Retirement Corpus Calculator for India: How Much Do You Need to Retire?

Imagine waking up at 60 with no salary, no job, and no safety net. That’s what happens if you don’t plan your retirement properly. In India, most people assume their savings or family will carry them through old age. But with rising healthcare costs, inflation, and shrinking joint families, that’s no longer enough. You need a clear number - a retirement corpus - to know exactly how much you need to save before you stop working.

What Is a Retirement Corpus?

A retirement corpus is the total amount of money you need saved up to live comfortably without working. It’s not just about covering rent or groceries. It’s about covering medical bills, travel, hobbies, emergencies, and inflation for 20 to 30 years after you retire. In India, the average life expectancy is now 70.5 years. If you retire at 60, you could be living off your savings for over three decades.

Many Indians think ₹1 crore is enough. But that number is outdated. Ten years ago, ₹1 crore might have stretched. Today, with inflation running at 6% annually, that same ₹1 crore will buy you barely half as much in 2035. A retirement corpus isn’t a guess. It’s a calculation based on your lifestyle, location, health, and how long you expect to live.

How to Calculate Your Retirement Corpus

You don’t need a financial advisor to figure this out. You can do it yourself in five minutes. Here’s how:

- Estimate your monthly expenses in retirement. Look at your current spending. Then adjust for changes. Will you still pay your child’s college fees? Probably not. Will you spend more on medicine? Almost certainly. Most people need 70-80% of their current income to maintain their lifestyle after retiring.

- Factor in inflation. If you’re 35 now and plan to retire at 60, that’s 25 years away. At 6% inflation, your ₹50,000 monthly expenses today will become ₹2.16 lakh per month in 2051. Use the formula: Future Expense = Current Expense × (1 + Inflation Rate)Years to Retirement.

- Estimate how long you’ll live after retirement. Plan for at least 20-25 years. If you’re healthy and your family lives long, plan for 30. The longer you live, the bigger your corpus needs to be.

- Subtract expected income sources. Do you have a pension? Will your spouse work? Do you own property you can rent out? Subtract these from your total monthly need. Only the gap needs to be covered by your savings.

- Multiply monthly need by 12, then by years of retirement. If you need ₹1.5 lakh per month for 25 years, your corpus = ₹1.5 lakh × 12 × 25 = ₹4.5 crore.

That’s it. No fancy software needed. Just basic math.

Real-Life Examples from Indian Cities

Let’s say you live in a Tier-2 city like Indore or Coimbatore. Your current monthly expenses are ₹40,000. You’re 38. You plan to retire at 60. Inflation is 6%. Here’s what you’ll need:

- Future monthly expense in 22 years: ₹40,000 × (1.06)22 = ₹1.45 lakh

- Annual need: ₹1.45 lakh × 12 = ₹17.4 lakh

- For 25 years: ₹17.4 lakh × 25 = ₹4.35 crore

Now, if you live in Mumbai or Delhi, your current expenses might be ₹80,000. Same math:

- Future monthly expense: ₹80,000 × (1.06)22 = ₹2.9 lakh

- Annual need: ₹34.8 lakh

- Corpus needed: ₹8.7 crore

That’s not a typo. If you live in a metro and want to keep your lifestyle, you need over ₹8 crore. And that doesn’t include a major medical emergency - like a heart surgery or cancer treatment, which can cost ₹15-25 lakh out-of-pocket.

What Most Indians Get Wrong

Three big mistakes trap people:

- Ignoring inflation. People think, “I’ll save ₹50 lakh.” But ₹50 lakh today won’t cover even five years of basic living in 2040.

- Relying on property. Owning a house is great - but what if you need to move for better healthcare? Selling your home isn’t easy, and you can’t live in two places. Plus, property doesn’t pay your monthly bills.

- Thinking family will help. Adult children are stressed too. Many are burdened with EMIs, kids’ education, and their own aging parents. Don’t count on them. Plan for yourself.

Another myth: “I’ll invest in gold or FDs.” Gold doesn’t generate income. Fixed deposits give you 6-7% returns, but inflation is 6%. You’re barely breaking even. You need growth - not just safety.

Where to Invest for Your Retirement Corpus

You need a mix of safety and growth. Here’s what works in India today:

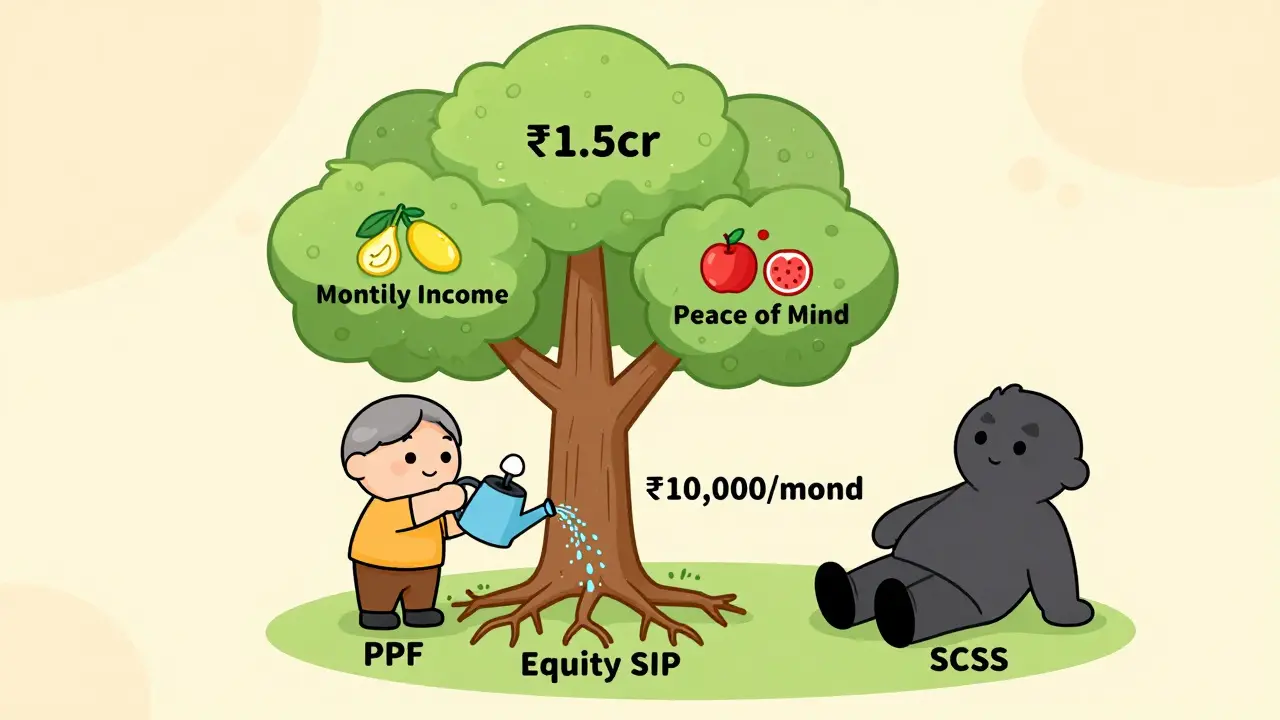

- Equity mutual funds (60-70%): Over 15-20 years, index funds like Nifty 50 have returned 12-14% annually. Start early. Even ₹10,000/month can grow to over ₹1 crore in 20 years.

- PPF (20-25%): Public Provident Fund offers tax-free returns at 7.1% (2026 rate). It’s safe, government-backed, and locks money for 15 years - perfect for retirement.

- Senior Citizen Savings Scheme (SCSS) or annuities (10-15%): Once you retire, shift part of your corpus into SCSS (7.4% interest) or an immediate annuity plan from LIC. This gives you a fixed monthly income.

- Real estate (optional): Only if you already own it. Don’t buy property just for retirement. It’s illiquid and expensive to maintain.

Don’t put everything in FDs. Don’t chase crypto. Don’t gamble on single stocks. Build a balanced portfolio that grows with inflation and protects you from market crashes.

What If You’re Behind?

It’s 2026. You’re 45. You’ve saved ₹20 lakh. You need ₹5 crore. What now?

It’s not too late. But you need to act fast:

- Boost your monthly savings. If you were saving ₹10,000/month, jump to ₹35,000. Cut subscriptions, delay vacations, downsize your car.

- Delay retirement by 3-5 years. Working longer means more savings, less time to fund, and higher pension eligibility.

- Downsize your lifestyle. Move from a metro to a Tier-2 city. Your expenses drop by 40-50%. That cuts your corpus need from ₹8 crore to ₹4 crore.

- Use your home equity. If you own a house, consider a reverse mortgage. It gives you monthly cash without selling your home.

There’s no magic fix. But you can still build a secure retirement - if you’re willing to change now.

Tools to Help You Track Progress

You don’t need to do everything manually. Use these free tools:

- SEBI’s Retirement Calculator - Built by India’s market regulator. Simple, accurate, no ads.

- Groww or Zerodha’s Retirement Planner - Lets you simulate different scenarios: inflation rates, returns, retirement age.

- Excel sheet - Download a free retirement calculator template. Input your numbers. Watch it update in real time.

Update your numbers every year. Life changes. Your expenses change. Your goals change. Your plan should too.

Start Today - Not Tomorrow

The biggest regret among retirees in India isn’t not having enough money. It’s not starting sooner. One man, 62, told me: “I thought I had 10 more years to save. Turns out, I had 10 more years to work.”

You don’t need to be rich. You just need to be consistent. Save ₹5,000 a month for 25 years. Invest it wisely. Let compounding do the heavy lifting. By 60, you’ll have ₹1.5 crore - enough to live well in most parts of India.

Retirement isn’t about luck. It’s about planning. And the best time to start was yesterday. The second best time is now.

How much retirement corpus do I need in India if I want to retire at 60?

There’s no single number. It depends on your monthly expenses, inflation, location, and life expectancy. A common rule is to multiply your estimated annual retirement expenses by 25. For example, if you need ₹1.2 lakh per month, you’ll need ₹3.6 crore (₹1.2 lakh × 12 × 25). In metros, aim for ₹5-8 crore. In Tier-2 cities, ₹3-5 crore is more realistic.

Is ₹1 crore enough to retire in India?

No, ₹1 crore is not enough for most people today. At 6% inflation, ₹1 crore today will be worth only ₹29 lakh in 20 years. If your monthly expenses are ₹50,000 today, you’ll need ₹1.45 lakh per month in 20 years. ₹1 crore will last less than 6 years. You need at least ₹4-5 crore for a comfortable retirement.

What is the best investment for retirement in India?

A mix of equity mutual funds (for growth), PPF (for safety and tax benefits), and annuities or SCSS (for steady income). Equity funds should make up 60-70% of your portfolio while you’re working. As you near retirement, shift to safer options. Avoid putting everything in FDs or gold - they don’t beat inflation long-term.

Can I retire early with ₹2 crore in India?

Yes, but only if you’re frugal. ₹2 crore can generate ₹1.2 lakh/month for 25 years if invested in a mix of annuities and debt funds yielding 7-8%. But this assumes no major medical emergencies, no inflation spikes, and living in a Tier-2 city. If you want to live in Delhi or Mumbai, or have chronic health issues, ₹2 crore won’t last.

How does inflation affect my retirement savings?

Inflation eats away at your money. At 6% annual inflation, your expenses double every 12 years. If you need ₹50,000/month today, you’ll need ₹1 lakh/month in 12 years and ₹2 lakh/month in 24 years. If your savings don’t grow faster than inflation, your money will vanish. That’s why you need equity investments - they historically return 12-14%, beating inflation.

Should I rely on my pension for retirement income?

Only as a supplement. Government pensions are often low - ₹15,000 to ₹30,000/month. Private sector jobs rarely offer pensions anymore. Even if you have one, it won’t cover healthcare, travel, or emergencies. Your retirement plan must be built around your own savings, not promises from employers or the government.

What if I don’t own a house? Can I still retire comfortably?

Yes, absolutely. Many retirees live comfortably in rented homes in Tier-2 cities for ₹15,000-₹25,000/month. The key is not owning property - it’s controlling your expenses. If you’re renting, include rent in your retirement budget. You’ll need a larger corpus, but it’s still achievable with disciplined saving.

Next Steps: What to Do Right Now

Here’s your action plan:

- Open a spreadsheet. List your current monthly expenses.

- Use the formula: Future Expense = Current Expense × (1.06)Years to Retirement.

- Multiply that by 12 and then by 25.

- Subtract any expected pension or rental income.

- Compare the result to what you’ve saved so far.

- If you’re short, increase your monthly SIP by ₹5,000. Start today.

You don’t need to be perfect. You just need to start. And keep going.