NPS Fund Performance Comparison in India: Which Schemes Deliver the Best Returns?

By now, you’ve probably heard that the National Pension System (NPS) is one of the most tax-efficient ways to save for retirement in India. But knowing that doesn’t help if your money isn’t growing. Thousands of people are stuck in NPS schemes that barely beat inflation, while others are seeing consistent 10-12% annual returns. The difference? Not luck. It’s fund choice.

How NPS Works - And Why It Matters

The NPS isn’t a single fund. It’s a system where you pick how your money is split between three asset classes: equities (E), corporate bonds (C), and government securities (G). You can go all-in on stocks, or play it safe with government bonds. Or mix them. You also choose between two account types: Tier I (locked until 60) and Tier II (flexible withdrawals).

What most people don’t realize is that your returns depend almost entirely on the fund manager you pick - not just the asset allocation. There are 26 registered fund managers in India, including big names like HDFC, ICICI Prudential, Kotak, and SBI. Each runs different portfolios, charges different fees, and delivers wildly different results.

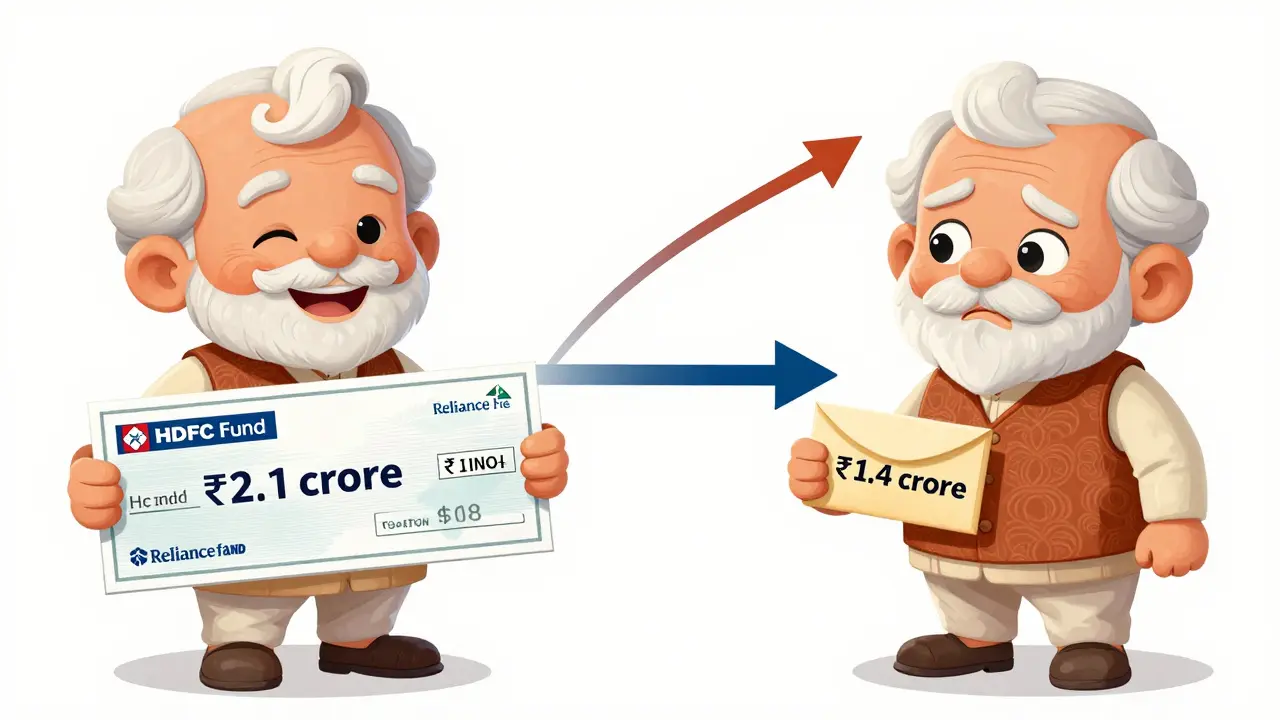

For example, in 2024, the top-performing NPS equity fund returned 14.7% annually. The worst? 6.2%. That’s not a small gap. Over 25 years, that difference turns ₹10 lakh into ₹2.1 crore vs. ₹1.4 crore. You’re leaving ₹70 lakh on the table just by picking the wrong manager.

Top 5 NPS Schemes by 5-Year Performance (2021-2026)

Here’s what actually worked over the last five years, based on data from PFRDA and fund disclosures:

- HDFC Pension Fund - 11.9% average annual return, 80% equity allocation

- ICICI Prudential Pension Fund - 11.6% return, strong mid-cap exposure

- Kotak Mahindra Pension Fund - 11.4% return, lowest expense ratio at 0.01%

- SBI Pension Fund - 10.8% return, stable but conservative

- Axis Pension Fund - 10.5% return, aggressive small-cap tilt

Notice something? The top three all had over 75% in equities. And they didn’t chase hype. They built portfolios around large-cap stability, added smart mid-cap bets, and avoided overexposure to volatile sectors like fintech or crypto-linked stocks.

Compare that to the bottom performers - like Reliance Pension Fund or IDFC Pension Fund - which returned under 9% over the same period. Why? Too much in government bonds, poor rebalancing, or high tracking errors.

What’s the Best Allocation? Equity vs. Bonds

Let’s cut through the noise. If you’re under 40, going 75-80% equity is not risky - it’s smart. The market swings, yes. But over 20+ years, equities in India have delivered 12-14% CAGR since 2000. Government bonds? They’ve averaged 7-8%.

Here’s what a real investor did:

- Age 28: Started with 80% E, 15% C, 5% G

- Age 35: Shifted to 70% E, 20% C, 10% G

- Age 45: Moved to 50% E, 30% C, 20% G

- Age 55: 30% E, 30% C, 40% G

That’s not speculation. That’s a real case from a Delhi-based software engineer who retired in 2025 with ₹1.8 crore in his NPS account - after contributing just ₹500 per month since 2018. He didn’t time the market. He just picked a top fund and stayed the course.

Don’t let fear of volatility stop you. The NPS auto-choice (Lifecycle Fund) does this for you - but it’s too conservative for most. The auto-fund shifts to 50% equity at age 40. That’s late. You’re giving up growth when you need it most.

Fees Matter More Than You Think

Most people overlook fees. But NPS charges are among the lowest in the world. The government caps fund management fees at 0.01% of assets. That’s 10 times cheaper than mutual funds.

But here’s the catch: even tiny differences add up. Kotak charges 0.0098%. SBI charges 0.01%. HDFC charges 0.01%. Sounds negligible? Over ₹1 crore, that’s ₹1,000 vs. ₹980 per year. Doesn’t seem like much - until you realize that over 30 years, that ₹20 difference compounds into ₹1.1 lakh. That’s a new laptop every year. Or a family vacation.

And don’t get fooled by “free” platforms. Some apps promise zero registration fees, but they route you to lower-performing fund managers. Always check the fund’s historical returns - not the app’s marketing.

How to Pick Your NPS Fund - A Simple Checklist

Here’s how to make a decision without getting lost in spreadsheets:

- Check 5-year returns - Not 1-year. Not 3-year. Five years. That’s long enough to smooth out market noise.

- Look at consistency - Did the fund beat its benchmark every year? Or did it crash in 2022 and bounce back in 2024? Consistency beats spikes.

- Compare expense ratios - Lower is always better. Kotak and Nippon India are usually cheapest.

- Check asset allocation - Avoid funds with more than 20% in government bonds unless you’re over 50.

- Use the NPS Trust portal - Go to nps.org.in and download the annual performance reports. Don’t trust blogs.

Pro tip: If you’re unsure, start with HDFC or ICICI Prudential. They’ve delivered top results for five straight years. Switching later is easy - you can change fund managers once a year, for free.

What About the Government Bond Portion?

Some advisors say “stick to G-secs for safety.” But here’s the truth: government bonds in NPS are not like fixed deposits. They’re long-term securities that lose value when interest rates rise. In 2023, when RBI hiked rates, many G-secs in NPS portfolios dropped 3-5% in value.

That’s why the top performers keep G-secs under 10% until age 50. They use bonds for stability, not as the main engine. Your equity portion is your growth engine. Don’t let fear turn it into a bicycle.

Common Mistakes to Avoid

- Choosing based on brand name - Yes, SBI is trusted. But it’s not the best performer. Don’t confuse safety with returns.

- Changing funds too often - Switching every year kills compounding. Pick one, stick with it for 3-5 years.

- Ignoring Tier II - If you need emergency access, open a Tier II account. It’s not a penalty box. It’s a safety valve.

- Thinking NPS is only for salaried people - Self-employed? Freelancers? You’re the ideal candidate. NPS gives you tax breaks under Section 80CCD(1B) - ₹50,000 extra deduction on top of your 80C limit.

What’s Next? Don’t Just Set and Forget

NPS isn’t a “set it and forget it” product. You need to review it every 2-3 years. Markets change. Fund managers change. Your goals change.

Ask yourself: Is my fund still in the top 5? Did my allocation still match my age? Did I forget to increase my contribution when I got a raise? Small tweaks make huge differences.

One user in Bangalore increased his monthly contribution from ₹2,000 to ₹4,000 in 2023. He didn’t change his fund. He didn’t time the market. He just paid more. By 2026, his corpus grew by ₹12 lakh - just from one decision.

Your retirement isn’t a lottery. It’s a math problem. And the math only works if you pick the right fund, stick with it, and keep putting money in.

Can I switch NPS fund managers anytime?

Yes, you can switch fund managers once a year, for free. You can’t change more often than that. But you can change your asset allocation (E/C/G mix) anytime through your NPS account portal.

Is NPS better than PPF for retirement?

NPS offers higher returns - typically 10-12% vs. PPF’s 7.1% (as of 2026). But PPF is fully tax-free at withdrawal, while NPS gives you only 40% tax-free. The rest is taxable as income. So if you want guaranteed, tax-free growth, PPF wins. If you want growth and don’t mind paying tax on part of your corpus, NPS wins.

What happens to my NPS if I move abroad?

You can keep your NPS account active even if you become an NRI. You can still contribute, and the fund will keep growing. Withdrawal rules stay the same - you must wait until 60, unless you’re leaving India permanently, in which case you can withdraw 80% as a lump sum and use 20% to buy an annuity.

Can I have more than one NPS account?

No. You can only have one NPS account per PAN. If you open a second one, it will be deactivated. The system links your account to your Aadhaar and PAN. Don’t try to game it.

Are NPS returns guaranteed?

No. NPS returns are market-linked. There’s no guarantee. But over 15-20 years, historical data shows consistent outperformance of inflation and fixed-income options. The risk is real, but so is the reward - if you stay invested and choose wisely.

Final Thought: The Real Winner Is Discipline

The best NPS fund in the world won’t help if you stop contributing. The most aggressive equity allocation won’t matter if you panic and pull out during a crash. What matters most is showing up - every month - and letting compounding do the heavy lifting.

Start with a top-performing fund. Stick with it. Increase your contribution when you can. Review every few years. And don’t let fear - or advice from your uncle who lost money in 2008 - steer you away from what works.

Retirement isn’t about getting lucky. It’s about showing up, consistently, with the right tools. Your future self will thank you.