Welcome to Allahabad Development Authority: Your Gateway to Prayagraj’s Growth

If you want the latest on how Prayagraj is changing, you're in the right spot. The Allahabad Development Authority (ADA) is leading the way in crafting smarter urban spaces, improving infrastructure, and bringing new projects to life across the city.

What Does ADA Do for Prayagraj?

Think of ADA as the city's planner and builder combined. From roads and public parks to housing and commercial zones, they guide development to meet the needs of residents and businesses. It’s all about making Prayagraj a model city by blending tradition with modern urban planning.

Stay Informed and Get Involved

On this platform, we keep you updated with ADA’s latest projects, urban policies, and announcements. Whether you're a local, investor, or visitor, knowing what’s happening can help you engage better with the city’s pulse. Curious about infrastructure upgrades or real estate opportunities? ADA’s work impacts all of that directly.

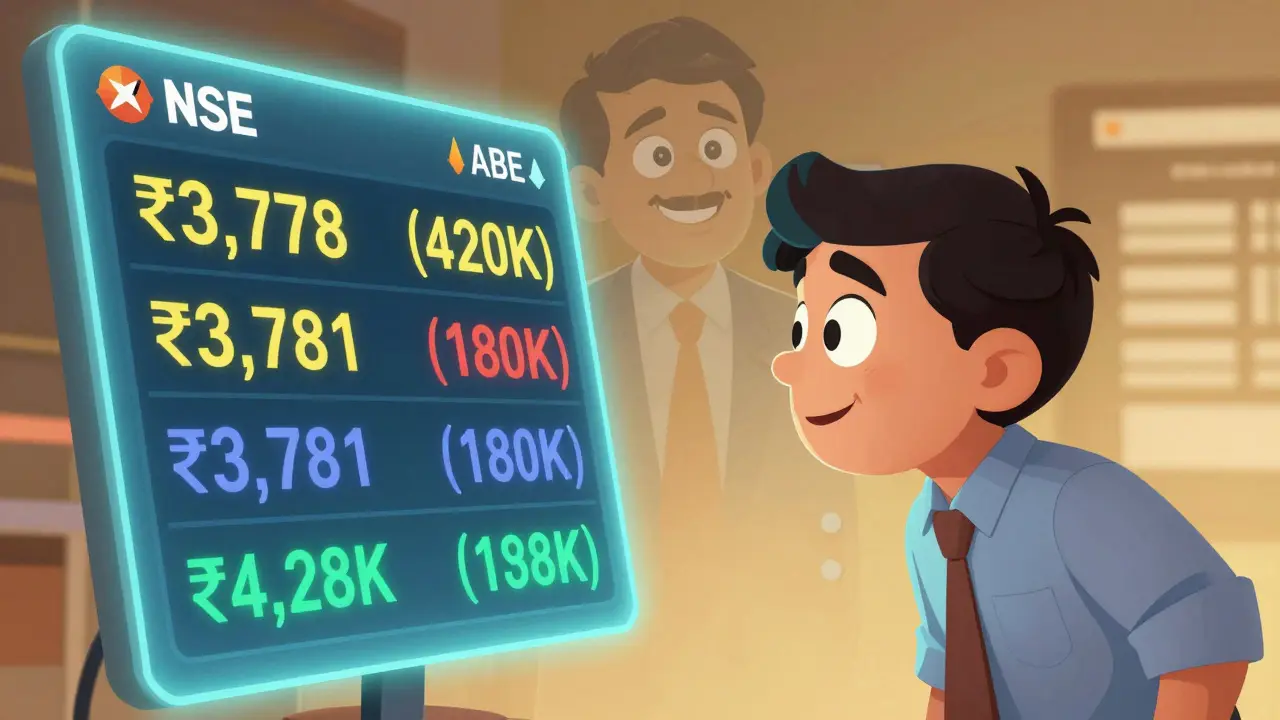

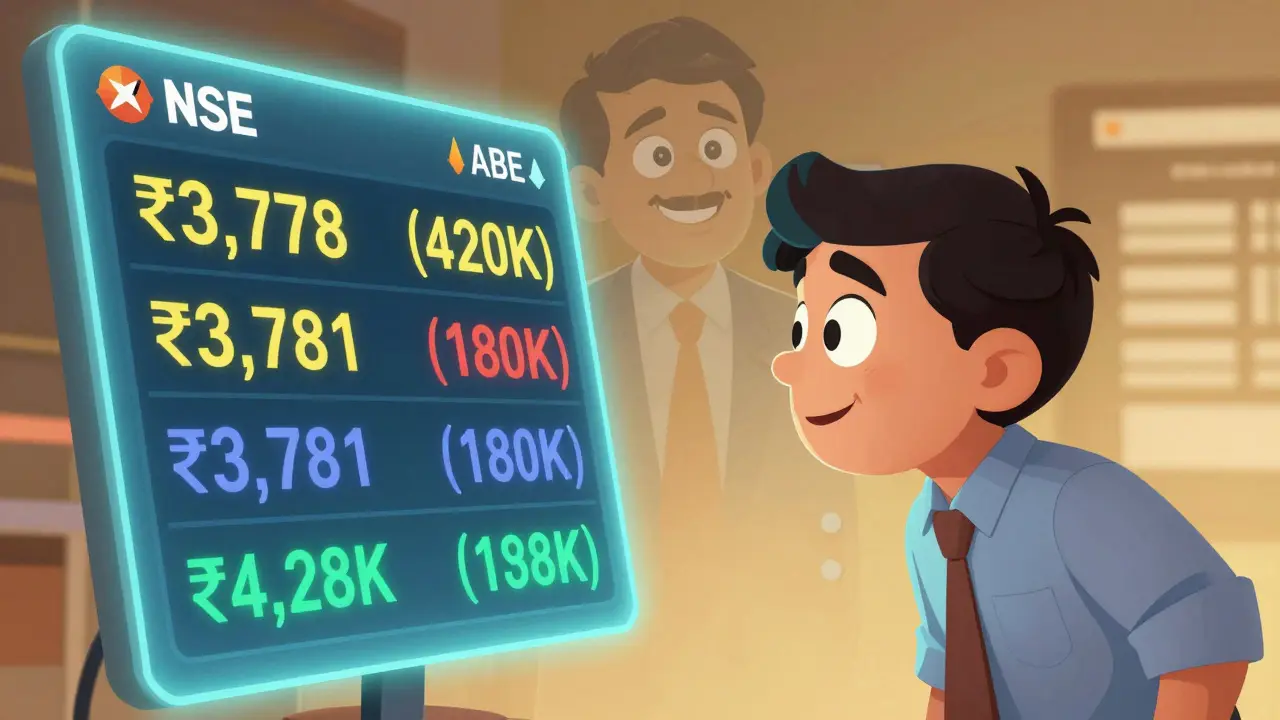

Learn how to read NSE and BSE order books to spot market depth, best 5 levels, and liquidity signals. Understand institutional behavior, avoid traps, and make smarter trades using real-time bid-ask data.

Continue Reading

SEBI's Risk-O-Meter gives Indian mutual fund investors a clear, color-coded view of fund risk levels. Learn how the five-category system works, why it matters, and how to use it to choose funds that match your goals and comfort zone.

Continue Reading

NIFTY 50 and SENSEX are India's two main stock market indices, but they differ in composition, calculation methods, and performance. NIFTY 50 tracks 50 stocks with free-float weighting and is used by most mutual funds, while SENSEX tracks 30 and uses full market cap. Understanding these differences helps investors make smarter choices.

Continue Reading

Understand the three key values behind Indian stocks: face value, market value, and book value. Learn how to use them to avoid overpaying and spot real investment opportunities.

Continue Reading

Learn the real rules for claiming tuition fee deductions under Section 80C in India. Know which fees qualify, how many children you can claim for, and what documents you need to avoid tax issues.

Continue Reading

International mutual funds let Indian investors access global markets like the U.S. and Europe without opening foreign accounts. Learn how they work, tax rules, top funds in 2026, and how much to invest.

Continue Reading

Retirees in India need a dedicated emergency fund to handle unexpected costs like medical bills or inflation. The best places to park this safety corpus include senior citizen fixed deposits, Post Office SCSS, high-interest savings accounts, and liquid mutual funds-safe, liquid, and reliable options.

Continue Reading

Share price fluctuations in India are driven by company earnings, global markets, investor sentiment, government policy, and supply-demand dynamics. Understanding these forces helps investors navigate volatility with confidence.

Continue Reading

NRIs in India can claim up to ₹1.5 lakh in tax deductions under Section 80C, but only on specific investments like ELSS, life insurance, and home loan principal. PPF and post office schemes are off-limits. Know what’s allowed and what’s not.

Continue Reading

NRI property investment in India is governed by FEMA rules, repatriation limits, and tax laws. Understand how to buy, sell, and transfer funds legally to avoid penalties and maximize returns.

Continue Reading

Learn how large-cap, mid-cap, and small-cap stocks in India are classified by market capitalization, their risks, rewards, and how to build a balanced investment portfolio.

Continue Reading

Section 80C deductions can save you up to ₹1.5 lakh under India's old tax regime. But the new regime offers lower rates with no deductions. Find out which one saves more based on your income, investments, and lifestyle.

Continue Reading