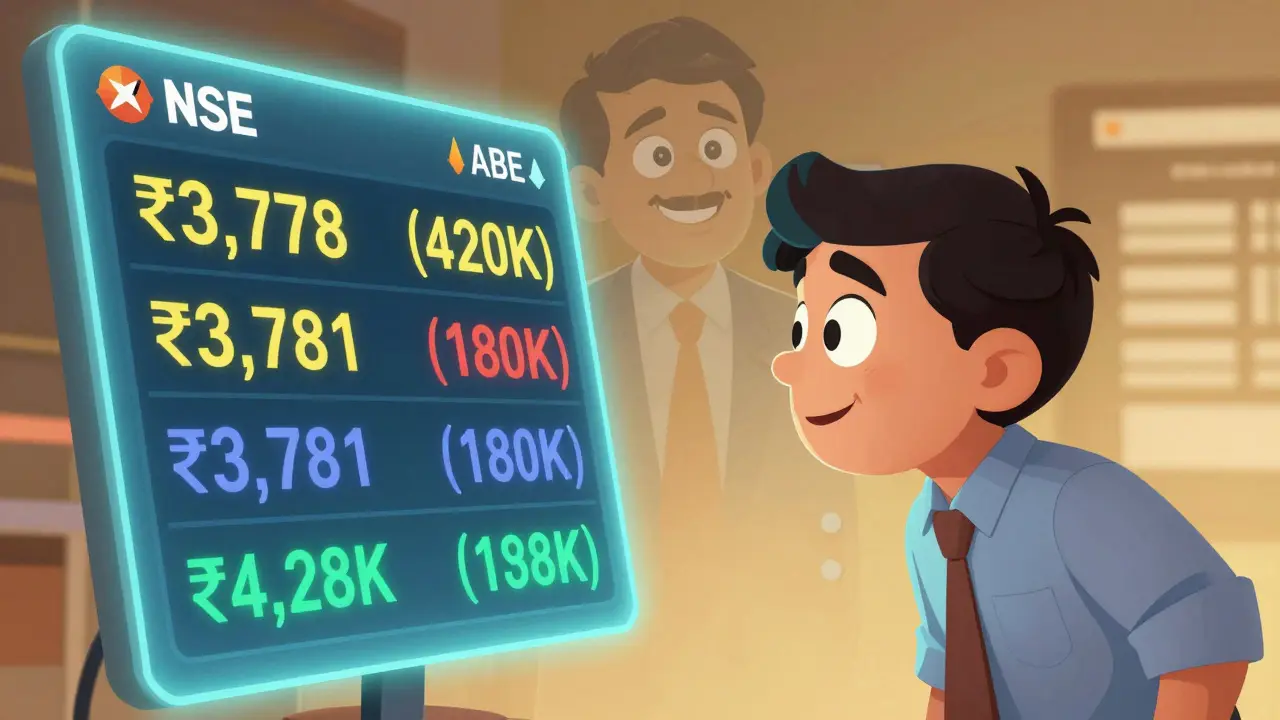

How to Read NSE/BSE Order Books: Depth, Best 5, and Liquidity Signals

Learn how to read NSE and BSE order books to spot market depth, best 5 levels, and liquidity signals. Understand institutional behavior, avoid traps, and make smarter trades using real-time bid-ask data.

Continue Reading