Subvention Schemes in India: How Builder Payment Plans Work and What Risks You Face

When you buy a new apartment in India, the builder doesn’t always ask for the full amount upfront. Instead, they offer a subvention scheme-a payment plan where you pay a small down payment, then make small monthly installments while the builder pays your home loan interest until possession. It sounds like a dream: lower upfront cost, no EMI burden during construction. But behind the shiny brochures and zero-interest promises, there’s a growing list of buyers who lost lakhs of rupees-and their peace of mind.

How Subvention Schemes Actually Work

A subvention scheme is a three-way agreement between you, the builder, and the bank. Here’s how it plays out:

- You pay 10-20% of the property price as a down payment.

- You sign a home loan agreement with a bank for the remaining amount.

- The builder promises to pay your EMI (interest portion) to the bank until they hand over the keys-usually 2 to 4 years later.

- Once possession is given, you start paying the full EMI, including principal.

This setup looks like a win. You’re not paying EMIs while the building is still under construction. But here’s the catch: the bank doesn’t give you the full loan amount at once. They release it in stages, matching the builder’s construction progress. So even though you’re technically paying nothing now, the loan is still active-and so is the risk.

Why Builders Love Subvention Schemes

Builders don’t offer these plans out of kindness. They use them to move inventory fast, especially when cash flow is tight. By promising zero EMIs, they attract buyers who can’t afford large upfront payments. But the builder isn’t putting up their own money to pay your interest. They’re using the bank’s money-money that’s tied to your loan.

Here’s the real trick: the bank releases funds only after each construction milestone. If the builder delays the project, they still owe the bank interest on the disbursed amount. But they’re not paying it. That debt piles up. And eventually, someone has to cover it. More often than not, it’s you.

The Hidden Risks You’re Not Being Told

There are five major risks tied to subvention schemes. Most buyers don’t realize them until it’s too late.

- Project delays: If the builder misses the possession date, they stop paying your interest. But your loan doesn’t pause. The bank starts charging you from the date the loan was disbursed-not from possession. You could owe 2-3 years of back interest in one lump sum.

- Builder bankruptcy: If the builder runs out of money or gets sued, the subvention stops. Your loan keeps growing. You’re now paying interest on money you never received.

- Loan cancellation: Banks have the right to cancel your loan if the project is delayed beyond a certain point (usually 18-24 months). You’re stuck with the property and no way to pay the full amount.

- Higher interest rates: Builders often partner with smaller banks or NBFCs that charge higher rates. You might think you’re getting a good deal, but your interest rate could be 1-2% higher than market rates.

- No legal protection: Subvention clauses are buried in fine print. If the builder defaults, your only recourse is a civil court case-which can take 5-10 years in India.

In 2023, the National Consumer Disputes Redressal Commission (NCDRC) ruled against a major builder in Noida who failed to deliver homes under subvention. Over 300 buyers were left paying EMIs on properties that were still half-built. The court ordered interest refunds-but most buyers never saw a rupee.

What Happens When the Builder Defaults

Let’s say you bought a 50-lakh apartment in Pune with a subvention plan. You paid 15% (7.5 lakh) upfront. The bank disbursed 42.5 lakh in stages over 2 years. The builder promised possession in 3 years. But at year 2.5, construction halted. The builder stopped paying your interest. The bank started charging you from day one of the first disbursement.

Now you owe:

- 42.5 lakh principal

- Interest at 8.5% for 30 months on the full amount: ~₹9 lakh

- Penalties and late fees: ~₹2 lakh

Total: ₹51.5 lakh. But you’ve only paid ₹7.5 lakh. The property is still incomplete. The bank won’t release more funds. You can’t sell it. You can’t walk away. And you’re now paying EMIs on a home you can’t live in.

How to Protect Yourself

If you’re still considering a subvention scheme, here’s what you must do before signing anything.

- Check the builder’s track record: Look up past projects. How many were delayed? How many faced legal cases? Search the RERA portal for complaints against the builder.

- Read the loan agreement: Does it say the bank will charge interest from the first disbursement? If yes, you’re at risk. Ask for written confirmation that interest payments will only start after possession.

- Verify bank partnership: Only trust subvention schemes tied to top public sector banks like SBI, HDFC, or ICICI. Avoid small NBFCs or unknown lenders.

- Ask for a completion guarantee: Some builders offer third-party insurance for delays. It’s rare, but if available, it’s worth the extra cost.

- Don’t pay more than 15% upfront: The less you pay before possession, the less you lose if things go wrong.

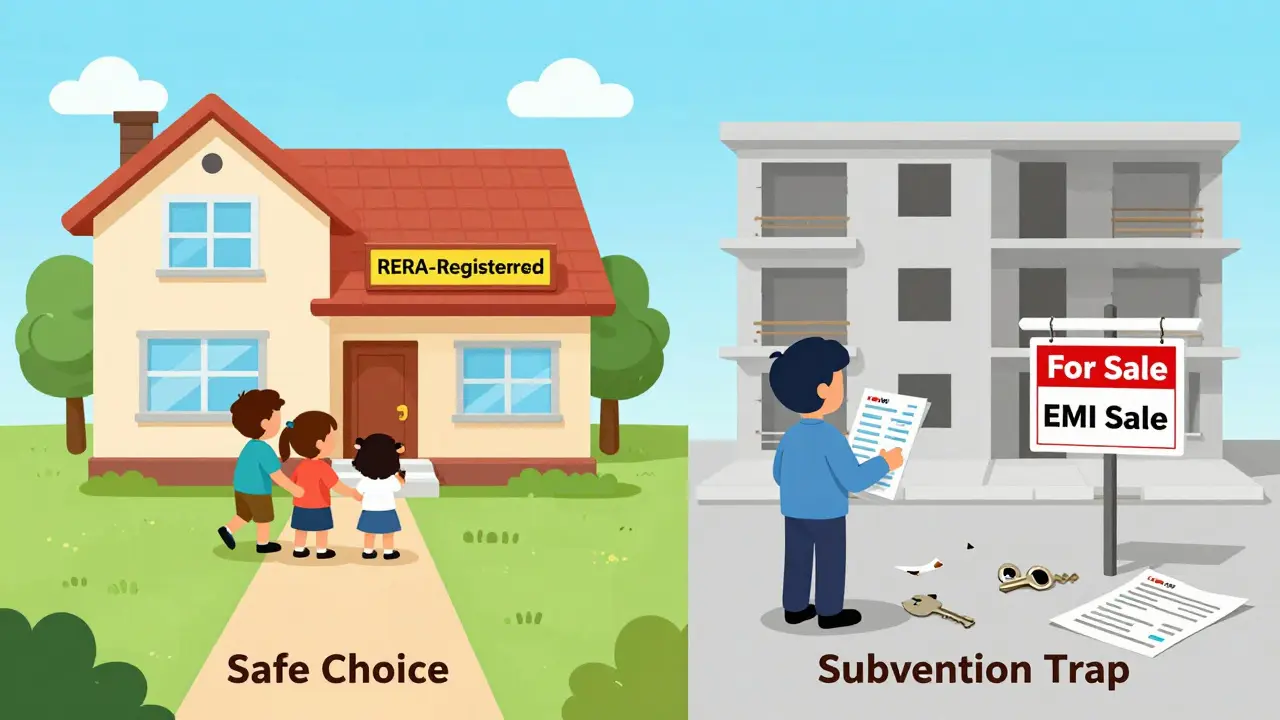

Alternatives to Subvention Schemes

If you’re worried about subvention risks, consider these safer options:

- Ready-to-move-in homes: Pay full price, no loan risk. You know exactly what you’re getting.

- Under-construction projects with RERA registration: If the builder is RERA-compliant, you can track progress online. Delays trigger penalties.

- Joint development with reputable firms: Some developers partner with established housing finance companies that manage disbursements transparently.

- Buy in secondary markets: Resale apartments in established areas often have lower prices and no construction risk.

In cities like Bangalore and Hyderabad, buyers who chose ready homes over subvention schemes saved an average of ₹4-6 lakh in interest and legal fees over 5 years, according to a 2025 study by the Indian Real Estate Society.

Final Reality Check

Subvention schemes are not a gift. They’re a financial gamble-and you’re the one betting. The builder gets cash flow. The bank gets interest. You get a promise.

Real estate in India is not a short-term investment. It’s a 10-15 year commitment. If you can’t afford to pay EMIs from day one, maybe you’re not ready to buy yet. Waiting a few more months to save for a bigger down payment or choosing a ready home might cost you more in the short term-but it protects you from losing everything in the long run.

There’s no shame in walking away from a deal that sounds too good to be true. The most expensive homes aren’t the ones with the highest price tags. They’re the ones you paid for but never got to live in.

Are subvention schemes legal in India?

Yes, subvention schemes are legal-but they’re poorly regulated. There’s no law that forces builders to pay your interest during construction. The only protection comes from your loan agreement and RERA registration. Always get all promises in writing.

Can I exit a subvention scheme if the builder delays?

You can try to cancel the agreement, but you’ll likely lose your down payment. Most builder contracts have clauses that penalize buyers for cancellation. Your best option is to file a complaint with RERA or the consumer court, but this takes years. Prevention is better than cure.

Do all banks offer subvention schemes?

No. Only certain banks partner with builders for these schemes. Public sector banks like SBI and PNB are more cautious. Private banks like HDFC and ICICI usually avoid them unless the builder has a strong reputation. Smaller NBFCs are the main promoters-so be extra careful.

What’s the difference between subvention and zero EMI?

Zero EMI is a marketing term. It usually means the builder pays your EMI for a few months-but not always the full interest. Subvention is a formal arrangement where the builder pays interest until possession. Zero EMI often hides higher upfront costs or inflated prices. Always compare the total cost.

Should I buy a property under subvention if I’m planning to rent it out?

It’s risky. Until possession, you can’t rent the property. You’re paying EMIs (or waiting for them to start) while earning nothing. If the project delays, you lose rental income and face interest accumulation. It’s better to wait for ready properties if your goal is rental returns.