National Pension System (NPS) in India Explained: Your Complete Guide to Retirement Planning

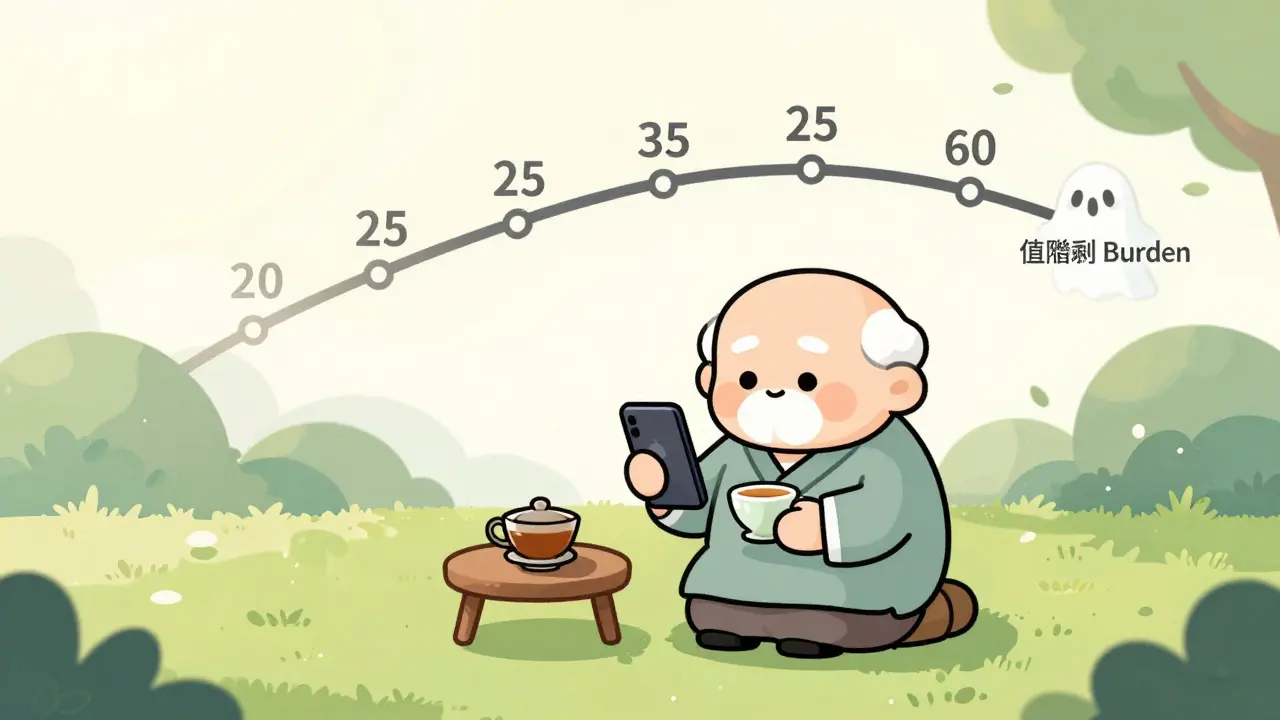

By 2030, over 100 million Indians will be over 60 years old. That’s more than the entire population of Germany. Yet, less than 5% of working Indians have a formal retirement plan. The National Pension System (NPS) isn’t just another savings option-it’s one of the few tools designed to help you avoid becoming a financial burden on your family later in life. If you’re working in India and haven’t thought seriously about retirement, this guide will show you exactly how NPS works, what you’re missing, and how to make it work for you.

What Is NPS and How Does It Work?

The National Pension System (NPS) is a government-backed retirement savings scheme launched in 2004. It’s open to all Indian citizens between 18 and 70 years old, including self-employed people, private sector employees, and government workers. Unlike traditional pension plans that pay you a fixed amount every month, NPS is a defined contribution plan. That means your retirement income depends entirely on how much you save and how well your investments grow.

You contribute money into your NPS account, and it gets invested in a mix of assets: government bonds (up to 50%), corporate debt (up to 75%), and equities (up to 75%). You choose how much goes into each-this is called your asset allocation. There are two types of accounts: Tier I (mandatory, locked until retirement) and Tier II (flexible, like a savings account you can withdraw from anytime).

When you turn 60, you can withdraw up to 60% of your corpus as a lump sum. The remaining 40% must be used to buy an annuity-a regular monthly payout for life. You can delay withdrawal until 70 if you’re still working. If you die before retirement, your nominee gets the entire balance.

Why NPS Is Different From Other Retirement Plans

Most people think of fixed deposits, LIC policies, or mutual funds when planning for retirement. But NPS stands out in three big ways.

- Lower fees: NPS charges just 0.0009% of your investment annually. Compare that to mutual funds, which often charge 1.5% to 2.5% per year. Over 30 years, that difference can cost you over ₹15 lakh.

- Government backing: Your money is managed by approved pension fund managers like Kotak Mahindra, SBI, or ICICI Prudential. The government monitors them closely. There’s no risk of fraud or collapse like with some private schemes.

- Tax advantages: You can claim deductions under Section 80C (up to ₹1.5 lakh) and an extra ₹50,000 under Section 80CCD(1B). That’s ₹2 lakh in tax savings per year if you max out.

Here’s how NPS compares to a typical mutual fund SIP for retirement:

| Feature | NPS | Equity Mutual Fund SIP |

|---|---|---|

| Annual fee | 0.0009% | 1.5% - 2.5% |

| Max annual tax deduction | ₹2,00,000 | ₹1,50,000 (under 80C) |

| Lump sum withdrawal at 60 | Up to 60% | 100% |

| Monthly income option | Required (40% annuity) | Optional (you decide) |

| Regulation | Government supervised | SEBI regulated |

The annuity requirement is the trade-off. You give up full control over your lump sum to guarantee lifetime income. But for most people, that’s a good trade. Outliving your money is a bigger fear than not having enough flexibility.

How to Open an NPS Account

Opening an NPS account takes less than 15 minutes online. You need:

- Aadhaar card

- PAN card

- A bank account

- A mobile number

Go to nps.org.in (the official portal) and click "Register as a Subscriber." You’ll be asked to choose a Point of Presence (PoP)-this is your service provider. Banks like HDFC, ICICI, or SBI act as PoPs. You can also use online platforms like Paytm or Groww.

After submitting your details, you’ll get a Permanent Retirement Account Number (PRAN). This is your unique ID for life. You’ll also get a NPS Smart Card. Keep it safe. You’ll need it for every transaction.

Once your account is active, you can start contributing. The minimum contribution is ₹500 per year for Tier I and ₹250 for Tier II. You can contribute monthly, quarterly, or whenever you want. There’s no upper limit except for tax benefits.

Choosing Your Investment Options

One of NPS’s biggest strengths is control. You pick how your money is invested. There are three choices:

- Active Choice: You decide the exact percentage between equities, corporate bonds, and government securities. For example, you might put 50% in equities, 30% in corporate bonds, and 20% in government securities.

- Auto Choice: The system automatically adjusts your allocation based on your age. When you’re young, it invests more in equities. As you get older, it shifts to safer assets. This is called the "Lifecycle Fund."

If you’re under 35 and comfortable with risk, go with Active Choice and put 70-75% in equities. If you’re 45 or older and want to play it safe, Auto Choice is simpler and smarter.

You can change your allocation once a year. Many people forget to do this. If you’re 40 and still investing 60% in equities, you’re taking more risk than you need to. Review it annually. It takes 5 minutes.

What Happens When You Retire?

At 60, your NPS account matures. Here’s what you can do:

- Withdraw up to 60% of your corpus as a lump sum. This amount is tax-free.

- Use the remaining 40% to buy an annuity from an IRDAI-approved insurer like LIC, SBI Life, or HDFC Life.

- Delay withdrawal until 70 if you’re still working. Your money keeps growing.

The annuity gives you a monthly payout for life. The amount depends on the annuity plan you choose-lifetime, lifetime with return of purchase price, or joint life with spouse. Monthly payouts range from ₹1,500 to ₹15,000 depending on your corpus. A ₹50 lakh corpus typically gives you ₹3,000-₹4,000 per month.

If you die before 60, your nominee gets the entire balance. If you die after 60, the annuity payments stop unless you chose a joint life plan.

Common Mistakes People Make With NPS

Most people don’t lose money in NPS. They just don’t use it well. Here are the top three mistakes:

- Not contributing regularly: Many start with ₹500 a year and forget. Set up an auto-debit from your bank. Even ₹1,000 a month adds up to ₹3.6 lakh in 20 years.

- Ignoring asset allocation: Sticking with Auto Choice after 50 is fine, but if you’re 30 and on Auto, you’re missing out on compounding. Active Choice gives you control. Use it.

- Thinking it’s only for government employees: NPS was originally for government workers. Now, over 80% of subscribers are private sector employees. You don’t need a job with a pension to benefit.

Also, don’t confuse NPS with EPF (Employees’ Provident Fund). EPF is mandatory for salaried employees and offers fixed returns (currently 8.25%). NPS is voluntary, market-linked, and has higher long-term potential.

Who Should Use NPS?

NPS isn’t for everyone. It’s perfect if:

- You’re between 25 and 50 and have 10+ years until retirement

- You want to reduce your taxable income

- You’re comfortable with some market risk

- You don’t want to rely solely on family support after retirement

It’s not ideal if:

- You need full access to your money before 60

- You’re risk-averse and want guaranteed returns

- You’re over 60 and just starting to plan

If you’re in your 40s and haven’t started, it’s not too late. Even 15 years of consistent investing can build a ₹25-30 lakh corpus. That’s ₹15,000-₹20,000 a month in annuity income.

Next Steps: What to Do Today

You don’t need to wait for the perfect time. Here’s what to do right now:

- Go to nps.org.in and check if you already have a PRAN. Many people do without knowing.

- If you don’t have one, register. It takes 10 minutes.

- Set up an auto-debit of ₹2,000 per month. That’s less than ₹70 a day.

- Choose Active Choice and set your equity allocation to 70% if you’re under 40.

- Review your allocation every December.

Start small. Even ₹500 a month adds up. In 25 years, with 9% average returns, that’s over ₹50 lakh. That’s not a luxury-it’s security.

Can I withdraw money from NPS before retirement?

You can withdraw up to 25% of your Tier I contributions for specific emergencies like medical treatment, higher education, or buying a home. This can be done only three times in your lifetime. The rest is locked until 60. Tier II account allows full flexibility anytime.

Is NPS better than PPF for retirement?

PPF offers fixed returns (currently 7.1%) and is safer, but NPS has higher growth potential because of equity exposure. PPF allows full withdrawal at maturity. NPS gives you a lump sum plus annuity. If you’re young and can handle risk, NPS is better. If you want guaranteed returns and no market exposure, PPF is safer.

What happens to my NPS if I move abroad?

You can keep your NPS account active even if you become a non-resident. Contributions can still be made from your foreign bank account. Withdrawal rules remain the same-you can only access funds after 60. If you die abroad, your nominee in India receives the balance.

Can I have both NPS and EPF?

Yes. EPF is mandatory for salaried employees. NPS is voluntary. You can contribute to both. Your EPF balance is separate and doesn’t affect your NPS. Many people use EPF for short-term goals and NPS for long-term retirement.

Are annuity payments from NPS taxable?

Yes. The lump sum withdrawal (60%) is tax-free. But the monthly annuity payments are treated as income and taxed at your slab rate. This is similar to pension income from other sources. Plan for this tax liability in your retirement budget.