Retirement Income India: How to Build Stable Income After Work

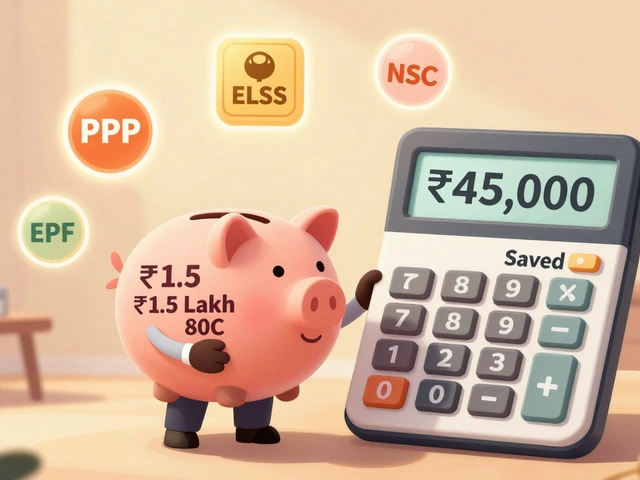

When you stop working, where does your money come from? In India, retirement income, the steady money stream people rely on after leaving full-time work. It’s not just about savings—it’s about planning what you own, what you earn, and how taxes affect it. Unlike countries with strong state pensions, most Indians must build their own income after 60. That’s why tools like reverse mortgage India, a way for seniors to turn their paid-off home into monthly cash without moving out are gaining real traction. And it’s not just about property—Section 80C, a tax-saving rule that lets you deduct up to ₹1.5 lakh from your income for investments like PPF, ELSS, and EPF is one of the most powerful levers for long-term retirement growth.

People often think retirement means stopping work entirely. But for many in India, it means shifting how they earn. A retired teacher might rent out a room. A retired engineer might use a mutual fund SIP to generate monthly payouts. The mutual funds India, a system where pooled money from many investors is managed by professionals to grow over time you choose matters. Equity funds for growth, debt funds for steady returns, and ELSS for tax breaks—all can feed your retirement income if timed right. And because India doesn’t have universal social security, your personal choices carry more weight than anywhere else.

What you do in your 40s and 50s decides what your 70s look like. If you’ve been putting money into EPF or NPS through your employer, that’s a start. But if you own a house and have no heirs who need it, a reverse mortgage could turn bricks and mortar into monthly cash. If you’ve been skipping tax-saving investments, now’s the time to catch up. The retirement income you want isn’t magic—it’s made from consistent decisions: investing early, choosing the right instruments, and understanding how taxes eat into your returns. Below, you’ll find real guides on how to use reverse mortgages, how to pick mutual funds for steady payouts, and how to stretch your Section 80C limits to build lasting income. No fluff. Just what works for Indian retirees today.

Sequence of returns risk can destroy retirement income in India-even with a large portfolio. Learn how market timing, inflation, and withdrawal strategies impact your savings-and how to protect your income for life.

Continue Reading