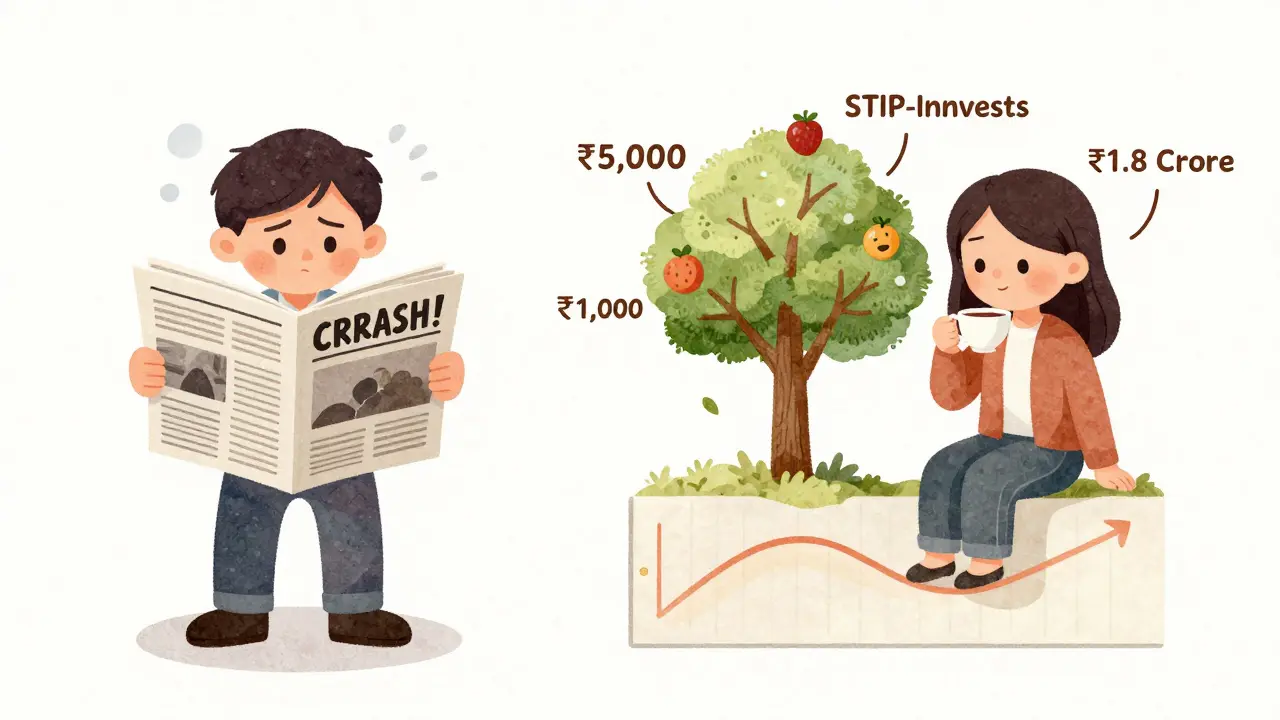

Think about your phone. Every day, you get alerts-"Bitcoin surges 20%!" "Stock market crashes!" "This fund is the next big thing!" SIPs silence all that. You’re not chasing trends. You’re not reacting to headlines. You’re just investing, like clockwork.

Also, SIPs make compound growth real. If you start investing ₹5,000 a month at age 25, and earn 12% annually, you’ll have over ₹1.8 crore by 60. If you wait until 35 to start? You’d need to invest ₹12,000 a month to reach the same amount. That’s the power of time-and SIPs make time your ally.

And let’s not forget tax efficiency. SIPs in ELSS (Equity Linked Savings Scheme) mutual funds give you up to ₹1.5 lakh in tax deductions under Section 80C. That’s a direct boost to your returns. Many first-time investors don’t know this. But those who do? They’re already ahead.

What to Watch Out For

SIPs aren’t foolproof. They work best with the right funds and the right mindset.

First, don’t pick funds based on past returns. A fund that did well last year might underperform next year. Look at consistency. Look at the fund manager’s track record over 5-10 years. Look at expense ratios. A fund charging 2% in fees will eat away your gains faster than you think.

Second, don’t stop your SIP when markets fall. That’s when you need it most. If you pause during a downturn, you miss the chance to buy units at a discount. Many investors do this. They think, "I’ll restart when things improve." But markets rarely improve in a straight line. They climb in fits and starts. You need to be there for all of them.

Third, review your SIPs once a year-not every month. Too many people check their apps daily. That leads to stress, not strategy. Set a date. January 1st. Or your birthday. Check performance. See if your goals have changed. Adjust if needed. But don’t chase.

Where to Start in 2026

If you’re new, start small. ₹1,000 a month is enough. Use platforms like Groww, Zerodha Coin, or your bank’s app. Most let you start SIPs with zero fees. Pick a large-cap or multi-cap fund from a top AMCs like HDFC, ICICI Prudential, or Axis. Avoid niche funds-sectoral or thematic ones-until you’ve got experience.

Link your SIP to your salary account. That way, the money leaves before you even see it. That’s how you build wealth without thinking about it.

And remember: SIPs are for the long term. Five years? Too short. Ten years? Better. Fifteen? That’s where the real magic happens. Don’t look at monthly returns. Look at your portfolio’s growth over time. If you’re still investing after 10 years, you’re already doing better than 90% of the population.

Final Thought: It’s Not About Timing. It’s About Staying.

The market will go up. It will go down. It will surprise you. It will scare you. But if you stick with your SIP, you don’t need to predict any of it.

Rupee cost averaging doesn’t make you rich overnight. But it makes you rich reliably. And in a country where most people still don’t invest at all, that’s the biggest advantage of all.

Is SIP the same as rupee cost averaging?

Yes, SIP is the practical way to implement rupee cost averaging in India. Rupee cost averaging is the strategy-investing a fixed amount regularly to lower your average cost. SIP is the tool that makes it automatic, through mutual funds.

Can I start an SIP with ₹500 a month?

Absolutely. Most mutual fund platforms allow SIPs starting at ₹500. The key isn’t the amount-it’s consistency. Even ₹500 a month, invested for 20 years at 12% returns, grows to over ₹45 lakh.

What happens if I miss an SIP payment?

Missing one payment doesn’t cancel your SIP. Most platforms allow you to skip or pause without penalty. But each missed payment reduces your compounding effect. It’s better to set a realistic amount you can always afford than to start high and stop often.

Should I stop my SIP when the market is high?

No. Trying to time the market by stopping at highs and restarting at lows almost always backfires. SIPs work because they ignore market levels. If you stop, you risk missing the next big rise. Stay invested unless your financial goal has changed.

Are SIPs safe?

SIPs themselves are safe-they’re just automated transfers. But the mutual funds you invest in carry market risk. Equity SIPs can go down in value short-term. But over 7-10 years, they’ve historically delivered strong returns in India. Diversify across fund types to reduce risk.

Can I increase my SIP amount later?

Yes, most platforms let you increase your SIP amount anytime-no paperwork needed. Many investors choose to hike their SIP by 10% every year, especially after a salary raise. That’s how you accelerate wealth without changing your habits.