Property Investment Returns in India: What You Really Earn After Taxes and Costs

When people talk about property investment returns, the net profit you make from owning real estate after all expenses, taxes, and time. Also known as real estate returns, it’s not just about rent or price jumps—it’s what’s left after everything else is paid. Most investors think buying a flat or plot means automatic money growth. But in India, the real story is messier. You’ve got property tax, maintenance fees, broker commissions, long vacancies, and income tax on rent—all cutting into your numbers. A 10% rental yield sounds great until you realize it’s before you pay ₹15,000 a year in repairs and three months of empty units.

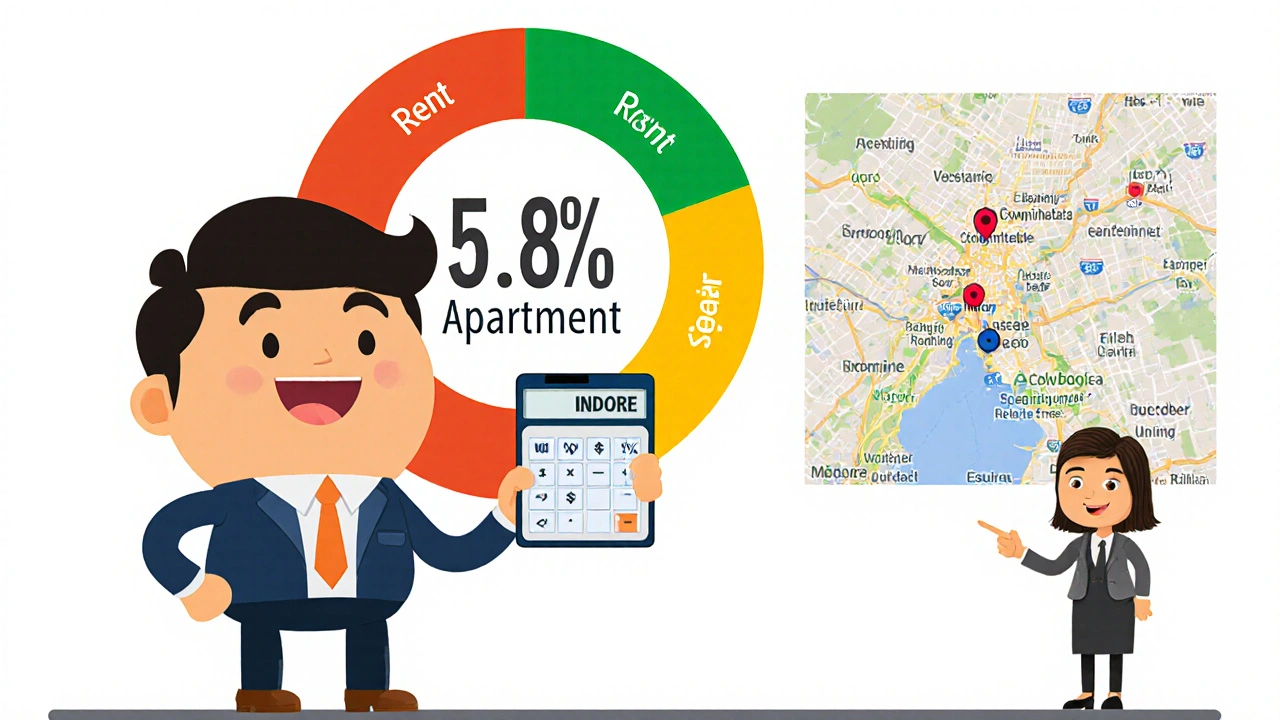

Rental income tax, the tax you pay on money earned from renting out property under Section 24 and Section 56 of the Income Tax Act is one of the biggest surprises. If you earn ₹60,000 a year in rent, you might owe ₹8,000–₹12,000 in taxes after deductions. And if you sell the property after five years, you’ll pay capital gains tax too—unless you reinvest wisely. Property appreciation, the increase in a property’s market value over time looks good on paper, but in cities like Prayagraj, it’s uneven. A plot near the river might double in 10 years, while one two streets away stays flat. The Allahabad Development Authority’s infrastructure plans can shift values overnight—but only if you’re in the right zone.

People often ignore real estate investment, the act of buying, managing, and selling property to generate income or profit as a full-time job. It’s not passive. You deal with tenants, repairs, legal paperwork, and market shifts. The best returns come from owners who know local rules, track maintenance costs closely, and understand how urban development affects their asset. That’s why posts here cover everything from how to declare rent correctly to how new roads or metro lines change neighborhood values. You won’t find fluff here—just what actually moves the needle on your bank balance.

What you’ll find below are real examples from Indian investors—how one person turned a ₹40 lakh apartment into ₹1.2 crore over 12 years, how another lost money by ignoring vacancy rates, and why buying in Prayagraj’s emerging zones might beat a flashy new project in Lucknow. These aren’t theories. They’re receipts, spreadsheets, and hard lessons from people who’ve been there.

Learn how to calculate real estate ROI in India with accurate steps, hidden costs, and city-specific yields. Avoid common mistakes and find where property investments actually pay off.

Continue Reading