Property Appreciation India: Where and Why Real Estate Grows in Value

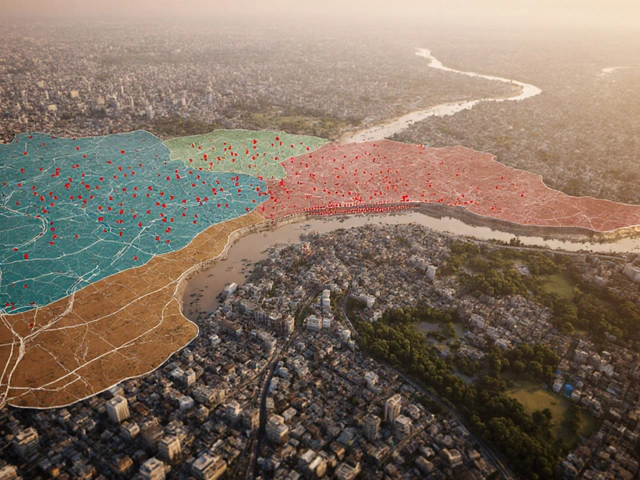

When you hear property appreciation India, the rise in value of real estate over time due to location, demand, and development. Also known as real estate growth, it's not just about buying land—it's about understanding what makes a place worth more tomorrow than it is today. In India, this isn’t luck. It’s planning. Cities like Prayagraj, once known as Allahabad, are seeing real shifts—not because of flashy ads, but because of roads, water systems, sewage networks, and public spaces being rebuilt from the ground up. The Allahabad Development Authority isn’t just issuing permits; it’s reshaping how people live, work, and invest.

Property appreciation doesn’t happen in a vacuum. It’s tied to urban development India, the planned expansion and modernization of city infrastructure and public services. When a new flyover cuts commute time by 30 minutes, when a park gets added near a housing colony, when water supply becomes reliable—those are the moments property values tick up. You won’t see it in a news headline, but you’ll feel it when your neighbor sells their house for 40% more than they paid three years ago. This isn’t Mumbai or Delhi. This is Prayagraj, where long-term planning is quietly turning quiet neighborhoods into hotspots. And it’s happening because of decisions made by local authorities, not speculative investors.

Look at the posts below. They cover rental income tax, reverse mortgages, ELSS funds, and even how to switch mutual fund schemes without paying extra taxes. Why? Because real estate isn’t just bricks and mortar. It’s part of a bigger financial picture. If you own property in India, you’re not just a homeowner—you’re an investor. And like any investment, it needs to be managed with awareness of rules, timing, and tax impacts. The same people who track mutual fund expense ratios or NPS withdrawal rules are also watching property values rise in places like Prayagraj. They know: value doesn’t come from hype. It comes from stability, access, and consistent improvement.

What you’ll find here isn’t a list of ‘top cities to invest in.’ It’s a collection of real, practical insights from people who’ve seen how development turns quiet streets into valuable assets. Whether you’re renting out a flat, planning to retire in your home, or just trying to understand why your neighborhood is changing, these posts connect the dots between city planning and your wallet. No fluff. No guesses. Just what’s actually happening—and what it means for you.

Learn how to calculate real estate ROI in India with accurate steps, hidden costs, and city-specific yields. Avoid common mistakes and find where property investments actually pay off.

Continue Reading