Tax Saving Investments and Retirement Planning in November 2025

When planning your finances in late 2025, Section 80C, a tax deduction limit under India’s Income Tax Act that lets you reduce taxable income by up to ₹1.5 lakh. Also known as tax-saving investments, it is the foundation for millions of Indian households trying to lower their tax burden while building long-term wealth. This month’s collection focuses on real, actionable ways to use Section 80C—not just by picking any product, but by understanding what actually works for your situation. Whether you’re using EPF, ELSS, fixed deposits, or even NPS through payroll, the goal is the same: save tax without losing money to fees, lock-ins, or poor timing.

Two major tools that keep coming up are NPS, a government-backed pension scheme offering market-linked returns with tax benefits. Also known as National Pension System, it is designed for people who want higher growth but can handle some risk. And PPF, a safe, fixed-income option backed by the government with guaranteed returns. Also known as Public Provident Fund, it is the go-to for those who hate volatility and want certainty. The big question isn’t which is better—it’s which fits your life. NPS gives you control over asset allocation; PPF gives you peace of mind. Both can be used together, and several posts break down exactly how to balance them without overcomplicating things.

Then there’s the world of mutual funds, a broad category of investment vehicles that pool money from many investors to buy stocks, bonds, or other assets. Also known as MFs, it is where most Indians actually grow their wealth over time, whether through SIPs, direct plans, or switching between schemes. The articles here don’t just tell you what mutual funds are—they show you how to avoid losing money to high expense ratios, how to switch funds without triggering capital gains tax, and how tracking error can silently eat into your returns. You’ll also find clear guidance on choosing between equity, debt, hybrid, and ELSS funds based on your goals, not just what your agent recommends.

Retirement isn’t just about saving—it’s about protecting what you’ve built. That’s why you’ll see deep dives into reverse mortgages, a tool that lets seniors turn their paid-off homes into monthly cash without moving out. Also known as home equity retirement, it is a lifeline for older Indians who own property but have limited income. And if you’re renting out property, you’ll find how to declare rent income correctly and claim every possible deduction under income from house property rules. Even estate planning comes up—wills, nominees, and succession laws aren’t just for the wealthy. If you have assets, you need a plan.

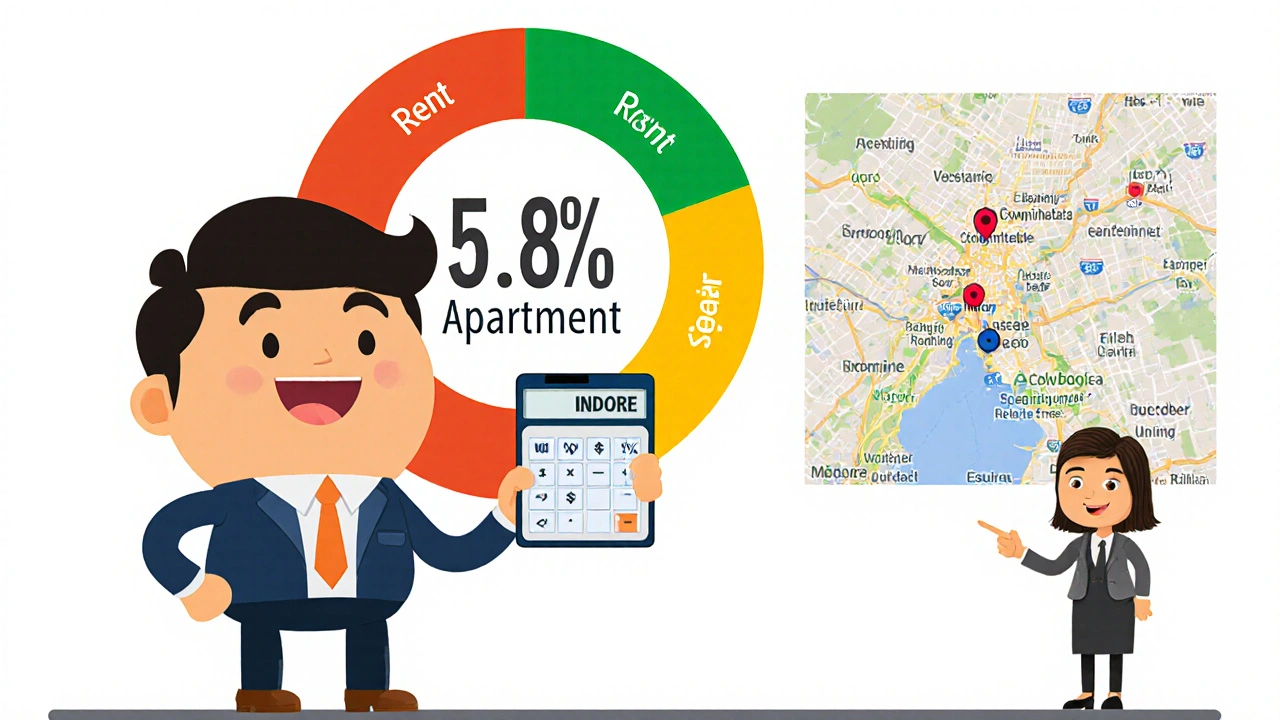

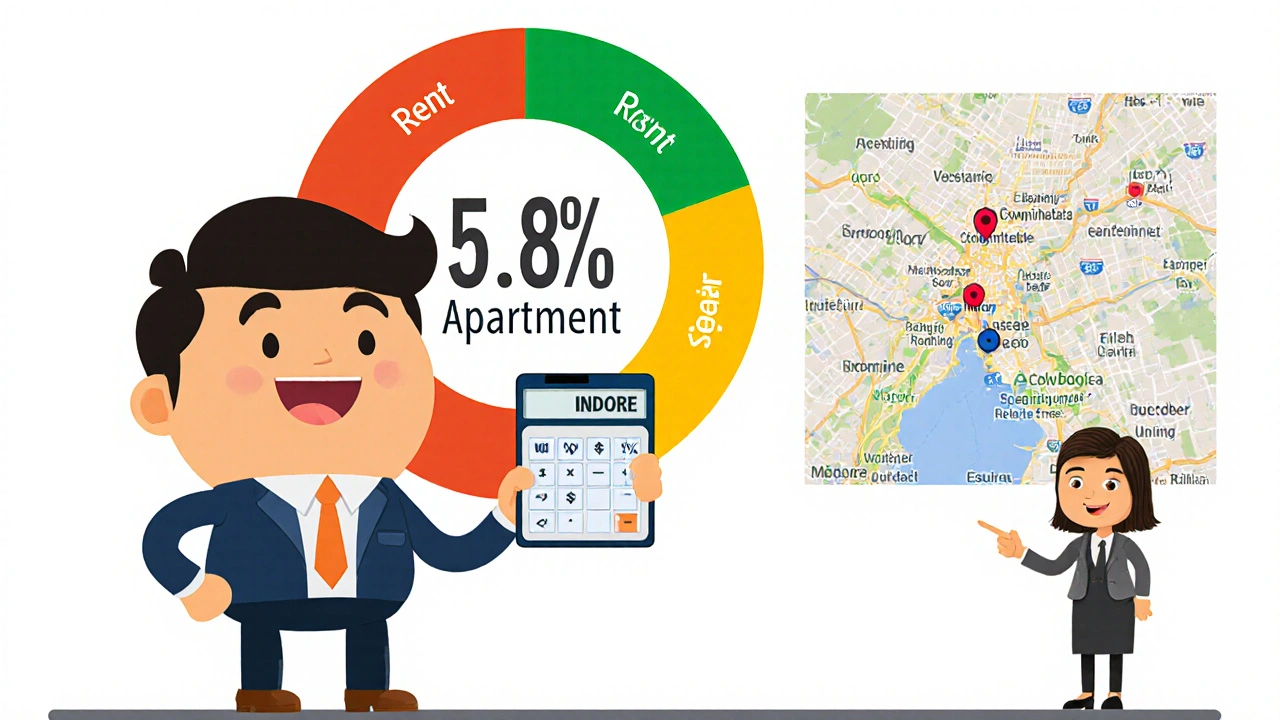

What ties all these posts together? They’re written for people who want to do the right thing but don’t have time to wade through jargon. No fluff. No theory without practice. Just clear steps: how to build a Section 80C ladder, how to calculate real estate ROI in Prayagraj, how to pick the right ELSS fund, and why sequence of returns risk can wipe out a retirement portfolio even if you saved enough. You’ll also find practical takes on crypto wallets, staking pools, and even virtual real estate—but only where they connect to real financial decisions. This isn’t a list of random articles. It’s a curated set of tools for anyone serious about their money in 2025.

Learn the exact PAN, Aadhaar, and bank requirements to claim your full ₹1.5 lakh tax deduction under Section 80C in India. Avoid rejections and delays with this clear, step-by-step guide.

Continue Reading

Tax-saving fixed deposits in India offer a safe, guaranteed way to reduce your taxable income under Section 80C. Learn how they work, compare returns, and avoid common mistakes.

Continue Reading

Use the NPS Pension Calculator in India to estimate your monthly retirement income based on your contributions, investment returns, and annuity rates. Know what to expect after 60.

Continue Reading

Estate planning for retirees in India isn't optional - it's essential. Learn how wills, nominees, and succession laws affect inheritance, and what steps to take now to protect your family.

Continue Reading

Compare NPS and PPF in India to find out which retirement scheme suits your goals-guaranteed returns with PPF or higher growth with NPS. Know tax rules, risks, and how to use both together.

Continue Reading

Staking pools and solo staking both let you earn rewards on Ethereum, but they suit very different users. Solo staking offers higher returns but needs $112K and tech skills. Pools are easy and accessible but charge fees. Here’s how to pick the right one.

Continue Reading

Learn how to calculate real estate ROI in India with accurate steps, hidden costs, and city-specific yields. Avoid common mistakes and find where property investments actually pay off.

Continue Reading

Virtual real estate NFTs let you buy, own, and build on digital land in metaverses like Decentraland and The Sandbox. Learn how it works, where to buy, and whether it's worth the risk.

Continue Reading

Learn how mutual fund expense ratios in India silently reduce your long-term returns and discover how switching to direct plans or index funds can save you lakhs over time.

Continue Reading

Cosmos IBC is the trust-minimized protocol enabling secure, direct transfers between independent blockchains. Unlike bridges, it requires no third-party validators and has zero major exploits since 2019.

Continue Reading

Understand the NPS withdrawal rules in India: when you can access your retirement funds, how much you can withdraw, tax implications, and how to avoid costly mistakes. Learn the step-by-step process for withdrawal at 60 and beyond.

Continue Reading

Despite over 659 million crypto owners worldwide, less than 2% of U.S. adults use it for daily purchases. The real barrier isn't regulation or tech-it's unusable interfaces. Here's what must change for crypto to go mainstream.

Continue Reading