Debt Mutual Funds in India After Tax Changes: What Investors Need to Know

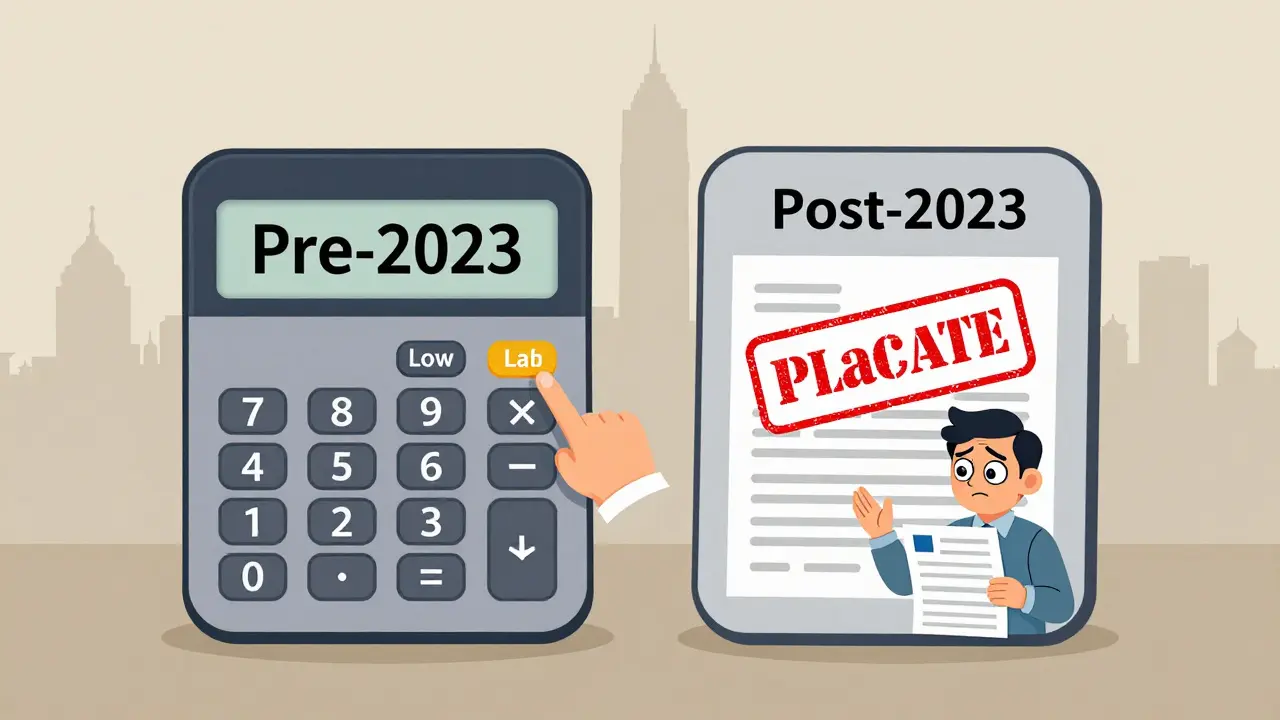

Starting April 1, 2023, the tax rules for debt mutual funds in India changed in a way that caught many investors off guard. If you’ve held debt funds for years thinking they were tax-efficient, you need to recheck your strategy. The government removed the indexation benefit for debt funds held longer than three years - a move that slashed post-tax returns for most long-term investors. This isn’t a minor tweak. It’s a structural shift that changes how you should think about debt funds entirely.

What Changed in Debt Fund Taxation?

Before April 2023, if you held a debt mutual fund for more than three years, you paid capital gains tax at 20% after indexation. Indexation meant the government adjusted your purchase price for inflation. For example, if you bought a fund for ₹1 lakh in 2018 and sold it for ₹1.5 lakh in 2023, indexation might have raised your cost to ₹1.3 lakh. You’d only pay tax on ₹20,000, not ₹50,000. That made debt funds attractive for long-term goals like buying a house or funding retirement.

Now, indexation is gone. All debt funds - whether held for 1 year or 10 years - are taxed at your income tax slab rate. That’s it. No inflation adjustment. No special rate. If you’re in the 30% tax bracket, your gains are taxed at 30%. If you’re in the 20% bracket, it’s 20%. The holding period no longer matters for tax treatment.

This change was part of the Finance Act 2023. The government’s goal was to simplify the system and reduce tax arbitrage. But the impact was immediate: debt fund returns dropped by 25-40% in post-tax terms for long-term holders. A fund that once delivered 7% annualized returns after tax now delivers closer to 4-5%.

How This Affects Your Investment Goals

Debt funds were never meant to be tax-saving instruments like ELSS or PPF. But they were the go-to option for conservative investors who wanted better returns than fixed deposits, with moderate risk. Now, that advantage is gone.

If you’re using debt funds for goals under three years - like a car down payment or a vacation - the change doesn’t hurt much. Short-term gains (held less than 3 years) were always taxed at your slab rate anyway. So nothing changed for you.

But if you’re using them for goals beyond three years - say, your child’s education or retirement - you’re now paying more tax than before. A ₹50 lakh corpus built over 7 years in a debt fund might have been worth ₹42 lakh after tax under old rules. Now, it’s closer to ₹34 lakh. That’s an 18% drop in real value.

What Should You Do Instead?

You still need safe, stable investments. But debt funds are no longer the best option for long-term goals. Here’s what to consider now:

- Fixed Deposits (FDs): Interest is taxed at your slab rate, but there’s no capital gains complexity. For those in lower tax brackets, FDs can still be competitive, especially with high-interest banks offering 7-8%.

- Post Office Savings Schemes: The Senior Citizen Savings Scheme (SCSS) and Public Provident Fund (PPF) offer tax-free returns. PPF gives 7.1% (as of 2026) and is completely exempt under Section 80C. SCSS gives 8.2% and is tax-free on maturity.

- Hybrid Funds: Conservative hybrid funds (60-75% equity) still get indexation benefit if held over three years. They’re taxed at 20% with indexation, just like equity funds. If you can tolerate a bit more volatility, this is often a better bet than pure debt funds.

- Corporate Bond Funds with Short Duration: If you must stay in debt funds, stick to funds with average durations under 2 years. They’re less sensitive to rate hikes and generate lower gains, meaning less tax impact.

Don’t Panic - But Do Rebalance

Many investors sold their debt funds in early 2023 out of fear. That was a mistake. If you had a fund that had already gained 15-20% before April 2023, selling then would’ve triggered a big tax bill. Holding through the change meant you avoided that. If you’re still holding, don’t rush to exit.

Instead, review your portfolio. Ask yourself: Why did you buy this fund? What goal was it for? If the goal is still three+ years away, consider switching to a hybrid fund or PPF. If it’s under three years, keep it - but don’t expect big gains.

For new investors: avoid pure debt funds for goals longer than three years. The math doesn’t work anymore. Even if the fund’s yield is 7.5%, your after-tax return might be under 5% - and that’s before accounting for expense ratios and exit loads.

What About Arbitrage Funds?

Arbitrage funds are often grouped with debt funds, but they’re taxed like equity funds. They’re not truly debt - they’re equity strategies that exploit price differences between cash and futures markets. If held over one year, gains are taxed at 10% (above ₹1 lakh). No indexation. No slab rate. That’s still better than debt funds for long-term goals.

Arbitrage funds are low-volatility, and they’re ideal for parking money you need in 1-3 years. They’re not risk-free, but they’re safer than pure equity funds and offer better tax treatment than debt funds. If you’re looking for a cash-like alternative, this is one of the few options left with decent post-tax returns.

Common Mistakes Investors Are Making Now

After the tax change, three big errors keep popping up:

- Assuming all debt funds are the same - Not true. Corporate bond funds, gilt funds, and liquid funds behave differently. Duration and credit quality matter more than ever. A 5-year gilt fund could lose 10% in value if rates rise - and you’ll still pay tax on any gain.

- Using debt funds for retirement - Retirement needs inflation-beating returns. Debt funds can’t deliver that anymore. PPF, NPS, or even balanced advantage funds are better.

- Ignoring exit loads - Many investors switched funds after the tax change and hit exit loads of 1-2%. That wiped out any tax savings they thought they gained.

Don’t make these mistakes. Track your fund’s average maturity and credit rating. Use tools like Value Research or Morningstar to compare post-tax returns, not just yields.

Real Example: A ₹10 Lakh Investment

Let’s say you invested ₹10 lakh in a dynamic bond fund in January 2020. By April 2026, it’s worth ₹15.8 lakh. Here’s how taxes break down:

| Scenario | Pre-2023 Tax Rule | Post-2023 Tax Rule |

|---|---|---|

| Capital Gain | ₹5.8 lakh | ₹5.8 lakh |

| Indexed Cost (assumed) | ₹11.2 lakh | - |

| Taxable Gain | ₹4.6 lakh | ₹5.8 lakh |

| Tax Rate | 20% | 30% (assuming 30% slab) |

| Tax Paid | ₹92,000 | ₹1.74 lakh |

| Net Amount After Tax | ₹14.88 lakh | ₹14.06 lakh |

That’s ₹82,000 less in your pocket - just from the tax change. No change in fund performance. Just tax policy.

Bottom Line: Debt Funds Still Have a Role - But a Smaller One

Debt mutual funds aren’t dead. They still work for:

- Emergency funds (liquid funds)

- Short-term goals (1-2 years)

- Systematic Transfer Plans (STPs) into equity funds

But for long-term wealth building? They’re no longer the right tool. The era of debt funds as tax-efficient, stable growth vehicles is over. The market has moved on. Investors who adapt - by switching to hybrid funds, PPF, or even fixed deposits - will keep more of their returns. Those who stick with old habits will see their savings grow slower than inflation.

Check your portfolio today. If you’re holding debt funds for goals beyond three years, it’s time to rethink. Not because the market crashed. Because the rules changed. And you need to play by the new ones.

Are debt mutual funds still a good investment after the tax change?

Debt mutual funds are still useful for short-term goals (under 3 years) and as a parking space for emergency funds. But for long-term goals like retirement or education, they’re no longer tax-efficient. Post-tax returns have dropped significantly because indexation is gone. Hybrid funds, PPF, or even fixed deposits now offer better after-tax outcomes.

What happens if I sell my debt fund before April 2023?

If you sold your debt fund before April 1, 2023, you benefited from the old rules. You could claim indexation and pay only 20% tax on long-term gains. If you held it for more than three years, you paid less tax than you would today. Selling after that date means you’re subject to the new slab-rate tax, no matter how long you held it.

Can I avoid tax by switching to equity funds?

You can’t avoid tax by switching - you’ll trigger capital gains. But if you’re investing new money and want better tax treatment, consider hybrid funds (conservative or balanced advantage). They’re taxed like equity funds: 10% on gains above ₹1 lakh after one year, with no indexation needed. This often beats debt funds for goals over three years.

Do I need to pay tax on unrealized gains in my debt fund?

No. You only pay tax when you sell or redeem units. Holding a debt fund with paper gains doesn’t trigger any tax. The change in tax rules only affects you when you exit. So if your fund has grown in value but you haven’t sold, you haven’t paid anything yet - and won’t until you do.

What’s the best alternative to debt mutual funds for conservative investors?

For conservative investors, the best alternatives are Public Provident Fund (PPF), Senior Citizen Savings Scheme (SCSS), and fixed deposits from high-interest banks. PPF offers tax-free returns and is ideal for long-term goals. SCSS gives higher interest and is tax-free on maturity. For short-term needs, liquid funds or arbitrage funds are still viable options with better tax treatment than traditional debt funds.