NPS Investment Options in India: Equity, Corporate Debt, and Government Securities Explained

When you sign up for the National Pension System (NPS) in India, you’re not just picking a retirement plan-you’re deciding how your money grows over decades. The choices you make today between equity, corporate debt, and government securities will shape your life after 60. It’s not about chasing the highest return. It’s about matching your risk tolerance, time horizon, and peace of mind with the right mix.

What Exactly Is NPS?

The National Pension System is a government-backed retirement scheme open to all Indian citizens, including self-employed people and those working in the private sector. Unlike old pension systems tied to employers, NPS lets you control how your contributions are invested. You choose from three asset classes: equity (E), corporate debt (C), and government securities (G). You can even let the system auto-allocate for you through the ‘Life Cycle Fund’.

Every rupee you put in-whether it’s ₹500 a month or ₹10,000-gets split across these three buckets. The government caps your equity exposure at 75% until age 50, then gradually reduces it. That’s designed to protect your savings as you near retirement.

Equity: High Risk, High Reward Over Time

Equity means investing in stocks-company shares listed on Indian exchanges like NSE and BSE. This is where your money has the best shot at beating inflation and growing significantly over 20-30 years. Historically, Indian equities have returned around 12-14% annually over the long term, according to data from the Pension Fund Regulatory and Development Authority (PFRDA).

But here’s the catch: equity can drop 20-30% in a single year. If you panic and pull out during a market crash, you lock in losses. That’s why equity works best for young investors-say, someone starting NPS at 25. They have time to ride out downturns. By age 40, even if markets tanked twice, their portfolio likely recovered and kept growing.

Equity isn’t just about picking individual stocks. In NPS, your money goes into index funds or passive portfolios managed by approved fund managers. You don’t need to be a stock picker. You just need patience.

Corporate Debt: Steady, But Not Risk-Free

Corporate debt is when you lend money to private companies through bonds. These are IOUs issued by firms like Reliance, Tata, or Infosys. In return, they pay you fixed interest-usually higher than government bonds because companies are riskier than the government.

Corporate debt in NPS typically yields 7-9% annually. That’s better than bank fixed deposits, and less volatile than stocks. But it’s not safe. Companies can default. In 2020, IL&FS defaulted on ₹1 lakh crore worth of debt. While NPS fund managers avoid high-risk issuers, you still face credit risk.

Corporate debt is ideal for mid-career investors-say, 35 to 50-who want growth but can’t stomach the rollercoaster of equity. It’s a middle ground: better returns than government bonds, lower risk than stocks. But don’t expect miracles. If you’re looking for 15% returns, corporate debt won’t deliver.

Government Securities: The Safety Net

Government securities-also called G-Secs-are loans you give to the Indian government. They’re backed by the full faith and credit of the nation. That means near-zero default risk. In NPS, these are mostly long-term bonds with maturities of 5 to 40 years.

Yields hover between 6.5% and 8% depending on market conditions. In early 2025, 10-year G-Secs were trading at 6.9%. That’s lower than corporate debt, but it’s steady. Even when markets crash, G-Secs hold their value. During the 2020 pandemic, while equity funds lost 25%, G-Sec funds gained 5%.

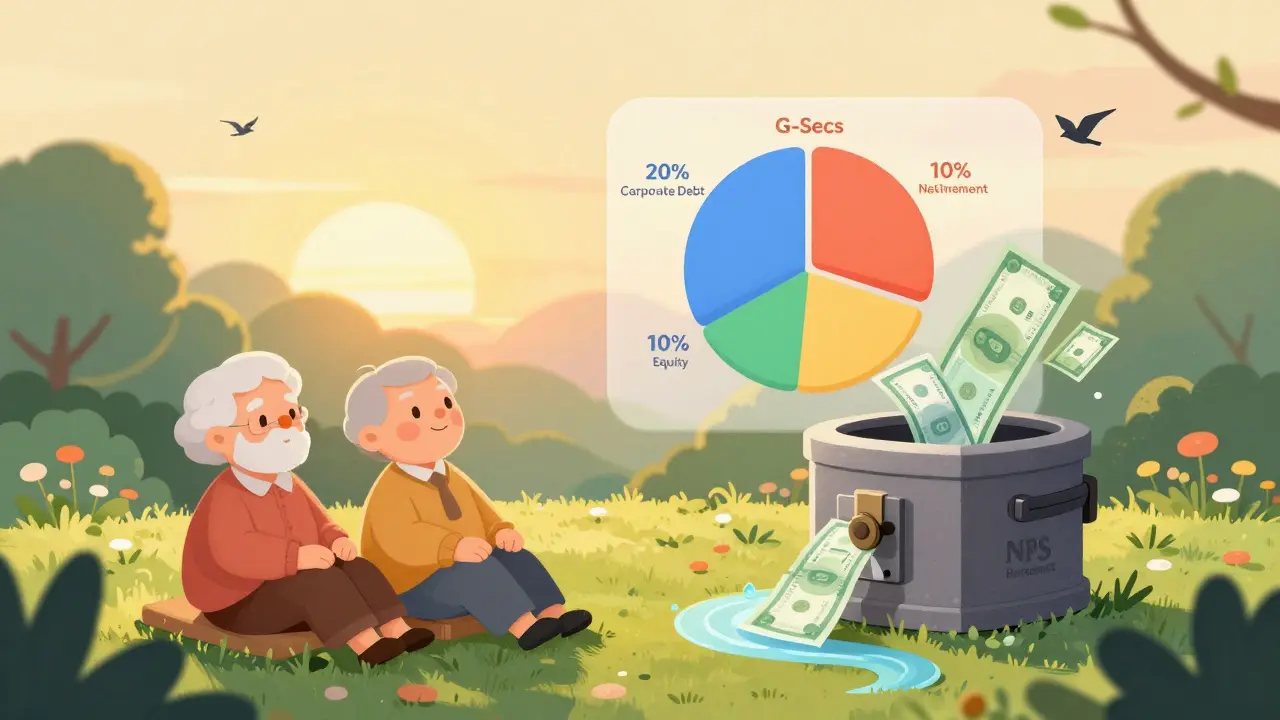

Government securities are perfect for people nearing retirement-50 and above. They’re also the backbone of the auto-allocation Life Cycle Fund. As you get older, more of your portfolio shifts here automatically. If you’re risk-averse or need predictable income after 60, this is your anchor.

How to Choose the Right Mix

There’s no one-size-fits-all answer. But here’s how real people make it work:

- Age 25-35: 70% equity, 20% corporate debt, 10% government securities. You’re young. Let your money grow. Even if markets dip, you have 30 years to recover.

- Age 36-45: 50% equity, 30% corporate debt, 20% government securities. You’re building wealth. Still want growth, but start adding stability.

- Age 46-55: 30% equity, 30% corporate debt, 40% government securities. Retirement is closer. Reduce volatility. Protect what you’ve built.

- Age 56+: 10% equity, 20% corporate debt, 70% government securities. Income matters more than growth. Safety first.

These aren’t rules. They’re starting points. If you’re terrified of market drops, dial down equity even if you’re 30. If you’re a financial professional with extra savings outside NPS, you might go 80% equity at 40.

Auto-Allocated Life Cycle Fund: The Hands-Off Option

If you don’t want to think about allocations, choose the Life Cycle Fund. It’s built into NPS. It starts with 75% equity when you’re under 50. Every year after 50, it reduces equity by 2% and shifts to government securities. By age 60, you’re at 10% equity, 20% corporate debt, and 70% G-Secs.

It’s not perfect. The glide path doesn’t adjust for your personal risk tolerance or income needs. But for 80% of people who forget to check their NPS account, it’s better than doing nothing. It’s automatic, regulated, and aligned with long-term retirement goals.

What to Avoid

Don’t chase returns blindly. A friend of mine put 90% in equity at 55 because he heard about a stock market boom. When the market crashed in late 2024, his NPS balance dropped by 38%. He had to delay retirement by two years.

Don’t ignore fees. NPS has low charges-around 0.01% annually. But some fund managers charge more. Stick to the top-performing ones like SBI Pension Fund or ICICI Prudential Pension.

Don’t stop contributing. Even ₹1,000 a month adds up. At 8% annual return, ₹1,000/month for 30 years becomes ₹1.5 crore. That’s not a luxury-it’s a foundation.

How NPS Compares to Other Retirement Tools

NPS isn’t the only option. There’s PPF, EPF, mutual funds, and insurance plans. But NPS stands out:

- PPF: Fixed 7.1% return (2025 rate), tax-free, but capped at ₹1.5 lakh/year. No equity exposure.

- EPF: Employer-sponsored, 8.25% return, but only if you’re salaried. No choice in asset allocation.

- Equity Mutual Funds: Higher returns possible, but no tax benefits on withdrawal. NPS gives you extra tax breaks under Section 80CCD(1B).

NPS is the only retirement plan in India that lets you directly control your exposure to equity, corporate debt, and government securities. That control is powerful.

Final Thought: It’s Not About Timing the Market

Most people overthink NPS. They wait for the ‘right time’ to increase equity. They panic when markets fall. They switch funds every year.

Real success comes from consistency. Set your allocation once, stick with it, and keep contributing. Even small, regular investments compound into something meaningful. You don’t need to be smart. You just need to be steady.

By 60, your NPS won’t make you rich. But it might let you retire without worrying about bills. And that’s worth more than any short-term gain.

Can I change my NPS investment allocation anytime?

Yes, you can change your asset allocation up to four times a year for free. You can switch between active and auto-allocation modes anytime. But frequent changes rarely help. Stick to a plan and adjust only if your life situation changes-like a job loss, inheritance, or health issue.

Is NPS better than PPF for retirement?

It depends. PPF is safer and tax-free at withdrawal, but it has no equity exposure and lower returns. NPS offers higher growth potential through equity and corporate debt, plus a tax deduction of ₹50,000 under Section 80CCD(1B). If you’re comfortable with some risk, NPS is better for building a larger retirement corpus.

What happens to my NPS money if I die before 60?

Your nominee receives the entire corpus. There’s no mandatory annuity purchase if you die before retirement. The nominee can withdraw the amount or transfer it to their own NPS account if eligible. This makes NPS more flexible than traditional pension schemes.

Can I withdraw from NPS before 60?

Yes, but only under limited conditions: critical illness, higher education for children, marriage, or buying a house. You can withdraw up to 25% of your contributions (not interest) before 60. At retirement, you must use at least 40% of the corpus to buy an annuity. The rest is tax-free.

Are NPS returns guaranteed?

No. NPS returns are market-linked. Equity and corporate debt returns vary. Government securities give stable but not fixed returns-yields change with interest rates. The government doesn’t guarantee returns, but it does guarantee the safety of the system. Your money is held in trust by regulated fund managers.