Understanding F&O in India: Futures and Options Basics for Equity Traders

If you’ve ever seen a stock like Reliance or TCS spike 10% in a day and wondered how some traders made ten times that profit overnight, the answer often lies in F&O-Futures and Options. These aren’t complicated tools reserved for hedge funds. In India, millions of retail traders use them daily. But if you’re new, the jargon can feel like a foreign language. Let’s cut through the noise and explain exactly what F&O is, how it works, and why it matters for equity traders in India.

What Exactly Are Futures and Options?

Futures and Options are derivative instruments. That means their value comes from something else-usually a stock or index. They don’t give you ownership of the underlying asset. Instead, they let you bet on its future price.

A futures contract is an agreement to buy or sell an asset at a set price on a future date. You’re locked in. If you think Infosys will rise to ₹2,800 in a month, you can lock in that price today. If it goes to ₹3,000, you profit. If it drops to ₹2,500, you lose. No options. No escape. That’s the key difference from options.

An option gives you the right-but not the obligation-to buy or sell at a set price before a specific date. Think of it like a reservation. You pay a small fee (called a premium) to hold that right. If the stock moves your way, you use it. If it doesn’t, you walk away. Your loss is limited to the premium. That’s why options are often called "insurance" for traders.

Why Do Indian Traders Use F&O?

Three reasons dominate: leverage, hedging, and speculation.

Leverage is the biggest draw. In equity trading, you need ₹100,000 to buy ₹100,000 worth of shares. In futures, you might only need ₹10,000 as margin to control the same position. That’s 10x leverage. A 5% move in the stock becomes a 50% gain-or loss-in your account. It’s powerful. And dangerous.

Hedging is how big players protect themselves. Say you own 500 shares of HDFC Bank and fear a market crash. Instead of selling and paying taxes, you can sell Nifty futures. If the market drops, your loss in shares is offset by profit in futures. It’s not about making money-it’s about not losing it.

Speculation is what most retail traders do. They bet on direction. Buy a call option if they think a stock will rise. Sell a put if they think it will fall. With options, you can make big returns on small capital. But that’s also why so many lose money-without a plan, leverage turns into a trap.

How F&O Works in India: Key Rules

The National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) are the main platforms. Here’s what you need to know:

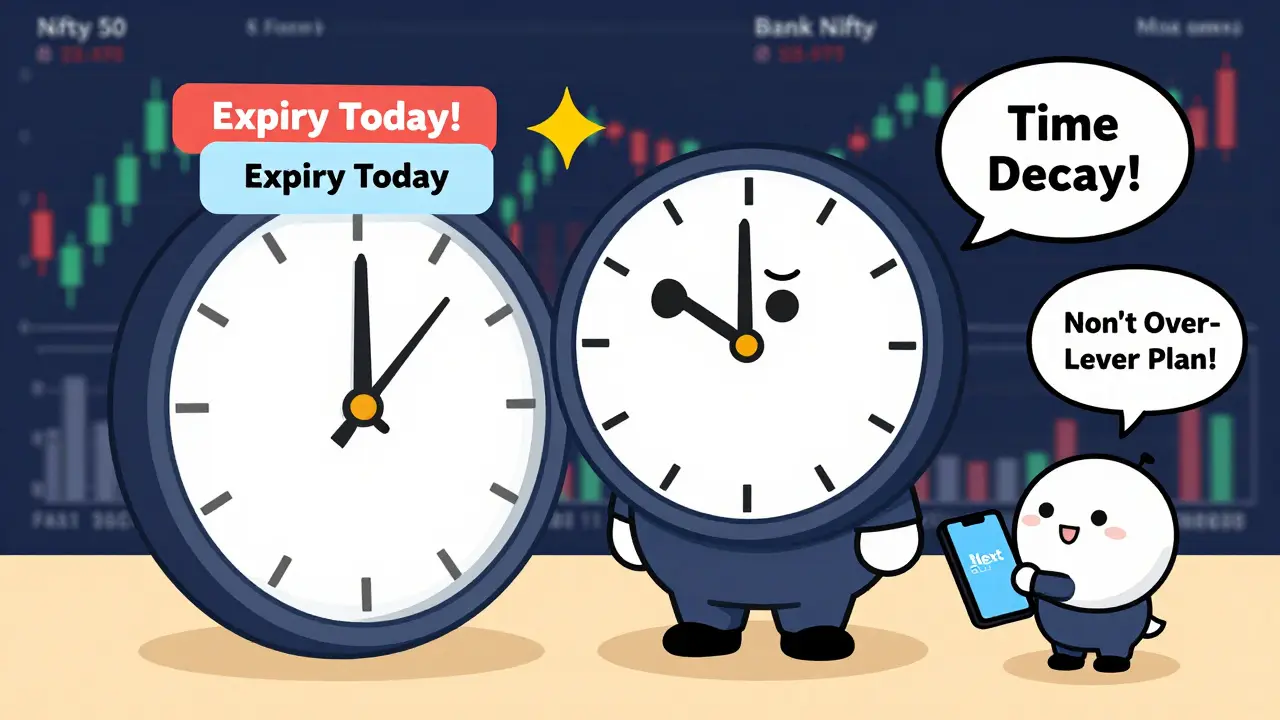

- Expiry dates: All F&O contracts expire on the last Thursday of every month. If that’s a holiday, it moves to Wednesday.

- Contract sizes: Each futures or options contract has a fixed lot size. For example, one lot of Tata Motors might be 1,500 shares. You can’t trade 10 shares-you trade in multiples of the lot.

- Margins: Brokers require you to deposit money upfront. For futures, it’s usually 10-20% of the contract value. For options, it’s based on the premium and risk exposure.

- Mark-to-market: Every day, your position is revalued. If you lose money, your account gets debited. If you win, it’s credited. No waiting until expiry.

- STT and taxes: Securities Transaction Tax (STT) applies on both entry and exit. Short-term capital gains are taxed at 15%. Long-term (if held over a year) is tax-free-but F&O positions rarely last that long.

These rules are set by SEBI (Securities and Exchange Board of India). They change. Always check the latest margin requirements before trading.

Futures vs Options: A Simple Side-by-Side

| Feature | Futures | Options |

|---|---|---|

| Obligation | You must buy/sell on expiry | You have the right, not the obligation |

| Upfront Cost | Margin (10-20% of contract value) | Premium (price you pay to buy the option) |

| Potential Loss | Unlimited (can lose more than your margin) | Limited to the premium paid |

| Potential Profit | Unlimited (if price moves strongly) | Unlimited (for calls), limited (for puts) |

| Best For | Traders confident in direction | Speculators, hedgers, beginners learning risk |

Common Mistakes New Traders Make

Most people lose money in F&O-not because the market is rigged, but because they skip basics.

- Trading without a plan: "I think this stock will go up" isn’t enough. You need entry, exit, and stop-loss levels written down.

- Ignoring time decay: Options lose value as expiry nears. Holding a long option too close to expiry is like buying a coupon that expires tomorrow.

- Over-leveraging: Using 20x leverage on a single trade? That’s not trading-it’s gambling. Many brokers now limit margin for retail traders after SEBI’s 2024 reforms.

- Chasing high premiums: A call option priced at ₹150 might sound cheap. But if the underlying stock is at ₹1,200 and the strike is ₹1,300, it’s deep out-of-the-money. The chance of profit is slim.

- Not tracking expiry: If you forget your option expires, you might wake up with zero value. Set calendar alerts.

Where to Start as a Beginner

You don’t need to master complex strategies like straddles or iron condors right away. Start here:

- Open a demat and trading account with a broker that offers F&O (Zerodha, Upstox, ICICI Direct).

- Trade in Nifty 50 or Bank Nifty futures first-they’re liquid and less volatile than individual stocks.

- Use paper trading (simulated trading) for 30 days. Most platforms offer this for free.

- Learn to read candlestick charts and basic support/resistance levels.

- Never risk more than 1-2% of your capital on a single trade.

Books like "Options as a Strategic Investment" by Lawrence McMillan or free resources from NSE’s Investor Education portal are solid starting points.

What’s Changed in 2025?

SEBI tightened rules in 2024, and the impact is still rolling out:

- Margin hikes: For illiquid stocks, margins jumped from 15% to 40%. Many small-cap F&O contracts became too expensive for retail traders.

- Position limits: You can’t hold more than 5% of total open interest in a single stock’s F&O contract. This stops market manipulation.

- Disclosures: Brokers now show real-time margin usage and risk warnings before you place a trade.

These changes made F&O less speculative and more strategic. It’s harder to get rich overnight-but easier to build consistent returns.

Final Thought: F&O Isn’t Magic

Futures and options aren’t shortcuts. They’re tools. Like a hammer. Use it right, and you build something. Use it wrong, and you break your thumb.

Most people enter F&O chasing quick money. The ones who stick around? They treat it like a business. They track trades, analyze losses, and stick to discipline. If you’re willing to learn, practice, and control your emotions, F&O can become a powerful part of your trading toolkit.

But don’t rush. Start small. Understand the risks. And remember: in the Indian stock market, the biggest edge isn’t the strategy-it’s the patience to wait for the right setup.

What is the difference between futures and options in simple terms?

Futures are binding-you must buy or sell at the agreed price on the expiry date. Options give you the right to do so, but you’re not forced. You pay a premium for that right. If the market moves against you, you can walk away from an option, but you can’t walk away from a future.

Can I trade F&O without owning the underlying stock?

Yes. F&O contracts are purely speculative or hedging tools. You don’t need to own shares of Reliance or TCS to trade their futures or options. You’re betting on price movement, not ownership.

Is F&O trading risky in India?

Extremely. Leverage amplifies both gains and losses. A trader with ₹50,000 can lose it all in one day if the market moves against their leveraged position. SEBI has added safeguards, but responsibility still lies with the trader. Never trade with money you can’t afford to lose.

Which is better for beginners: futures or options?

Options are often better for beginners because your maximum loss is limited to the premium you paid. With futures, losses can exceed your margin. That said, options require understanding time decay and strike prices, which adds complexity. Start with Nifty futures on a demo account before using real money.

How much capital do I need to start F&O trading in India?

You can start with ₹10,000-₹20,000 for Nifty or Bank Nifty futures, since margins are lower. For individual stocks, you may need ₹50,000 or more due to higher margins. For options, the cost depends on the premium-some can be bought for under ₹500 per lot. Always check current margin requirements before trading.