NPS Tax Benefits in India: How to Maximize Deductions and Build Tax-Efficient Retirement Savings

When you hear NPS, don’t just think retirement account. Think tax break. Think long-term savings that actually reduce your income tax bill every year. In India, the National Pension System isn’t just another investment option-it’s one of the most powerful tools for cutting your taxable income while securing your future. And if you’re not using it right, you’re leaving money on the table.

How NPS Lowers Your Tax Bill

The NPS lets you claim deductions under three sections of the Income Tax Act: 80C, 80CCD(1B), and 80CCD(2). That’s not one discount-it’s three stacked on top of each other. Most people only know about 80C. But here’s the secret: 80CCD(1B) gives you an extra ₹50,000 deduction, completely separate from your ₹1.5 lakh limit under 80C.

Let’s say you’ve already invested ₹1.5 lakh in PPF, ELSS, and life insurance. You think you’re done. But if you put another ₹50,000 into NPS, you get that entire amount deducted from your taxable income. No cap. No overlap. Just pure tax reduction. For someone in the 30% tax bracket, that’s ₹15,000 back in your pocket-just for contributing to your retirement.

Employer Contributions: Free Money with Tax Benefits

If you’re salaried, your employer might already be contributing to your NPS account. That’s not a bonus-it’s a tax advantage. Under Section 80CCD(2), your employer’s contribution (up to 10% of your basic salary + DA) is also deductible from your income. And here’s the kicker: this limit is over and above the ₹2 lakh total you can claim under 80C and 80CCD(1B).

For example, if your basic salary is ₹12 lakh a year and your employer contributes 10% (₹1.2 lakh), that ₹1.2 lakh is fully tax-free for you. You don’t pay tax on it, and you don’t need to claim it-it’s automatically excluded from your taxable income. That’s like getting a raise without asking for one.

What You Can Deduct: The Real Limits

Here’s the breakdown of how much you can save:

- ₹1.5 lakh under Section 80C (includes NPS, PPF, insurance, etc.)

- Extra ₹50,000 under Section 80CCD(1B) - only for NPS

- Employer contribution up to 10% of salary under Section 80CCD(2) - no cap within this limit

So if you’re a salaried employee putting in ₹2 lakh of your own money and your employer adds ₹1.2 lakh, your total NPS-related deductions can hit ₹3.2 lakh. That’s not just tax savings-it’s a major reduction in your annual tax liability.

Self-employed professionals? You don’t get employer contributions, but you can still claim up to ₹2 lakh total: ₹1.5 lakh under 80C and ₹50,000 under 80CCD(1B). That’s still better than most other instruments.

How NPS Compares to Other Retirement Options

Let’s say you’re choosing between NPS, PPF, and mutual fund SIPs for retirement. PPF gives you tax-free returns, but the annual limit is ₹1.5 lakh. NPS gives you the same limit plus an extra ₹50,000 deduction. And unlike PPF, NPS lets you invest in equities-meaning higher long-term growth potential.

Equity mutual funds through SIPs don’t offer any direct tax deduction. You only get tax benefits if you invest in ELSS, which has a 3-year lock-in. NPS has a 60-year lock-in (you can’t withdraw before 60), but that’s the price for the bigger tax break. And unlike ELSS, NPS doesn’t cap your annual contribution-you can put in ₹5 lakh if you want, and still get the ₹2 lakh deduction.

Here’s how they stack up:

| Feature | NPS | PPF | ELSS |

|---|---|---|---|

| Max annual deduction | ₹2 lakh (₹1.5L + ₹50K) | ₹1.5 lakh | ₹1.5 lakh |

| Extra deduction beyond 80C | Yes (₹50K under 80CCD(1B)) | No | No |

| Employer contribution eligible | Yes (up to 10% of salary) | No | No |

| Equity exposure | Up to 75% | 0% | Up to 80% |

| Lock-in period | Until age 60 | 15 years | 3 years |

| Tax on withdrawal | 40% tax-free, 60% taxable | 100% tax-free | Long-term capital gains taxed after ₹1 lakh |

PPF is safe and tax-free at maturity. ELSS is flexible and grows fast. But only NPS gives you the highest possible deduction, employer contributions, and exposure to market returns-all in one package.

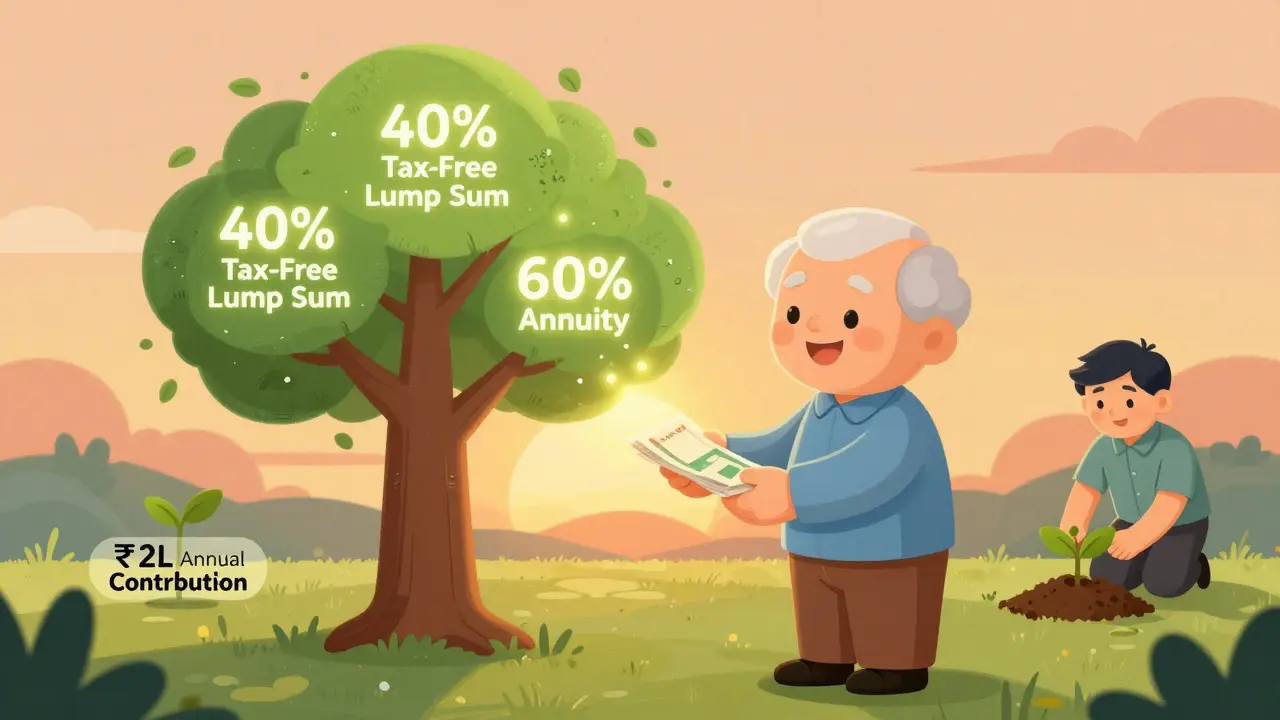

What Happens When You Withdraw?

At 60, you can withdraw 60% of your NPS corpus as a lump sum. Here’s the catch: 40% of that lump sum is tax-free. The other 60% is taxable as income. But here’s the trick: you can use that 60% to buy an annuity, and the annuity payments are taxed as income-just like a pension.

Most people panic at this. They think, “I’ll pay tax on everything!” But you’re not paying tax on the full amount. You’re paying tax only on the portion you withdraw as cash. And if you spread your withdrawals over time, you can stay in a lower tax bracket.

Example: You have ₹1.2 crore in your NPS account at 60. You take ₹72 lakh as cash (60%). You pay tax on that ₹72 lakh based on your income that year. If you’re retired and have no other income, your tax could be zero or very low. The remaining ₹48 lakh goes into an annuity. You get monthly payments, and those are taxed as income-but at a lower rate because your overall income is lower.

And here’s the best part: you can defer the lump sum withdrawal until you’re 70, if you want. That gives you more time to grow your corpus and delay the tax hit.

How to Start and Maximize Your NPS Contributions

Opening an NPS account is free and takes 10 minutes online. You can choose between Tier I (mandatory, locked) and Tier II (flexible, withdraw anytime). For tax benefits, only Tier I matters.

Here’s how to maximize it:

- Set up auto-debit for ₹16,667 per month (₹2 lakh annually). This hits both your 80C and 80CCD(1B) limits.

- If you’re salaried, confirm your employer’s contribution. Add it to your total deduction.

- Use the NPS mobile app to track your portfolio. Rebalance your equity exposure every year-aim for 50-75% equity if you’re under 45.

- Don’t wait until March. Spread contributions evenly. It helps with cash flow and avoids last-minute stress.

- Link your NPS to your Aadhaar and PAN. It’s mandatory for tax claims.

Many people miss out because they think NPS is complicated. It’s not. The government handles the fund management. You pick your asset allocation, and the rest is automatic.

Common Mistakes That Cost You Tax Savings

Here’s what most people get wrong:

- Believing NPS is only for government employees. It’s open to everyone-private sector, freelancers, even NRIs.

- Thinking 80C limit is the only cap. You’re ignoring the extra ₹50,000 under 80CCD(1B).

- Contributing too late. If you put ₹2 lakh in March, you miss out on compounding. Start in April.

- Not checking employer contributions. If your company offers NPS, don’t ignore it-it’s free money with tax benefits.

- Withdrawing early. You lose all tax benefits if you withdraw before 60. Only exceptions are critical illness or death.

One client I worked with-freelance designer, 42 years old-was putting ₹1.5 lakh in PPF. She switched ₹50,000 to NPS. Her tax bill dropped by ₹15,000. Her portfolio grew faster. And she didn’t change her spending. Just moved money.

Who Should Skip NPS?

NPS isn’t perfect for everyone. If you:

- Need access to your money before 60 (for a house, business, or emergency)

- Are over 55 and haven’t started saving

- Prefer guaranteed returns over market-linked growth

Then PPF or fixed deposits might suit you better. But if you’re under 50, earn more than ₹10 lakh a year, and want to cut your tax bill while building wealth-NPS is the smartest move you can make.

Final Thought: It’s Not About Retirement. It’s About Tax Efficiency.

NPS isn’t just a retirement plan. It’s a tax optimization engine. Every rupee you put in reduces your taxable income. Every year. For decades. And when you retire, you still have control over how you take your money out.

The real advantage? You’re not just saving for the future. You’re saving on taxes today. And that’s the kind of win that compounds-not just in your account, but in your bank balance.

Can I claim NPS deduction if I’m self-employed?

Yes. Self-employed individuals can claim up to ₹2 lakh in deductions under NPS-₹1.5 lakh under Section 80C and an additional ₹50,000 under Section 80CCD(1B). You don’t get employer contributions, but the tax savings are still significant.

Is NPS better than PPF for tax savings?

NPS offers higher deductions. PPF caps at ₹1.5 lakh under 80C. NPS gives you ₹1.5 lakh under 80C plus an extra ₹50,000 under 80CCD(1B). If you’re in a high tax bracket, NPS saves you more. But PPF offers 100% tax-free withdrawals. Choose NPS for higher deductions; PPF for tax-free returns.

Can I withdraw NPS money before 60?

Yes, but only under limited conditions: critical illness, higher education for children, or buying a house. You can withdraw up to 25% of your contributions. But you’ll lose the tax benefits on that amount. Early withdrawal should be avoided unless absolutely necessary.

Does NPS offer guaranteed returns?

No. NPS returns are market-linked. You choose your asset allocation-equity, corporate bonds, government securities. Historically, NPS has delivered 9-11% annual returns over the long term. But there’s no guarantee. It’s riskier than PPF, but with higher growth potential.

Can NRIs invest in NPS?

Yes. Non-Resident Indians can open NPS accounts through designated banks or points of presence. They get the same tax deductions under 80C and 80CCD(1B), but only on contributions made from NRE or NRO accounts. Withdrawals are subject to Indian tax laws and double taxation agreements.

What happens to NPS if I die before 60?

The entire corpus is paid to your nominee. It’s tax-free in their hands. No inheritance tax or income tax applies. This makes NPS a powerful estate-planning tool.

Can I have both NPS and EPF?

Yes. EPF contributions are covered under 80C, and NPS contributions can still claim the extra ₹50,000 under 80CCD(1B). You can max out both. EPF is mandatory for salaried employees; NPS is optional but highly beneficial for tax savings.

How do I claim NPS deduction in my ITR?

You’ll find NPS contributions listed in Form 16 under Section 80C and 80CCD(1B). Enter the total in the relevant section of ITR-1 or ITR-2. Keep your NPS contribution receipt from the CRA (NSDL) as proof. No additional forms are needed.

If you’re serious about reducing your tax burden and building wealth over time, NPS isn’t optional-it’s essential. The system is designed to reward disciplined savers. And if you start now, you’ll thank yourself at 60.